Eagle Financial Publications Presents Jon Johnson's

Trading the Dips

Millionaire Summit

The Proven Way to Secure Triple-Digit Gains

In Today’s Volatile Markets

Discover how to turn historic market plunges into the biggest paydays of your life so you NEVER have to worry about money again!

One of Americ's most successful traders reveals the secrets that let you bank gains of 103% to 271% -- even when the stock market is in free fall.

And he reveals how you can potentially compound these profits to grow a modest $1,000 into as much as $141,000 in just a few months.

Hello. I'm Roger Michalski, publisher here at Eagle Financial Publications.

There is no getting around it. The stock market selloff in February and March 2020 spooked a lot of people.

Yet spooked or not, investors and retirees still need to generate income from their investments.

After all, bills don't go away just because the stock market is tanking.

And that's why I ask that you pay particular attention to this special summit.

In the next few minutes, one of the most successful traders in the world will reveal how he makes THOUSANDS of dollars every week trading even when the stock market is in free fall!

In fact, you will see how you can lock in between $2,500 and $5,000 in fast cash every week regardless of what is happening in the market.

During the weeks when the stock market was doing THIS…

The trader I am talking about showed his followers how to…

- Turn $14,000 into $68,880 with Zoom Video Communications, a gain of 392% in 39 days.

- Turn $5,730 into $21,258 with Lam Research, a gain of 271.3% in 13 days.

- Turn $5,100 into $15,096 with Caterpillar, a gain of 196% in 8 days.

- Turn $2,260 into $6,192 with Teva Pharmaceuticals, a gain of 174.3% in 21 days.

- Turn $6,600 into $14,586 with United Therapeutics, a gain of 121% in 13 days.

- And turn $4,900 into $9,800 with Reliance Steel, a gain of 100% in 23 days.

And that was just in February and March of 2020, when the market was crashing.

This former attorney-turned-full-time-trader took advantage of the sell-off and market volatility to ALSO do this: He made a couple of neat trades on Microsoft recently -- in one day, out the next -- making 50% to 70%.

Then bagged 64% with Twilio in a few sessions, and 60% with Nvidia in 2 days.

Here are some more examples of the profits this trade made during this extreme volatility:

- $9,555 on Beyond Meat…

- $5,000 on Hubspot...

- $3,813 on Paypal…

- $3,400 on Eli Lilly and Company…

- $3,064 on Netflix…

- $2,926 on Netease Inc…

- $2,576 on the Junior Gold Miners ETF…

And here is the best part of this:

This trader collects profits like these even in a market where stocks are plummeting and WITHOUT having to risk the bulk of his savings in the stock market!

Instead, he uses an intermediate-term technical trading strategy -- borrowing the best parts of a system first developed 300 years ago in Japan -- that has been CRUSHING it over the past several years.

So please stick around for the rest of this very important summit broadcast!

I think you're going to be amazed at what you'll discover over the next few minutes.

And, at the end of this summit, I'll tell you how you can collect a $1,000 grubstake to begin making these super-profitable trades yourself!

Plus, I'll also reveal how you can get three actual trades immediately that could make each person watching this right now up to $15,000 richer within days, regardless of whatever is happening with the market.

So, please stay tuned until the end.

For now, I'd like to welcome our special guest… Jon Johnson, the creator and chief investment officer of the Investment House Daily Pro trading advisory service.

Over the past seven years, Jon's unique technical trading system has produced more double- and triple-digit winners than any other trading system I know of -- and, as one of Wall Street's top financial publishers, I've seen them all.

In the last seven years, it has delivered an astonishing 1,306 double- and triple-digit winners, including:

- 1,300% on Exact Sciences Corp.

- 820% on Tilray

- 762% on Celgene

- 634% on GoPro

- 516% on Cronos Group

- 514% on Amazon

- And lots MORE just like these.

In addition, Jon has been a guest on numerous media outlets, such as CNBC and Bloomberg TV.

And his wildly successful trading methods have been featured in prominent publications like the Washington Post, The Chicago Sun, The Wall Street Journal, Smart Money Magazine, Bloomberg, Kiplinger Personal Finance Magazine, Business Week, Money Magazine and many other news magazines.

To top it all off, Jon is a licensed attorney who has practiced in commercial litigation and oil-and-gas law, arguing before the Texas Supreme Court and the US Fifth District Court of Appeals.

And so now, without further ado, Jon, welcome to the Trading the Dips Millionaire Summit!

Thanks, Roger. Great to be here!

So, the reason we wanted to do this summit is because so many investors don't know what to make of the market recently.

We've seen record one-day drops as well as record one-day gains of something like 2,000 point swings in the Dow in each direction.

The Dow fell from its historic high of 29,551 all the way down to 18,618 on March 24 -- a 36.9% drop in less than a month that puts us officially in a bear market. I believe that makes it the fastest market crash in history.

Jon, what do you make of a market like this?

Well, to be honest, Roger, for active traders like myself, a hyper-volatile market like this is sort of Christmas, Hanukkah, your birthday and the Fourth of July all rolled into one!

We've seen drops of up to 3,000 points in a single day… but also rallies of up to 2,000 points in just one day.

It's the best of all possible markets to be in for an active trader!

Really? Some so-called experts on TV have said it's untradeable. And for many people, it's a nightmare.

Of course. If you're a buy and hold index investor, and there's nothing wrong with being that, then a market like we saw in February and March 2020 can be frightening.

No one likes to see a third or a half of their life savings disappear before their very eyes, even just on paper.

The market will eventually return to where it was before any correction, but the question is always how long that will take -- and what investors and retirees will do in the meantime for income. Especially when you throw in so-called black swan events like a global pandemic. There is an opportunity cost to sitting in a stock.

And that's the beauty of active trading!

With just a little help from someone who knows what they are doing, you can make money -- a lot of money -- while everyone else is just hoping and praying.

In fact, you can make money whether the market goes up, down or sideways.

And as you said, Roger, your bills don't stop just because the market is tanking.

This is a way for investors and retirees to generate income even when they are temporarily unemployed or not working.

That's precisely what many people need right now.

By the way, before I forget. We set up a special email address in case any of our viewers have questions.

If you have any questions for Jon, please email them right away to:

TradingTheDips@InvestmentHouse.com

We'll try to get at least some of them answered during this presentation.

But if we can't get to them here, we'll send you a follow-up email with our answer within the next 48 hours.

Now Jon, before we dig into the details, can you tell us briefly how you got started with active trading? I mean, what led you to it?

Sure. As you mentioned, I'm a lawyer by profession.

I was in commercial litigation, so I had a lot of very successful clients and I became interested in the markets and trading as a result of what I saw them do.

I eventually became a millionaire myself, but I didn't make my money by practicing law.

I made it by trading the markets, both stocks and options.

Yet, if it weren't for my legal training, I would not have cracked the code on trading the markets.

What do you mean by that?

Well, the secret to winning in court is to ask the right questions.

When I first started trading, I didn't do that.

I lost a lot of money along the way trying to "crack the code," as they say.

Once I lost $50,000 in a single day at a time in my life that I could not afford to lose -- as if there is ever a good time to lose that much!

But that only made me more determined to figure out what was going on and to ask the right questions.

Soon I was making $1,000 a trade, then $2,000, $5,000, and even more, on trades as small as $100.

So, what is your secret? What did you discover that lets you make money like this so consistently?

Well, 99.9% of all investors try to figure out WHY a stock or a market will go up or down.

Sure there are general reasons for the market to rise and fall, and my system does a good job at identifying those. For any individual stock, however, that is the WRONG question.

The average investor can NEVER really know the fundamentals in a stock or market.

Data on fundamentals, such as gross revenues, are months, if not years, out of date… even if they exist.

Plus, you can't possibly compete with Wall Street insiders when it comes to analyzing the fundamentals in a given stock or market.

They spend BILLIONS of dollars on research, hire THOUSANDS of analysts who work full-time researching specific market niches, even specific companies.

Yes, that's absolutely correct. I always chuckle when I see commercials where the average Joe investor complains that his broker doesn't give him proprietary research or more fundamentals -- as if that would help!

But fortunately, to make money in a market, you don't need to know WHY a stock price rises or falls.

All you need to know is WHERE the money in a given market is going.

What you need to do is measure accurately how much money is flowing INTO a particular investment… or much is flowing AWAY from an investment.

Successful trading can then be reduced to two simple rules:

Rule #1: BUY if the money flowing TO a particular stock exceeds -- and we mean greatly exceeds -- the money flowing away from it.

Rule #2: SELL if the money flowing AWAY from a particular stock clearly exceeds the money flowing to it..

So, what you're saying is that trading is really just physics by another name?

Yes, exactly, from what I can remember of my high school physics…

If most of the money in a market is moving into an investment, the pressure from all of that cash flowing into the market will FORCE the price of an investment higher no matter what the alleged fundamentals might be.

That is why the price of some commodities, such as gold or oil, can often continue rising even when the fundamentals of supply and demand suggest they "should" fall!

When the buying pressure exceeds the selling pressure, the price is going to go up no matter what the so-called experts say. Physics trumps opinion.

And the reverse is true as well, right?

That if investors are panicking and pulling all of their money out of a stock or a commodity, then the price will plummet?

That's right. Greed and fear are powerful emotions, some say even stronger than love.

And that's when you can make a fortune very, very quickly.

If you know how to trade as prices plummet, if you know what to look for and you remain dispassionate, you can usually make money even faster than when markets are rising.

And by the way, one of the first really useful measures of this money flow momentum was first discovered nearly 300 years ago by a rice trader in Japan.

By a what? A rice trader?

Yes, his name was Munehisa Honma.

He was from the tiny seaside village of Sakata.

Anyway, Honma discovered that markets are often irrational and that what really matters is buying and selling momentum.

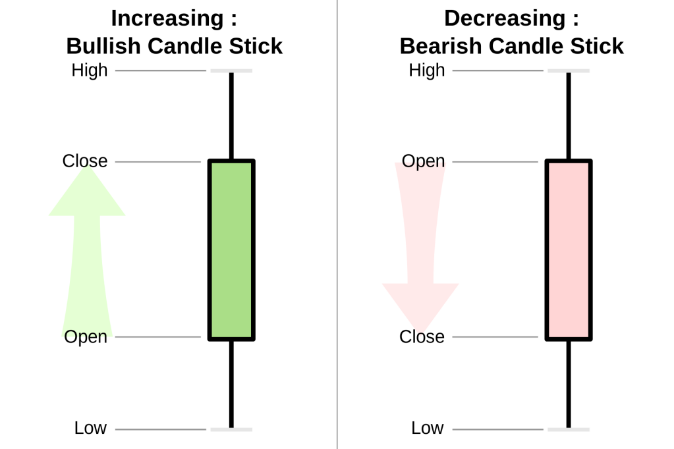

He is widely credited with inventing a simple charting technique so he could track this momentum -- the candlestick charts that traders use today, which became more widely used in the West around the year 2000.

Honma's key insight was that the up and down movement of prices for any given commodity -- such as rice -- reflects a herd psychology among buyers and sellers.

What's more, he saw that the price patterns revealed TRENDS that could be exploited.

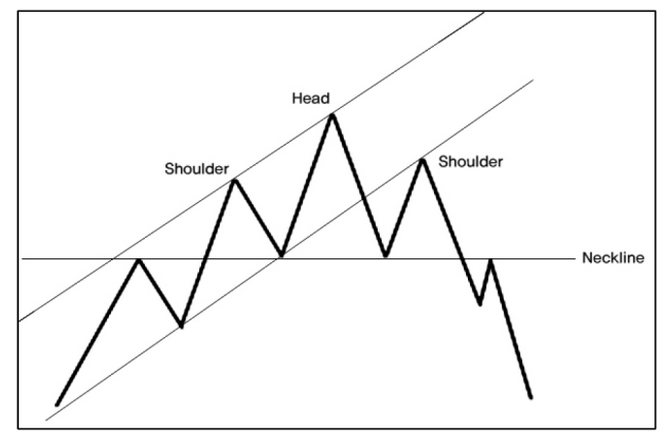

One pattern in particular stood out for Honma: what he called the three mountains but what traders today know as a head and shoulder pattern.

Whenever Honma saw the three mountains on his price charts, he knew it was time to SELL rice, because prices were likely to plummet.

When Honma saw the opposite -- dips followed by a sharp movement upwards in prices -- he knew it was time to BUY, because prices were likely to rise.

It worked like magic.

When he died, Honma was worth an estimated 100 billion dollars in today's terms -- one of the most successful, if not the most successful, trader in history.

He became Japan's largest landowner and his descendants, who today run the Honma Golf Company and golf resorts all over Japan, continue to benefit from the trading secrets he discovered.

That's an incredible story! I've never heard anything about this before.

And here's what's really exciting about this: although we still use Honma's candlestick charts in trading…

There is actually a far simpler trading signal for measuring the buying and selling pressure on a stock or options on a daily basis.

Rather than trying to figure out if a stock is cheap or not -- and analyzing price to earnings ratios, price to book, and other attempts at measuring fundamentals -- you can simply use this indicator to follow the money.

The way I do this is to use the price of a stock in relation to what is called its 50-Day Exponential Moving Average or EMA.

When I combine this with Honma's candlestick charting, the result is a very powerful trading tool.

These simple indicators -- which you can get for free on the Internet -- have made me literally MILLIONS of dollars in the past few years.

Let me show you how it works.

Here is a recent chart of a stock called Zoom Video Communications.

As you can see, the price of Zoom Video dipped down below the EMA line.

For the purposes of this summit, we can call this simply The Dip.

And then it headed sharply back up again.

This is an indicator that the stock is likely to continue rising higher, at least in the short term.

I'll explain in a moment how we were able to QUADRUPLE our money with this trade at the end of February 2020, turning every $5,000 into $20,550.

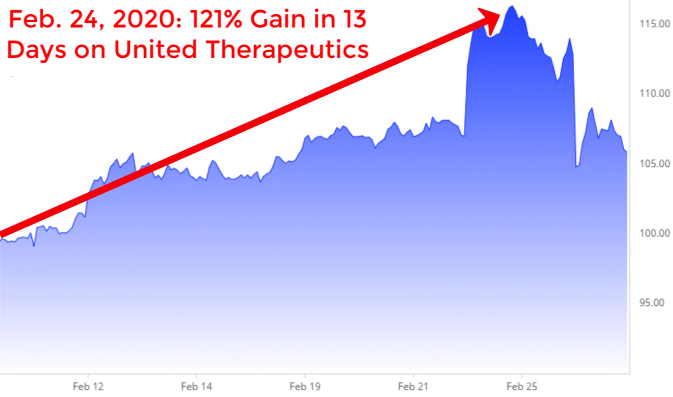

Here's another recent example with United Therapeutics.

You'll notice on the chart that, after the Dip occurs, the stock's price accelerates far above the Exponential Moving Average.

That's the wide gap between the candlesticks and the blue line indicating the moving average.

We were able to generate $6,050 in just two weeks with this signal, starting with just $5,000…

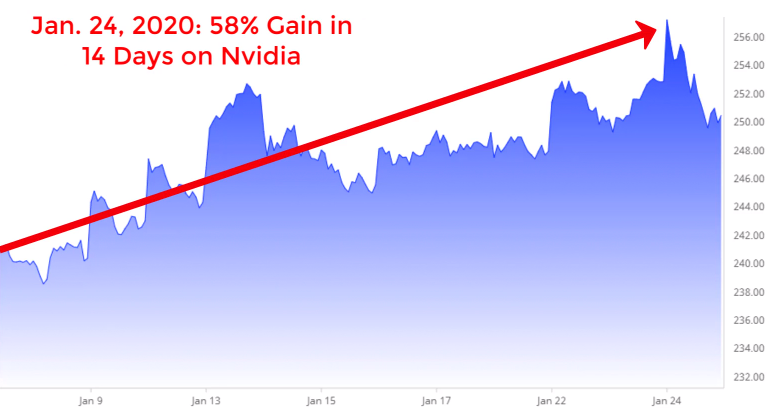

And here's Nvidia… another popular stock.

We played this setup, in February, earning $3,000 again in just two weeks.

Here's an example for Beyond Meat.

When we saw the Dip on this chart, and then the stock price accelerating away from the moving average, we recommended the trade. We made a 191% return on this in just four days.

Here's another example: Netease Inc Ads… ticker symbol (NTES).

This was also in early 2020.

As you can see from the chart, there was actually a series of dips in a row.

Honma, the Japanese rice trader, used to call a series of dips like these the Three Rivers…

That's why we need to see an explosive move to the upside following the Dip or Dips BEFORE we consider the trade. That is what happened here with Netease.

Here's another example with Match Group, the dating site company:

Notice there were dips before the one highlighted but we didn't trade those.

We're looking for a Dip that is FOLLOWED by an explosive move upwards… which is what we see here.

We actually made TWO trades based on this signal, one in which we netted an 83.7% return and another for 123.6% in profits, over two weeks last Christmas. Also, note what pattern formed after the surge: Honma's three mountains…

That's pretty amazing. I've never seen trading presented quite like this before.

Yeah, once you know what to look for… it is pretty amazing.

Here's another example: Shopify.

This is another example of one in which we made two trades: one for just 50% in two weeks, the other for 150% in a month. This pattern showed us the inverse of the Honma triple mountain.

And here's a chart for Broadcom.

We made a 93% return in just 5 days -- again, another inverse triple mountain.

So, Jon, is that all there is to it?

You just look for the Dip, followed by a sharp move upward away from the moving average?

I know you're kidding, Roger.

No, a lot more goes into trading than just this.

In fact, the EMA is merely ONE out of dozens of indicators that active traders like myself use to measure money flow in markets.

In addition, we look for specific patterns, like The Dip that I just showed you, which we call setups.

You've probably heard of many of them: Double Bottoms, Head and Shoulders, Cup with Handle.

Once we identify a particular setup, we look for entry points -- specific price moves that indicate a major shift upward or downward.

And then we pull the trigger.

And these setups work in BOTH directions, right?

You say you make money whether the market is going UP or DOWN?

That's correct. That is why the recent market turmoil is so exciting. You can make a FORTUNE in a market like this, if you're willing to trade on an active basis.

Remember that the three mountains pattern that the Japanese rice trader Honma talked about -- what we call a head and shoulders pattern?

Honma considered it a strong indicator that a commodity price was about to plummet.

Well, we continue to use this today.

Here's a chart in mid-March 2020 of Lam Research Corp (LRCX).

As you can see, there is a clear three mountains pattern that indicated the price of LRCX was about to do a nosedive.

It's the same idea: Using technical indicators and price chart patterns, we can see when investors are dumping a stock and the price is likely to plummet.

When everyone else was losing their shirts in the stock market selloff in March, we made not one but THREE profitable trades on LRCX:

- One for 271.7%,

- Another for 156.5%

- And a third for 75.3%.

All in just nine days.

You really can make huge profits even when the market is plummeting!

Absolutely. Here's another example from the end of March: Microsoft!

The market had rallied the week before and we saw an opportunity for a quick trade.

We recommended a particular trade on March 30 and took profits the next day for a 51.2% gain in just one day. You could have turned every $1,365 into $2,065 overnight.

That's amazing!

We did the same thing a couple days earlier… only this time, we made an 81% profit.

With this trade, you could have turned every $935 invested in Microsoft into $1,700, for an instant profit of $765 -- an 81.4% gain in just 4 days.

Or you could have turned $9,350 into $17,000 and banked $7,650, again in just 4 days.

Well, this sure convinces me!

But Jon, given the market we've seen recently, I have to ask you about buying the BIG dip -- meaning, can traders use these chart patterns to know when they've likely seen a market bottom?

Can they use your system to know when they should start buying stocks again?

You better believe they can! You just have to make sure that the Big Dip, as you call it, is followed by strong moves to the upside before you begin buying again.

Look at what happened in 2008.

There was a Big Dip, all right.

The market crashed 56% from peak to bottom.

Many investors sold at the bottom and then missed the inevitable rebound -- and still haven't really recovered!

But using our trading system, you could have seen when the market started rising strongly after that big drop and then rode what ended up being the biggest bull market in history for the next 12 years.

Indeed, that big dip was part of a large inverted head and shoulders pattern -- what Honma called the three rivers that set the bottom for the market.

We knew it was the bottom because we saw many high quality names such as Amazon setting up similar patterns.

Even as traders were saying the old indicators are broken, we saw them telling us to get ready for a massive buying opportunity.

Fortunes were made trading that drop and the subsequent bull market.

That's why I have many, many stock investors who follow my recommendations.

They need to know when a market is going to turn around after a big selloff… and when it may be peaking.

Plus, you have to do something if you're going to survive and prosper in the years ahead.

If you want to enjoy a prosperous retirement, you're not going to be able to rely solely upon mutual funds or money market accounts that pay almost nothing.

Especially if we're entering a longer term bear market, you're going to have to start generating the bigger profits that only come from successful trading in order to replace lost income.

With interest rates back down to near zero, you can't count on bonds and other traditional income investments for income.

But the good news is that my trading strategies and systems work spectacularly well in falling or down markets just as they do in rising bull markets.

Now, I know you trade both stocks and options. Tell me about the options part of all this.

Well, obviously that's where we make a lot of the money.

You get enormous leverage with options while still strictly limiting your risk.

For example, on the Zoom Communications trade I showed you earlier…

The stock gained only 29% during the trade… but the options we traded made a 311% profit.

We quadrupled our money, turning every $5,000 into $20,550.

Here's another example:

Micron Technology, we banked an 81% gain in just three days as the stock jumped only 9%.

And with Xilinx, we grabbed another 95% gain in 12 days, even though the stock itself only increased 10%.

Also, what I like about options is that even though the profits are usually so much bigger you can trade them for A LOT less money than trading stocks.

For example, you could have made that Zoom Communications trade for only $700 -- and then walked away with an extra $2,177 in cash in just 18 days.

This keeps more of your money safe.

To make a similar profit on the stock, you would have had to invest $7,500 or TEN TIMES more, not $700.

That means you can keep the bulk of your account safe in cash and just take small risks on these individual trades, one after the other.

And anyone can do this, right?

Yes, that's right.

In fact, you don't have to know a thing about trading.

All you have to do is tell your broker or enter the trade with an online brokerage firm.

It literally takes less than a minute.

Well, I know people who follow your trades are certainly happy. I can't believe the comments I've read about your trading service.

Here are just a few of them. For privacy reasons, we abbreviate their last names.

Jeff C. wrote to say, and I quote:

"I've made over $14,000."

And Scott K. emailed your office. He said…

"You have a wonderful working system here. I have only been using it for about 45 days now and have made $11,000 on 8 trades in that time period. A lot of people with money would like to know about what you have here. It’s a gold mine."

Paul S. wrote to say that he…

"...nearly tripled his money in 10 months."

James S. wrote in, and I quote:

"I have been a member for 11 months and want you to know how happy I am. It's such a pleasure following your good advice. I made 37 trades with you, 36 of which I sold for a profit."

Steven R. wrote to say:

"After one month utilizing your service I am up $3,500! 7 out of 7 winners. Planning on increasing my investment level now that there is comfort level. There may be no better way to invest in the market. Previously, volatility in the market caused my portfolio to swing widely. Now, using volatility and on a short term basis with quality stocks with you as the quarterback. I have THE SYSTEM. Many thanks to you and your staff. Keep up the good work."

And Steven wrote to say he is more than satisfied with Jon's trades:

"16 winners in a row!!! Your setups are beyond great. Subscriber for life."

Pretty incredible testimonials, I must say.

Yes, we've had a lot of very nice letters.

But just so our viewers can get a feel for how this works in the real world, can you walk us through some of these trades… showing us how you actually do them?

Of course.

Let's start with some recent ones for which we have charts.

Remember that chart I showed you for Beyond Meat?

Well, we could see the price of Beyond Meat was accelerating sharply upward and away from its Exponential Moving Average.

All of the other technical indicators we used were also pointing to a strong upward move in the intermediate range.

As a result, I recommended to our readers on January 10 that they buy a call option on Beyond Meat for $900 per contract.

As we suspected, Beyond Meat shot upward. In just four days, the stock had gained 21%.

But the options went crazy, soaring from $900 to $2,620, a return of 191%.

If you had invested $2,700 in three contracts, you could have pocketed $5,100 in profits. All in just four days.

This is why people become active traders.

Here's another example: American Tower Corp, whose ticker symbol is AMT.

I remember this one because we took profits on Christmas Eve.

Again, we saw the classic dip pattern that we've been talking about.

Actually, this was like the three rivers patterns that Honma talks about in his book on trading: The Fountain of Gold.

The dip was followed by a strong breakout to the upside.

So, on December 19, we recommended our readers buy a particular call option for $10 -- or $1,000 for one contract.

As you can see from the chart, the stock took off like a rocket, from $219 per share when we recommended it, to $227 a share on Christmas Eve, a gain of 3.65%.

But once again, the call option did a lot better. The option we bought for $1,000 on December 19 was worth $3,500 when we sold it five days later for a $2,500 profit!

That was a great Christmas present for a lot of families, let me tell you.

Again, this was a very simple trade: We told our readers the exact option to buy, when to buy, and how to buy it. It took maybe one minute to execute.

Five days later, they had a minimum of $2,500 in extra cash, more if they bought more than one contract. We didn't try to bleed every nickel out of the trade; we took the safe, fat part of the move, banking excellent gains when the move showed signs of stalling.

Here's another example: the Match Group trade I mentioned earlier when we took profits right after Christmas.

It's the same type of setup: a big dip followed by a strong move to the upside away from the EMA.

On December 16, we recommended both the stock and a call option -- $72.73 per share for the stock and a call option sell for $6.26 or $626 per contract.

Again, this was super-simple: we emailed our readers precisely what to do and what instructions to read to their brokers.

More conservative readers bought the shares, more aggressive traders bought the options or both the shares and the options.

Well, the stock continued rising, as we thought it would, from $72.73 per share to $82.92 per share, a gain of 14%.

But the option gained a lot more. It went from $626 per contract to $1,400 by December 30 when we took profits.

That represented $774 in profits per contract or a gain of about 124.6% in two weeks.

If you had invested $3,130 in 5 contracts, you would have walked away with $7,000 -- an extra $3,870 in profits. Again, in just two weeks.

We did this over and over again all last year and have continued doing this this year.

In fact, our profits have been even BIGGER this year because of the plummeting stock market!

Let me run through just a few trades from earlier this year.

We started off 2020 with a whole bunch of BIG winners…

- On January 3, we took profits on a trade with Skyworks Solutions that we had initiated in late November.

We made 320% returns on our money, turning every $440 we invested in call options into $1,850.

- A week later, on January 10, we doubled our money (100% profit) with

The option we recommended for $950 per contract on December 19 had soared to $1,900.

So, if you had invested in three contracts for $2,850 three weeks earlier, you doubled your money and had an extra $2,850 to start your day.

- Three days later, on January 13, we took a small gain of 58% on Netease, turning every $2,170 into $3,440.

- The next day, January 14, we took profits on that Beyond Meat trade I mentioned earlier, turning every $900 invested into $2,600 in just 4 days.

Sorry to interrupt here, Jon…

Am I boring you right now, Roger?

No, no. This is incredible. I just can't believe people can make this much money so fast.

Well, they can and do, believe me.

That's why we traders can't believe people will wait for YEARS to make the same profits some of us can make in a week.

Here's another example:

On January 24, we had a disappointing result with Nvidia. We only bagged 58% when we expected to make a lot more.

Still, we were able to turn every $1,825 invested into $2,920 in two weeks -- for a $1,095 profit per contract.

Things really picked up in February…

February was when the market started tanking!

Exactly! You make A LOT more money, and a lot quicker, in a falling market.

We had a few small trades in the beginning of the month -- like a 60% gain on Netflix -- but when the market fell we scored big time.

On February 24, the market was plummeting! Yet we took profits on a United Therapeutics trade, turning every $660 invested into $1,460 -- or a gain of 121% in just 13 days.

On February 28, we REALLY did well. Our Zoom Communications trade made us a whopping 311% profits. We turned every $700 invested into $2,880 -- or $2,180 per contract.

Again, had you followed our instructions and invested in three contracts for $2,100 on February 10, you could have had an extra $6,540 in your account by the end of the month.

And in March, when the market really crashed, we had our best month by far.

This chart shows what the Dow was doing beginning February when we made our trades…

That's when we bagged three trades in a row with Lam Research… 271%… 156%… and 75%.

And just a couple days later, we took profits on two smaller trades…

74.7% in 4 days with Zoom Video Communications again…

And 70% in just 2 days with Gilead Sciences.

As you can see from the chart, even in a crashing stock market, there are trading opportunities to the upside, like this one.

Jon, I'm speechless. Really. I hear people claim you can make big money even in a crashing market… but you really prove it.

Yeah, when I give seminars, I get that reaction a lot.

It's true I am focusing on our bigger winners.

But we're not proud: we take profits on smaller trades all the time -- like the 74% we banked with Zoom Video Communications on March 20.

One thing I want to stress: Stocks don't have to move that much for us to see big profits on the options.

I remember we banked an 80% gain in Facebook as the stock surged 7% -- our gain was more than 10x the stock's gain.

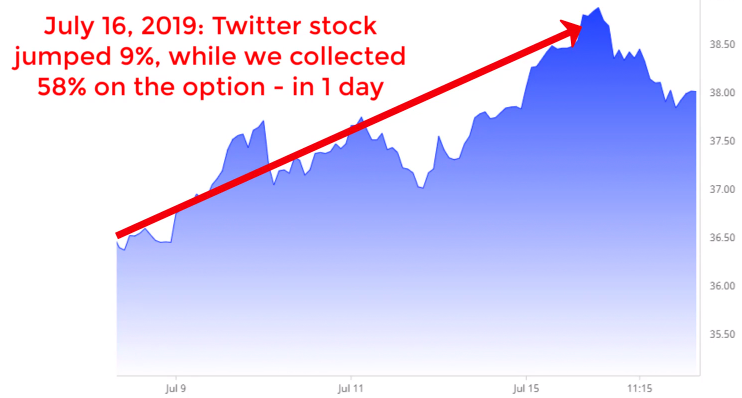

One time last year, Twitter's stock jumped 9% and we banked a 58% gain in one day.

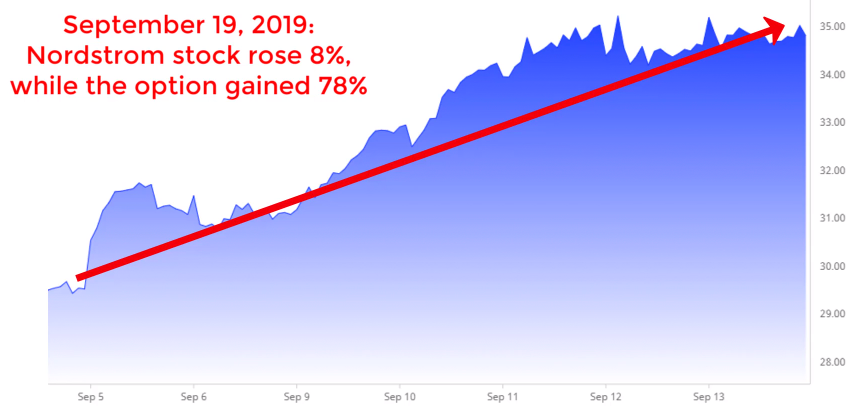

And we made a 78% gain on our Nordstrom options as the stock rose 8%, both in just 3 days.

But whenever we have a string of smaller winners like this, we almost always get a nice triple-digit winner along the way.

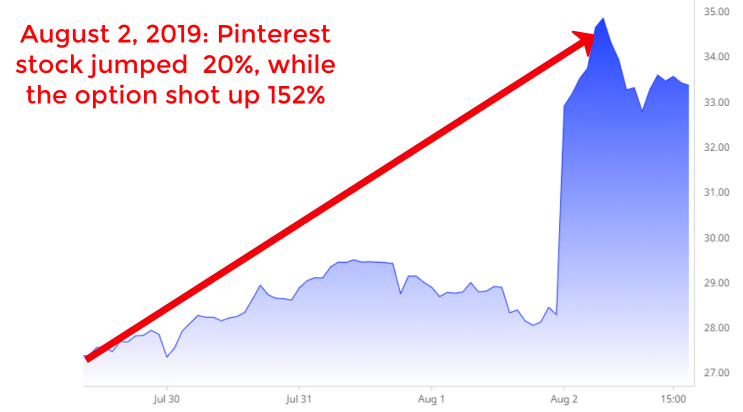

I remember last summer Pinterest stock jumped 20% and we banked a 152% gain in our options, all in just over a week.

We just received a question from Bob out in California. He wants to know if you ever have any losers?

Of course! Plus, it goes without saying that past performance is no guarantee of future results.

But as you mentioned earlier, over the past seven years we've had 1,306 double- and triple-digit winners.

That's an average of 186 winners a year or 15 each and every month!

Yes, in all my years, I've never seen a track record quite like this.

You continue to hit home run after home run.

But I have another question emailed to us from Wayne in Maryland.

He wants to know if you have to be a technical trader to make these trades?

That's a great question. And the answer is, you don't need to know anything about technical trading to follow this system and make thousands of dollars each week.

All you need are the specific instructions that we give everyone.

Well, while I'm at it, I have another question from a viewer named Elizabeth right here in Washington, D.C.

She says she doesn't want to risk much of her savings on something like this.

And she wants to know if it's possible to start with a small amount and grow it quickly by reinvesting her profits.

Jon, I know you do supercharge your performance by stringing your wins together, piling up profit on top of profit.

I'm glad you mentioned that, Roger! And yes, Elizabeth in D.C. hit on one of our big secrets.

We don't just make a trade, take profits, spend the money, then look around for another trade.

Instead, we reinvest our gains so that a very small amount of money can grow into a large amount very, very quickly.

Yes, that's why we have a special offer for all of our viewers that I will describe in more detail later.

We're actually going to GIVE AWAY $1,000 to any viewer who wants to get started trading and using your system, because we know how well you pile profits on top of profits.

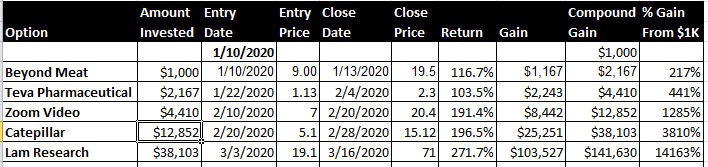

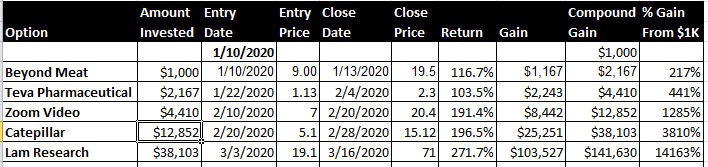

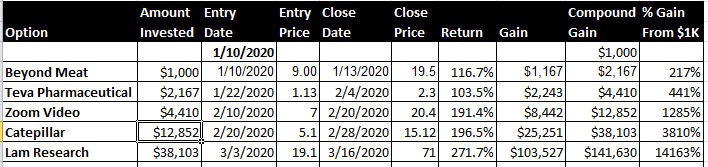

We decided to do this because we know you had five trades that could have grown just $1,000 into $141,630 from January through March 2020.

Jon, can you please tell our viewers how you did this?

Yes, as I said, many traders cash out of their trades rather than roll their profits into the next positions.

That's fine. One of the great things about active trading is that you are able to make cash income in both an up market… and one that is falling.

But people who choose to reinvest their profits, or even just a portion of their profits, into the next trades have a realistic chance to become wealthy.

The profits compound at an incredible rate.

Let me show you in this chart the first three months of 2020.

So, if we had started with $1,000 invested in Beyond Meat options on January 10, 2020, that $1,000 would have made a 116% return and turned into $2,167.

Not too bad! And many people would simply spend that money on whatever they want to spend it on.

Which would be great!

But if you had decided, instead, to reinvest your profits, then you could have put that $2,167 into another option trade -- this time in Teva Pharmaceutical which we recommended on January 22.

That was a great trade. We more than doubled our money again in about three weeks with a 103.5% return.

That would have grown your $2,167 into $4,410 -- again in just three weeks.

So, wait, you could have turned $1,000 into $4,410 in just over a month, right.

More like 5 weeks, but yes.

Amazing!

Yes, but what if you had just kept going? Sounds risky, I know, but bear with me.

Just six days after we took profits on Teva Pharmaceuticals, we recommended an option trade on Zoom Video Communications for just $700 per contract.

You could have rolled your previous profits into six contracts for $4,200!

And that was ANOTHER trade that was almost a triple!

By mid-February that would have seen a 191.4% return, creating an additional $8,400 in profits for a total of $12,852.

I have to say, Jon, I'd be tempted right there to spend some of that money.

Yes, I know, Roger, but this is just an illustration of what is possible.

Now, let's say, instead of jetting off to Paris or Hawaii or whatever, you took that 12 grand and reinvested it, this time in an option we recommended in Caterpillar.

This was another HUGE winner for us, this time to the downside.

We recommended the option for just $510 per contract on February 20, the same day we took profits on the previous trade.

It took just 8 days, and we almost tripled our money again for a 196% return.

That means your $12,852 would have turned into $38,103.

Now, we're talking real money!

And I admit, very few people would let it ride.

But given our track record of winners, a few just might.

So, here's what could have happened.

Remember that Lam Research trade I mentioned earlier?

Well, had you put all of your money into this trade on March 3 -- which, as I said, most people would NOT do -- you would have been more than pleased with your decision to delay gratification.

That's because we took profits only 13 days later, on March 16, when the options we bought for $19.10 each skyrocketed to $71 each for a return of 271.7%.

Yes, your $38,000 would have turned into $141,630.

Put another way, just by making these five trades -- during the fastest market crash in history -- you could have potentially grown a modest $1,000 into $141,000 in just short of three months.

That is why people actively trade the market.

It's true we had a series of big winners all in a row and that doesn't always happen.

But if you had rolled over your gains on these trades, you could have seen huge profits.

Well, Jon, no one would have the nerve to do that!

Well, I wouldn't say no one, Roger.

You don't know traders the way I do.

But I agree, most people would take a big chunk of their profits off the table.

I'm just telling you all this to illustrate the basic principle that, by compounding your gains, you really can grow a small amount of money into quite a big amount very quickly.

Maybe not to this degree… but still to an amazing amount.

That's why you don't need very much money to get started trading.

You can start with as little as $200 or $300 and a lot of people do.

With a few good trades, you could end up with tens of thousands of dollars.

I'm glad you mentioned that again, because, in just a moment, I'm going to explain how people can get that first $1,000 to begin trading. It's our own kind of stimulus money!

But before we do that, let's talk about how you help people make trades like these.

You were a trader for many years on your own, just building up your own fortune, right?

Yes, that's right. I made my first million in 1999.

I could have just retired right then and there.

But then what was I going to do?

Play golf?

That's not a bad option for some, but what did you do instead?

Well, I did what anybody would do.

Once I knew my system produced more winners than losers, I started sharing my trading recommendations with family members and good friends.

They started making amazing amounts of money -- I mean, more from trading than they made from their 9-to-5 jobs.

And I was surprised by how much fun that was, helping other people get rich.

I have to say, there's really nothing like it. And then my friends had their friends, and it just sort of grew from there.

I started to hire high school and college students, young adults who wanted not only to make some extra money, but wanted to learn a skill they could use for the rest of their lives, a skill to help them take control of their lives.

They did research for me, programming, website maintenance and I taught them what I knew about the stock market.

Well, I have hired these students and young adults for 20 years now, and I can say that NONE of them are with me today.

And that is exactly the way I want it.

They discovered that they can make money in any market and started doing so. It wasn't long before they moved on to live their lives.

Some became full time traders, others augmented their chosen careers path with the money they made in the market.

All of them have taken control of their lives and their financial future, with the confidence that they can live their lives as they choose.

Having a part in that was WAY more fun than playing golf.

I bet. Okay, I have one more email from Kim in New York. She asks, and I quote: So how do people get started?

Another great question! And the answer is, my team and I have boiled down 25 years of hands-on trading experience into a super-simple system designed for people with ZERO knowledge of trading -- but with enough advanced features, so that experienced traders will benefit hugely as well.

We call it… Investment House Daily Pro.

So, what is Investment House Daily Pro exactly?

It's a stock and option trading service that aims for the bleachers, as the saying goes.

We are NOT trying to pick off 5% or 10% gains every other month, the way some traders do.

We're aiming for triple-digit profits -- 100%, 200%, even 400% returns.

We don't always get them. We have our share of 50%… 35%… even 15% returns.

And as you said, we've had 1,306 double- and triple-digit winners with returns as high as 1,300% on Exact Sciences Corp.

And your trading system identifies NEW opportunities like these -- to take a few hundred dollars and turn it into thousands -- every week?

Yes, that's how we're typically able to take profits from a few days, a few weeks and sometimes when a trade is really working it may be a few months. Typically it's a few weeks..

And I can honestly say that I have NEVER seen trading opportunities like we're seeing now with this hyper-volatile market.

The problem is, few people know how to actively trade them!

And you teach people how to trade the way you do?

Yes. I've been teaching trading for years.

But I've been frustrated by the fact that people who learn HOW to trade often don't actually make the trades.

And that is incredibly frustrating to me.

I decided to create the Investment House Daily Pro not so much to teach trading (although it does do that indirectly) but simply to GIVE people specific trading recommendations they need to become wealthy.

In other words, Investment House Daily Pro is going to show you precisely what I am doing on a day to day basis -- and have you copy precisely that.

That way, if I make $10,380 in 12 days -- as I did in March when the market as a whole was in free fall -- so could you if you do everything I say.

In a sense, we both teach people HOW to fish… and also GIVE them fish as well.

So, can you tell us how your service works?

Sure. In practical terms, it's a way for beginning and intermediate traders to follow what I am doing in my own trading accounts.

You simply copy my trades in your own brokerage account or enter the trades (if you're paper-trading) in your demo account or Excel spreadsheet.

When I identify a potential trading opportunity based on the trading patterns we use… usually once every other day or so…

We fire off a Trade Alert by email to all of our members.

I tell you which stock or option trade we are recommending with specific instructions for buying the underlying shares if you want… and also how to invest in the option trade.

Plus, I use simple, easy-to-understand instructions.

I explain all of the reasons why I believe this particular play is a perfect opportunity -- both for the stock itself and for the option.

I actually do special videos where I walk people through a recommendation, explaining both HOW to make the trade and the reasons why I believe it's a great opportunity.

And as you mentioned earlier, we have a set of actual trades ready RIGHT NOW that viewers can enter immediately.

That sounds pretty comprehensive to me!

It is. Plus, unlike many trading advisories, you get trades to fit any account size or investment goals.

If you are very conservative, you can simply make my recommended stock and occasional ETF trades -- based on my system's analysis of the market trends.

But if you'd like to supercharge your existing portfolio, then you can copy my option recommendations.

The point is, you get to literally look over my shoulder and watch as I make these trades. You don't have to reinvent the wheel.

You can take advantage of my 25 years as a successful trader and simply do what I do.

You can start slow -- even with zero money -- and simply watch and learn.

As your confidence grows, as you see the profits these trades produce in the real world, you can begin making real-money test trades. Then, once you get used to making money as a trader, you may consider bigger investments.

What about people who work at a regular job or don't want to spend all their time in front of a computer? Can this system work for them, too?

It works especially for them!

One of the great benefits to the Investment House Daily Pro is that you don't have to be glued to your chair, anxiously watching computer screens.

That's my job. That's what my staff and I do. We spend all of our time monitoring the markets so you don't have to.

The other big benefit of the Investment House Daily Pro is peace of mind. We take small, calculated risks.

The trades we make in Investment House Daily Pro are extremely conservative as trades go.

This lets you sleep at night. And with a market as volatile as ours, that's important.

Okay, so let's go over what people get if they want to try out your trading service.

First, right off the bat you send everyone your THREE hottest new trades, right?

Yes, that's right.

When can you get them?

Right away. I mean, right now if you want.

You can enter these trades into an online brokerage in the next 10 minutes.

What else?

Well, you get our complete current portfolio -- what we call our Continuing Plays Table -- with ALL of our current active and just completed trades… for both UP and DOWN markets.

This is like the Midas Touch and the Goose That Laid the Golden Egg… all rolled into one.

And then I know you have your quick start trading dossier. Tell everyone about that in a nutshell…

Yes, the latest edition is entitled, Trading the Dips: How to Turn $1,000 into $141,000 with Pattern Trades.

It's our comprehensive introduction to technical trading.

I use simple, but extremely accurate, indicators to measure the flow of money into individual stocks and markets.

That is how I identify good candidates to trade. That is one secret to my success.

The second secret is flexibility -- both in terms of the direction of the market and of the instruments used to trade it.

If my system reveals a stock or specific market is headed for a significant downturn, I don't hesitate to trade it short.

I also don't limit myself to one or two instruments. I invest in individual stocks, options, and some precious metals ETFs.

My third secret is discipline. I never risk more than my initial investment on a trade, which means I don't sell naked options, buy on margin or trade futures.

I always assume that there are unknown unknowns that can interfere with any trade -- like the whole coronavirus panic -- so I limit the size of every trade and if necessary, move into and out of it incrementally.

Plus, I use stop-loss orders and cut my losses quickly -- but let my profits run.

Now, these simple but little-followed trading rules have allowed me to produce eye-popping profits year after year, even in down markets.

So, Trading the Dips reveals ALL of your secrets?

Well, I don't know if I can say all of my secrets.

But it is a very thorough introduction to making money consistently through trading.

We touch on the various setup patterns we use… the different bullish and bearish patterns such as Ascending Triangles, Double Bottoms and so on.

Plus, I cover our option strategies specifically, and explain everything in plain English.

Sounds thorough.

In addition, every day you get our DAILY pre-market and post-market Hotlines that tell you the key information you need to actively trade that day.

At night, they tell you what happened and why -- including technical charts -- our overview of the stock market, as well as other markets, data on earnings warnings, upgrades and earnings misses.

We call this simply The Daily -- and it's very popular with our subscribers.

This is in addition to our Trading Alerts -- which are issued whenever we spot a hot opportunity and need to make a change in one of our positions or to take profits.

How often do you get these Trade Alerts?

We send them by email -- at least one or two per week, usually many more.

Then there is our encrypted website that keeps track of all of our trades -- and has an archive of all daily Hotlines and Trade Alerts -- plus our complete current portfolio with specific instructions for each trade.

That's quite a package you’ve put together!

Yes, I think so.

Well, Jon, this is clearly an exclusive, high-end trading service designed for people interested in making serious profits through actively trading the market.

Let me tell our viewers about our special offer for it.

If you subscribe to Investment House Daily Pro today, you'll get instant access to ALL of Jon's current recommendations…

- Including his COMPLETE current portfolio of stock and option recommendations…

- As well as every other recommendation he makes going forward…

- PLUS all of his daily Hotlines…

- His Trade Alerts and weekly analysis and updates…

- His up-to-the-minute videos with detailed explanations of his trades and the reasons why they're such great opportunities…

- PLUS a copy of his technical trading quick start guide, Trading the Dips: How to Turn $1,000 into $141,000 with Pattern Trades.

- And all of Jon's other ongoing help and guidance.

Normally, the cost for such a successful trading service as this is a very reasonable $3,995 -- but you don't have to pay anything close to that.

Because of the current crisis we are facing, we decided to offer this service for a FULL 50% off the regular price -- or just $1,995…

But we’re going to do even better than that. For a limited time, we decided to up the ante even MORE. Because we want you to get started making money on these trades… right now.

We decided to stake you -- simply GIVE YOU -- $1,000 towards your very first trades.

That's no joke: one thousand dollars.

We're hoping everyone will use this money to start making Jon's trading recommendations right away -- to turn $935 into $1,700, as Jon's readers did with Microsoft on March 26 -- a gain of 81% in just two days.

Or to turn $7,310 into $10,400 with Google on March 31 -- pocketing $3,090 in profits in less than a week.

Or take $2,380 and turn it into $3,800 with Nvidia on March 31 -- banking a profit of $1,420 in just 2 days.

Again, these are real-money trades. When most people are watching money drain out of their accounts seemingly by the minute…

You can be banking literally THOUSANDS.

For example, by taking $3,490 on March 26 and turning it into $4,650 on March 31 -- banking a quick $1,160 in just 4 days.

I suggest using this $1,000 to begin making trades like these right away.

Or, if you prefer, you can also apply this $1,000 to the cost of Investment House Daily Pro.

That means, with the special crisis 50% discount and the $1,000 grubstake, that brings the cost for a FULL YEAR of weekly money-making trades down to the ridiculous price of only…

$995.

You could potentially earn that much on your very first trade!

And if you'd like an even BETTER value, you can get 79% off the regular price and lock in the special crisis subscription cost of just $1,695 for two years.

Yet there is just one catch:

You must take advantage of this special invitation right now -- TODAY.

As with most of our services, for logistical reasons, we can only accept small numbers of new members at any one time -- and we are taking only 200 new members to Investment House Daily Pro at this time.

When those slots are taken, we have to shut the doors at least for a few months.

That means that, once this special offer is over and the $1,000 grubstake is no longer available, you'd have to pay the full rate of $3,995 per year.

Keep in mind that Jon's trading recommendations can result in hundreds, even thousands of dollars in extra income every week.

Subscribers to Jon's services put it best:

E.T. wrote and said:

"Thank you for your great reports. I have made more money than I ever have in the last 15 years of investing. You guys really know your stuff."

Gene B. wrote to say…

"Through June 15 so far we have netted over $40K. What else can I say? Your recommendations are simply great. Your analysis of each position and markets are invaluable in their straightforward explanation and reasoning behind each move. … Thanks and keep on the great work."

W.W. emailed to tell us:

“I just want to say how much I value the comments of Jon in the daily email letter about the market conditions. I read it religiously and feel I have learned so much from him and continue to do so. …. Thanks Jon for your very personal touch in your commentaries!!!"

And with this current hyper-volatile stock market, a service with this kind of track record can potentially turn even a modest nest egg of $1,000 into tens, even hundreds, of thousands of dollars.

And that's why I'd like to invite you to try out Jon's Investment House Daily Pro RIGHT NOW.

What's more, I'm going to make you a very special promise:

A Winner Every Week… or you get an extra year FREE!

We promise that Investment House Daily Pro will deliver a minimum of 52 double- or triple-digit winning trade recommendations in the next 12 months.

If it doesn't -- if you only see 51 double- or triple-digit winners -- we'll give you a second year for FREE.

That’s a $3,995 value all by itself.

I can make this promise, because I know Jon's trading strategies have handed his readers 1,306 double and triple digit winners since 2013.

So, bottom line: this is a truly low-risk offer.

You don't even have to risk any of your investment capital to see if Investment House Daily Pro will make you money, either.

At first, you can use Jon's specific, step-by-step trading recommendations to paper trade or you can just make small test investments at first.

Whatever you decide, you're going to be SHOCKED at the results.

The only downside is the limit on the number of new members.

Once those 200 slots are taken, you won't be able to get in at this low price.

And now, I'd like to thank our special guest, Jon Johnson, for taking the time to be with us today during these trying times.

Thank you, Roger. This has been a lot of fun.

I urge you, our listeners, to click on the big button below to claim your $1,000 instant grubstake and accept a subscription to Jon's Investment House Daily Pro today.

Imagine hearing all the moans from your friends -- the complaints about how much money is being lost in the stock market -- knowing that you're secretly pocketing THOUSANDS OF DOLLARS every week.

It's definitely worth checking out -- by clicking on the button below right now.

Once you do, you'll be taken to a secure order page when you can review everything one more time.

You're just moments away from getting Jon's newest money-making trading recommendations… and remember, he’s crushing it -- even in today’s market!

Plus all the other benefits I mentioned.

Take advantage of this limited-time special offer during this crisis while you still can.

Click the button below right now to activate your membership and your first trade with Jon Johnson.

This is Roger Michalski. Thank you for listening.