Fellow Investor,

If you like the idea of making a lot of money in a hurry, then I have urgent news:

For the first time in 40 years, renowned free market economist Dr. Mark Skousen is recommending penny gold stocks.

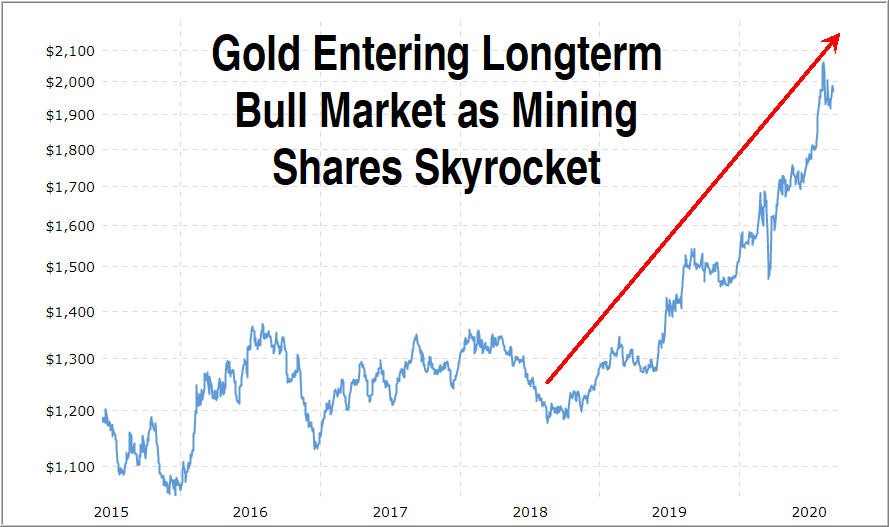

Due to the COVID-19 crisis, easy money policies by the Fed, and unprecedented government deficits, Dr. Skousen believes investors can make a small fortune on the right gold mining shares by getting into them today.

The window of opportunity is narrow, and could slam shut at any moment. Yet modest investments of $1,000 to $3,000 in penny gold shares could potentially return 9X your money or more… sometimes in just months:

Take Cabral Gold, Ltd (CBR.VN), for example.

It was selling for just 7 cents a share in March 2020. By August, it had jumped up to 48 cents a share.

A $2,000 investment would have risen in value to $12,800, less commissions.

Another penny gold stock, Kore Mining Ltd (KORE.VN), soared from 16 cents in March to $1.64 today — a nice 925% gain in a little more than five months.

And these are not outliers, either. In just the past year, you could have also bagged…

- 72% on Radisson Mining Resources Inc. (TSX-V: RDS.VN)

- 75% on Corvus Gold Inc. (TSX: KOR.TO)

- 77% on Yamana Gold Inc. (TSX: YRI.TO)

- 106% on Emx Royalty Corp. (TSX-V: EMX.VN)

- 138% on Gold Fields Ltd. (NYSE: GFI)

- 158% on Turquoise Hill Resources Ltd. (TSX: TRQ.TO)

- 174% on International Tower Hill Mines Ltd. (TSX: ITH.TO)

- 204% on Lion One Metals Ltd. (TSX-V: LIO.VN) and

- 219% on Hecla Mining Company (NYSE: HL)

- To name just a few.

What’s more, other penny gold stocks did even better!

Arbor Metals, a Vancouver company that acquired a 100% interest in 2,473 hectares in Saskatchewan’s famous Athabasca Basin, skyrocketed from 4.7 cents a share in early January 2020 to $1.77 by the end of August.

That represented an eye-popping 3,665% gain — or 36 times your money!

You could have made a $2,000 investment and, in about eight months, walked away with as much as $75,000 in cash.

A $3,000 investment in Freegold Ventures Limited (FVL.TO) in early 2020 would be worth $117,750 today, less commissions.

And then there’s Aura Minerals Inc (ARMZF), a tiny company with gold mines in Honduras and Brazil.

It shot up from 9.4 cents a share late December 2018 to $12 in July 2020 on the heels of skyrocketing gold prices.

That’s a 12,655% return: more than 126 times your money!

If you had plunked down just $2,000 on Aura Minerals and forgotten all about it, you could have woken up two years later with an extra $252,000 in your pocket.

A (Very) Special Situation

Has Arrived in the Gold Market

This is Roger Michalski, publisher of Eagle Financial Publications.

I’m bringing all this up because a special situation has developed in the gold market that I feel duty-bound to bring to your attention.

It’s true, we don’t normally talk about penny stocks or gold mining shares.

They are highly speculative, risky investments that most of our experts generally shy away from and rarely write about.

That’s why I was very surprised when our resident economist, Dr. Mark Skousen, who is not a gold bug by any means, began telling my colleagues and me that we are at the beginning of a brief but intense bull market in precious metals.

Now as you likely already know, Dr. Skousen is one of the world’s leading authorities on value investing and free market principles.

Named one of the 20 Most Influential Living Economists, Dr. Skousen is a former analyst for the Central Intelligence Agency, former president of the Foundation for Economic Education (FEE) in New York, and is currently founder and director of FreedomFest, one of the largest and most prestigious annual celebrations of freedom and prosperity in the world.

In addition, Dr. Skousen is the author of 25 books and has written for numerous publications, including the Wall Street Journal, Reason, Human Events, the Daily Caller, Christian Science Monitor and The Journal of Economic Perspectives.

A Top Secret Dossier of

Junior Gold Mining Stocks

Yet, what many people don’t know is that, over the past several months, Mark has been quietly compiling a secret portfolio of small gold mining stocks like the ones I mentioned earlier.

For the first time in 40 years, he is adding penny gold stocks to his usual blue-chip stock and option recommendations.

According to him, there are basically FOUR types of gold shares:

- Large-Cap Giants That Pay Dividends: The safest are large-cap gold mining companies that are super-profitable and are paying dividends. They can cost as much as $130 a share and often can’t beat the market.

- Large-Cap Giants That Don’t Pay Dividends: The next safest are large-cap mining companies that make money, but don’t pay dividends.

- Small-Cap Producers: The third safest are small- and mid-cap mining companies that are producing, but not profitable yet. These can sell for $5 to $25 a share.

- Small-Cap Resource Companies: The last group contains the most risk of all. These are small-cap companies that have proven gold discoveries, but are not yet in production. They are also the long-shot plays that sell for just pennies per share… and can sometimes see life-altering profits, fast.

Mark is convinced that unprecedented government deficits make speculating in these high-flying shares worth the risk now. The potential profits are simply too great to pass up if investors act fast.

And he isn’t the only expert who thinks so. As Barron’s put it recently…

“There could be more room for gold — and gold-mining stocks — to advance, with inflation-adjusted U.S. rates negative and the U.S. government running enormous deficits.”

And as Goldman Sachs said in a recent memo to their customers…

“We have long maintained that gold is the currency of last resort, particularly in an environment like the current one, where governments are debasing their fiat currencies and pushing real interest rates to all-time lows.”

So far, Mark has shared his secret gold picks with only a small number of people — not even with subscribers to his popular Forecasts & Strategies newsletter.

The reason why is obvious.

These are very thinly-traded stocks that can frequently take off like a rocket overnight simply on rumors.

Yet, they involve more risk and may not be suitable for the portfolios of most ordinary investors.

Many of them double, sometimes even triple, your money, but some go nowhere and some even lose money.

Phenomenal Shares for Less Than

$1 to $2 Apiece

I’ve known about Mark’s “secret portfolio” of penny gold picks for months now.

Every now and then, Mark would call or email me about another opportunity he’d discovered. He’d describe a small Canadian mining company with a massive potential deposit in northern Manitoba, for example.

Or he’d tell me about a company’s potential merger with a mining giant like Kinross.

One junior gold stock he told me about recently is up 688% just since March!

And each time, I’d say, “Let’s send out an alert! Let’s get this out to all our readers…”

“Well,” Mark would invariably reply, “There’s just one problem…”

These junior mining companies are almost all tiny, usually trading at less than $1 a share. And their market caps are miniscule — often less than $100 million.

That means they’re simply too small to recommend to Mark’s entire readership. They’re not liquid enough.

And it’s a shame.

The potential profits from these penny gold shares are phenomenal — 100%, 200%, even 950% (like we saw earlier this year) or more, sometimes in a matter of months…

Yet, I Just Couldn’t Stand By and Let These

Opportunities for Huge Profits Go to Waste

As a result, a few months ago, I talked Mark into doing a conference call for a few hundred subscribers to his TNT Trader service. Some participants paid up to a thousand dollars to attend this event.

The ground rules were simple: Mark would share with this small group about how and why he’s currently investing in penny gold stocks. His only request was that they not share the specific recommendations with anyone else.

It was all hush-hush.

Mark agreed to follow up each week. His emails would include all of his latest buy and sell recommendations.

And this was important.

You see, these are not the kinds of investments you can buy and forget about. You have to follow them closely… and sell at just the right moment. Here’s a peek at the penny gold shares Mark revealed to listeners on the call…

“Unconventional” Homerun Potential…

For $1.75 a Share

The first firm topping his “secret portfolio” was a small mining company that owns a deposit of 6.6 million ounces of high-grade ore in central Idaho, making it potentially the sixth-largest gold mine in the United States, and the 19th in the world.

Incorporated in 2011 and headquartered in Vancouver, Canada, this small mining company has had a rollercoaster ride over the past year, but has recently taken a major swing to the upside.

The company’s mining operations have been around since the Idaho Gold Rush days of the late 1890s. The property was an open-pit mining operation that was used to mine antimony and produce bullets during World War II.

The area was largely abandoned after 100 years of mining. Yet the new project, which began in 2011, expects to create a long-life, good grade, low cost, highly profitable open-pit operation for a dozen years…

While repairing past ecological damage and securing environmentally sustainable land.

The average cost of mining the gold is anticipated to be around $600 an ounce, making this mine highly profitable. This effort is expected to invest $1 billion in the economy and create 1,000 jobs in Idaho.

In addition, shareholders already include Barrick, Franco-Nevada, Oppenheimer and VanEck.

Even more impressive, perhaps, it just completed a $35 million financing bought entirely by a billionaire investor.

He knew the permitting process that had taken more than five years to complete is expected to be over any day now. That’s when mining can commence.

Given the bull market in gold, the production phase is ideally suited for maximum profitability.

Shares have already started to take off.

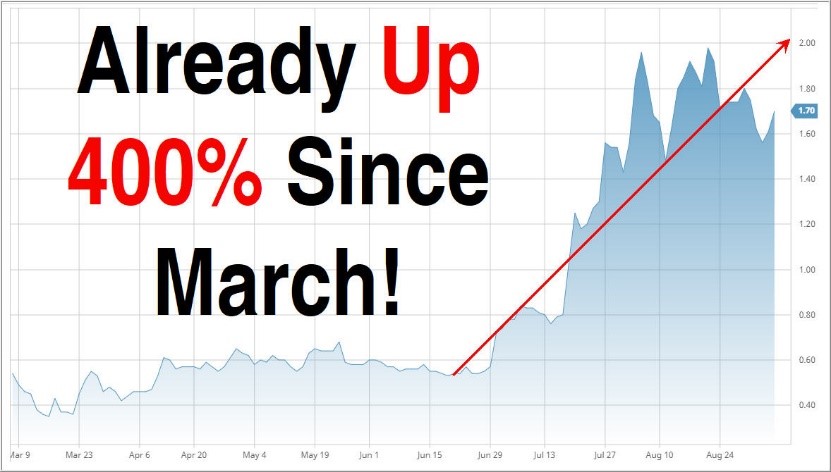

Since March, the price has skyrocketed from 35 cents a share to $1.75 today — a gain of 400% in just a few months.

Imagine plunking down $2,000 in March and watching it turn into $10,000 in half a year.

That’s what often happens with the right penny gold stocks!

Of course, not every win comes that fast.

In fact, the majority of them take longer — a year or two, sometimes more — to reach their full profit potential.

But those gains will make the short-term ones I just told you about seem like chicken feed.

That’s the opportunity you have here. Today you can still buy shares of this company for just $1.75 each. You can pick up 1,000 shares for just $1,750.

The market cap today is around $250 million. Mark said it could end up at $2-3 billion, making it a potential “ten-bagger” once production gets going.

That’s the sort of risk-reward ratio that is possible with these small gold mining shares!

A Penny Gold That Is Listed on the NYSE and

Is Up 179% Since March!

The second of Mark’s recent penny gold recommendations was a “micro gold” stock (with a $77 million market cap) that has been around for decades, with mining operations in Puebla State, Mexico

A full feasibility study has already been completed, meaning the permit process is almost complete. Once it is, all bets are off.

The company will dig into its enormous deposits of gold and silver. This region is considered one of the premier mining properties in Mexico, worth anywhere from $500 million to $1 billion, given today’s metals prices.

It is hard to believe that this New York Stock Exchange listing could be selling for under a dollar, but it is. It used to sell for over $5 a share after the initial Puebla discovery was made in 2010.

This time around, $5 might be on the conservative side.

Shares are already up 179% since mid-March, from 25 cents to 70 cents.

That means you can pick up 2,500 shares for only $1,750.

One analyst sees the stock eventually at $7-8 a share unless it is bought out sooner.

That means your $1,750 investment could grow into as much as $20,000.

A Junior Miner in Peru That Is

Already Up 688% Since March!

The third of Mark’s “top secret” penny gold picks shared during the call was an exploratory property in the Andes Mountains of Peru. According to Mark, buying shares now gives us a great shot for another ten-bagger.

Like many small mining companies, this company’s headquarters are in Vancouver.

It’s in the process of developing a copper, gold and silver project in the Miocene mineral belt of Peru — although the property is likely to generate 60% of its revenue from gold and silver.

Unlike the first two, this company has obtained a permit to mine on the land; drilling has already begun.

And the outlook for copper, gold and silver is strong.

Shares enjoyed this strength, as they’re already up 688% since March.

We’ll take lightning-fast, triple-digit gains like this every time we can.

But remember, that’s just the beginning of what Dr. Skousen believes is ahead for this stock.

By this time next year, shares could be double what they are now.

Same goes for the year after that.

The company is making a comeback after the government recently granted it the right to explore and develop major sections of the property.

Copper has been moving up to $0.92 per pound, and many analysts believe that its supply is limited.

At the same time, the use of copper in building, electronics and electric vehicles is gradually rising.

Given that the market cap is only $35 million, it won’t take much of a move in copper to ignite this penny play and send it into the stratosphere.

A Unique Ability to Find Triple-Digit Winners

Now, there’s a reason why Mark only revealed these three penny gold picks to subscribers of his unique TNT Trader service.

Mark designed TNT Trader to help investors make explosive gains from companies and mega-trends that are changing how we live our lives.

These include businesses with disruptive technologies, such as Apple’s smart phones, Google’s search platform, NVIDIA’s AI chips, or, as I’ve just been describing, a bull market in gold and gold stocks.

Spotting new trends like these early, and unearthing the companies that will dominate them, is the key to making huge gains in the months and years that follow.

Plus, TNT Trader recommends both stocks with explosive profit potential AND out-of-the-money call options to generate quick triple-digit gains.

Here are just a few of the winners from the last two years:

- +506% in 70 days with 58.com…

- +460% in 63 days with Valero Energy Corporation…

- +425% in 56 days with Keurig Dr Pepper…

- +308% in 21 days with Drive Shack…

- +308% in 63 days with Match Group…

- +306% in 100 days with Brinker International…

- +275% in 84 days with Lazard…

- +252% in 35 days with Penn Virginia Corporation…

- +246% in 113 days with Planet Fitness…

- +231% in 28 days with Ubiquiti Network…

- +201% in 88 days with Red Hat, Inc….

- +184% in 130 days with American Assets Trust…

- +180% in 84 days with Applied Materials…

- +165% in 20 days with Veva Systems…

And on and on.

Mark’s new penny gold stock portfolio fits right in with its two-fisted profit potential:

- Fast, explosive gains from stocks or options.

- Life-changing profits from holding shares longer.

Mark accelerates these wins and supercharges gains by also recommending out-of-the-money option trades on them.

For example, in February 2020, when the entire country was in a panic over COVID-19, Mark helped his followers more than double their money in just 13 days (up 124%) with options on NVIDIA shares.

He helped his subscribers bag profits of 181% in just 14 days with options on Tesla shares.

And earlier, he helped them make 129% profits in just 90 days from trading options on the S&P 500 Info Tech Sector SPDR shares.

In fact, over the past two years, Mark’s TNT Trader has posted an astonishing 34 double-digit winners and 22 TRIPLE-digit winners on both stock and option trades, with an average annual return of 76.7% for all trades.

And here’s what truly amazing: It turns out Mark was just getting started!

Dr. Skousen Had Even

BIGGER Winners This Year

Despite the COVID-19 whipsaw market, Mark’s recommendations in 2020 have been even BIGGER!

He bagged profits of…

- 426.8% on one position and 351.6% on another…

- 117% and 181% on two others in early 2020…

- 225% on a third in August 2020…

- And 133% on a fourth and 124.5% on another.

One recommendation, trading options on a bullish U.S. dollar mutual fund, made an eye-popping 950% profits in just 23 days.

So, here’s the reason I’m reaching out to you today.

Word of our conference call on penny gold stocks has gotten out, and I’ve been getting a lot of requests from readers to let anyone who wishes to invest in these small gold mining stocks.

But we simply can’t do that.

As I said earlier, these are mostly penny stocks.

They are highly volatile.

While we get many triple-digit winners, some end up losers.

So after months of thinking about it, we’ve decided on a compromise.

Mark has agreed to offer penny gold trades like these three solely in his TNT Trader service.

That’s because, while the penny gold recommendations have more risk, Mark’s track record of triple-digit winners in TNT Trader means the risk is likely worth the reward.

What You Get When You Join

Dr. Mark Skousen’s TNT Trader Service

Once you join, the first thing you’ll get is a link to Mark’s now-famous recorded conference call on investing in penny gold stocks in 2020.

This gives you Mark’s insights, as one of the world’s most trusted economists, on why the right gold mining shares could potentially make you a fortune over the next few months.

Plus, you also get Mark’s brand-new special report with details on the three micro- and small-cap gold stock recommendations you heard about today.

It’s called: “Penny Gold Profits: Become Up to 9X Richer in the 2021 Gold Rush”

This no-nonsense, plain-English guide reveals why these small gold mining companies offer realistic opportunities to multiply your wealth many times over…

- Specific details on the company that owns a deposit of 6.6 million ounces of high-grade ore in central Idaho. (Get ready, because Mark may recommend additional shares of this pick at any moment. This is one of his favorite picks.)

- A full report on the “micro” gold company that you can buy for 73 cents a share and that is already up 179% since mid-March 2020… Again, this is a stock in which a modest $1,750 investment could potentially grow into as much as $20,000.

- Everything you need to know about making a fortune in penny golds, including detailed instructions for the company with mines in Peru that has already soared 688% since March.

Once you crack open this report, the serious money-making benefits begin:

Swinging for the Bleachers with

Stock, Option and Penny Gold Picks

TNT Trader is definitely a “swing for the bleachers” type of service: It offers regular opportunities to take small amounts of money (say, $1,000 to $3,000) and turn it into $9,000 or $27,000 in just months.

Or you may be handed the next Aura Minerals… and turn every $1,000 into $126,000, in less than 24 months.

You’ll get homerun potential plays like this consistently over the entire year.

Ongoing New Recommendations

Almost Weekly

In addition to the current portfolio, you get new trading recommendations for tech stock and option trades throughout 2021.

Mark typically offers one or two new trades every other week, or about 20 to 30 recommendations a year on average.

These recommendations include penny gold stocks, but also stock and option recommendations in a number of explosive stock sectors, wherever there’s a fortune to be made.

You’ll Know Precisely When to Take Profits

Unlike many advisory services, Mark will tell you precisely when to take profits in all of his recommendations.

When he exits a profitable trade, he’ll normally close out the trade in stages.

For example, if Mark has a small gold mining stock that has soared over the past few months, he’ll recommend you sell perhaps half of your position one week… wait a week, or a month, or a year even, then sell the other half.

He does the same thing with his option winners.

I can’t tell you how many times I’ve seen Mark DOUBLE the profits by doing things this way.

I would think the move would be over, but I would be wrong! As a result, Mark will send you follow-up emails, as many as are necessary, with specific instructions on when to get in, when to get out, and when to “hang tight.”

Comprehensive Risk Management

Mark generally encourages you to limit the size of your trading positions, especially with volatile trades like penny gold stocks.

His rule of thumb is to never risk more than 5% to 10% of your trading funds on any one trade.

Also, Mark cuts losses early and ruthlessly.

You’ll Make Even MORE Money By

Not Exiting Trades Too Early

The flip side of that, however, is not to sell too soon if you’re riding a big winner.

That is where it really helps to have a seasoned pro guiding you.

Believe it or not, beginning traders are too quick to take a small profit.

In companies like these, that we want to hold onto for a while, that’s a sure way to miss out on the huge paydays that lie ahead.

Specific Stop Prices for Each Trade

Now, one thing you should know: There is no such thing as a risk-free strategy or asset class.

Past performance is no guarantee of future results. Trading is inherently risky (especially with options) which is why you should only trade with money you can afford to lose. Mark has losing trades like everyone else.

Yet the use of specific stop prices allows Mark to identify losing trades very quickly, so he can get out fast.

The best part of the way Mark trades these penny gold stocks, however, is that you can start small.

As you gain confidence that the trades really can produce significant profits, you can begin to slowly make bigger investments and then build up your account.

Answers to All of Your Questions

If you ever have a question or concern about one of Mark’s recommendations, you can call his Director of Trading, Grant Linhares, Monday through Friday, between 9AM and 5PM (Eastern Time). His toll-free, direct number is 844-419-4548.

With this premium service, you can bet Grant will answer your question fast.

Now, there’s one last thing…

TNT Trader is Limited to

Just 40 New Subscribers

As I said earlier, this is a very personal, hands-on service for serious investors, so we have to keep it small.

Plus, these penny gold mining stocks are very thinly traded.

We simply can’t have too many subscribers rushing to get in (or out) at once, or no one is going to make the buy or sell at a good price.

As a result, we have to limit this service to just 40 new subscribers at any one time or we can’t do it at all.

And once those slots are taken, that’s it: You’ll have to wait until someone leaves the service before you can get in.

Special $1,000 Instant Discount Available Now

Of course, access to Mark’s recommended portfolio of penny gold shares, tech stock recommendations and related option plays is NOT cheap. In fact, the regular price is $1,995 per year.

Yet, if you join today, as a new subscriber you’ll get a very special deal: a $1,000 instant discount! You pay just $995 for a full a year of Mark’s most explosive penny gold, stock and option picks.

That’s actually a great deal and it won’t last long, given the exclusivity of this service… and considering you could easily recoup the total cost with just one of Mark’s trades.

The deal won’t last for long. There’s a good chance all 40 slots will be taken as soon as tomorrow night.

Once all of the available openings have been taken, we’ll shut this offer down. If we make TNT Trader available again, sometime in the future, it’ll probably be at the full $1,995 price.

I suggest you act fast.

Test Drive Mark Skousen’s TNT Trader

Risk-Free for the Next 30 Days

Of course, this service isn’t for everyone.

This is an exclusive, high-end service geared for investors interested in the huge profit potential penny gold stocks offer… and who understand the risks.

Yet Mark decided to create a unique guarantee that, to me, is a no-brainer.

Secure one of the 40 new memberships openings today, just to make sure you get in… and Mark will let you test drive his TNT Trader on a strictly provisional basis for 30 days.

You can make the trades with real money or just “paper trade” them to see how they do.

What’s more, this offer also comes with a shocking promise:

If TNT Trader doesn’t earn you back the price of your subscription within the first 30 days, just ask us for your money back. You’ll get an instant refund.

That means you don’t have to take any risk whatsoever to see what TNT Trader can do for you.

In fact, in the unlikely event you do decide the TNT Trader is not for you, just let us know before the end of your 30-day trial period and we’ll refund 100% of your money, no questions asked.

As I mentioned, you can test drive TNT Trader risk-free for 30 days — and get Mark’s complete “secret portfolio” of penny gold stocks and other “explosive” recommendations today.

I believe the profits from trading these small gold mining shares could be extraordinary.

Just like the recommendations Mark’s already made this year that have earned subscribers as much as 950% in just months.

Yet to gain instant access to recommendations like these, you have to act NOW — before another huge surge in gold prices.

The window of opportunity for cashing in on select gold mining shares is very narrow — and could slam shut at any moment.

Right now, only a few hundred people have seen his “secret portfolio” of penny gold stocks. And if you act fast, you can likely join them… but once all 40 openings are taken, the door will shut.

So, please don’t wait. Instead, click the button below right now to get instant access to Dr. Mark Skousen’s latest penny gold stock recommendations.

Best wishes,

Roger Michalski

Publisher, Eagle Financial Publications

P.S. As a new subscriber, you can join Dr. Mark Skousen for a full 50% off the regular price of $1,995 a year (you pay only $995). Plus, you’ll get our iron-clad 30-day money-back guarantee. Click the button below now to test drive TNT Trader risk-free for 30 days. Or call Mark’s Director of Trading, Grant Linhares, toll-free at 844-419-4548, M-F, 9-5 (Eastern).