Bob Carlson, America’s #1 retirement expert trusted by CEOs and money managers, reveals how you can now…

Collect Tax-Free Income for Life!

Collect $2,500 to $3,900 per Month Tax-Free for the Rest of Your Life… Even if You Currently Have Nothing Saved!

Dear Friend,

This is Roger Michalski, publisher of Eagle Financial Publications.

Many retirees are shocked by how much they still pay in taxes once they stop working. When my parents and their friends retired, they could barely believe how difficult their finances were due to taxes.

Depending on your situation when you retire, you’re taxed on your:

- company pensions

- 401(k) and IRA distributions

- annuities

- rental income

- dividend and interest payments

- S. savings bonds

- Social Security!

In fact, if you make too much money while retired, you can have your Social Security payments taxed – even though you paid into the fund all your life!

The annual income threshold for when the IRS begins taxing your Social Security benefits is only $32,000 for a married couple!

Today, I want to tell you about a way you can potentially sidestep ALL of that!

Forever.

Say Hasta la Vista, Baby…to the IRS!

In fact, there is a way you can collect thousands of dollars per month for the rest of your life – tax-free.

That’s right: I said tax-free.

You can get a check or wire transfer weekly or monthly…

And not pay a single dime in taxes on it.

Plus, this tax-free income source is 100% legal and approved by the IRS.

However, practically no one knows about it.

The government doesn’t exactly advertise it.

Why would they? It’s better for the government if you put your hard-earned money into investments or savings they can tax the hell out of.

And here’s the kicker: Even if you don’t have enough money put away yet for retirement… even if you’re over age 60… you can still get thousands of dollars a month from this opportunity – and every penny you collect will be 100% tax-free.

Sound impossible?

Well, it’s not.

The Ultimate Catch-Up Strategy

for Retirement

I call this income-maximizing opportunity the Tax-Free Income for Life Strategy™.

Most wealthy people don’t know about it.

But the few who do know are laughing all the way to the bank… or to their condo on the beach.

They’re sipping Portuguese sangria, confident that they won’t have to pay tribute to the IRS on their monthly checks.

When I first heard about this little-known source of tax-free income, I almost fell over.

Few Experts Know About This Strategy, Yet It’s 100% Legitimate

I’ve been a financial publisher now for more than 25 years, and I didn’t even know this was possible until recently.

Even many tax advisors and accountants are in the dark.

I first learned about this source of tax-free retirement income from my colleague Bob Carlson, America’s #1 retirement expert.

We were discussing a newspaper article about a billionaire investor who knew all about the Tax-Free Income for Life Strategy™.

Thanks to the strategy, he was able to turn $2,000 into $5 billion in just 20 years.

You see, most sources of income, including retirement income, require you to pay federal and state income taxes up to 46.5% or more of what you earn.

That’s also true of withdrawals from a 401(k), IRA, SEP, or traditional pension.

That’s a major shock to many new retirees.

When you’re struggling to pay your bills in retirement, that’s a HUGE bite.

Yet what I’m talking about is different.

And this billionaire investor knew it!

He used the little-known Tax-Free Income for Life Strategy™ to virtually eliminate income taxes from his life.

Now he can collect $10 million a month, if he wishes, and the IRS can’t touch a penny of it.

In fact, it’s forbidden for them to touch it.

By law.

Regular retirees who know about the Tax-Free Income for Life Strategy™ can do something similar, collect thousands of dollars a month and not pay a red cent in taxes.

I know it sounds incredible, but it’s 100% legitimate.

And no, this has nothing to do with tax-free municipal bonds or anything like that.

Imagine how liberating this could be!

While your friends and relatives are paying 30% to 40% of their income because of MASSIVE taxes on their dividends, pension, even Social Security checks…

… you’re able to collect sizable amounts from the Tax-Free Income for Life Strategy™ and not owe a single penny in taxes.

This is money that lets you live life on your terms.

Traveling the world.

Or refusing to go back to work just to make ends meet.

This source of tax-free income is what some people call “shove it” money.

That’s because you can say shove it to the IRS and shove it to anyone who says you have to work.

(If you do work, it’s because you want to, not because you have to.)

And It Can Work for ANYONE…Employed or Even Retired

The Tax-Free Income for Life Strategy™ can also work if you have savings stashed away in an IRA, 401(k), or SEP.

And it can work if you’re self-employed, own your own business, or work as an employee.

Plus, it works particularly well for older couples who sell their equity-rich homes and want to generate an income with the proceeds but are horrified about how much they’ll have to pay in taxes.

What’s more, as I said, the Tax-Free Income for Life Strategy™ works even if you don’t have any money set aside yet!

Let me show you how.

For example, let’s say you found out about this amazing source of tax-free income when you were 55 and had zero saved for retirement.

You had a regular job with no pension and a side business that earned you $4,000 a month.

You knew that IRS rules only allowed you to save a maximum of $7,000 per year ($8,000 if you were over age 50) in an IRA or SEP – and that this wouldn’t be enough to retire on.

As a result, you would probably be wracked with worry about your future and how you were going to care for your loved ones.

But not once you had learned about the Tax-Free Income for Life Strategy™.

Using the strategy, you could legally put up to $76,500 a year in a special type of account – or nearly TEN times what you can contribute to an IRA or Roth.

This money can then grow tax-free, like an IRA on steroids.

Instant Retirement in a Box:

From Zero to $2,500 a Month

Let’s say you decided to put every extra dime you could come up with into the strategy for just five years.

You used money from your side business, your spouse’s job, proceeds from the sale of a boat you no longer used, or even a small inheritance you received.

As a result, you were able to save $4,000 a month for five years.

Well, if you did that and earned 10% annually on the account, which is roughly what a stock index fund like SPY has done for the past 30 years, you would end up with $322,349.

That may not sound like much when it comes to funding your retirement…

But get this: Because of the Tax-Free Income for Life Strategy™, you could begin collecting regular checks from this fund just five years after you started saving, beginning (in this example) at age 62.

With your money earning the same return as before, you could collect $2,500 a month and never run out of money – even if you lived to be 95!

And unlike your Social Security checks, this money would be tax-free forever thanks to the Tax-Free Income for Life Strategy™.

As a result, that $2,500 per month would be the equivalent of $3,000 or even $4,500 that was taxed.

(If you could only save $2,000 per month, you could collect $1,350 per month – like a second Social Security check – and never run out of money.)

And that’s not the best part.

With the Tax-Free Income for Life Strategy™, you would even have money left over for kids or grandkids – between $500,000 and $700,000, depending on how long you lived and how much you were able to put away.

Now, what if you were a wealthy lawyer or professional who had a bigger income but also hadn’t saved very much for retirement?

It Works Even BETTER

for High Earners!

Well, the Tax-Free Income for Life Strategy™ could work even better!

You could legally put up to $76,500 a year into a special account.

And unlike traditional savings programs, such as a Roth, there are no income limits for making contributions to the Tax-Free Income for Life Strategy™.

Earning 10% a year, this money could grow into a whopping $493,597 in five years – enough to generate a monthly income of $3,900 tax-free for the rest of your life.

Plus, you would have up to $674,000 left over to pass on to relatives or charities.

This Strategy Is a Fortress Protecting Your Wealth

And there’s another reason to take advantage of the Tax-Free Income for Life Strategy™.

That’s because it not only protects you from current taxes…

… but it also protects you from FUTURE tax increases!

You see, Congress will soon have no choice but to raise taxes, especially on the middle class.

The U.S. government is currently $33 trillion in debt.

Social Security’s trust fund is scheduled to run dry in just ten years.

According to the U.S. government, Medicare is already on shaky ground and will only get worse as baby boomers age.

And the #1 place government will go looking for more money is the life savings of retirees!

The bank robber John Dillinger famously said that he robbed banks because that’s where the money is.

And the savings of America’s retirees is where the money is – and government robbers know it!

There’s an estimated $35 trillion sitting in retirement accounts right now, waiting for greedy government bureaucrats to siphon it away.

Yet thanks to farsighted Republican legislators in the Clinton years, the law specifically prohibits the government from touching a single penny of the money collected through the Tax-Free Income for Life Strategy™.

It’s sacrosanct – or at least as sacrosanct as anything associated with the government can be.

Congress will be much more likely to increase taxes on Social Security benefits – or on withdrawals from IRAs and 401(k)s – than they will on money in the Tax-Free Income for Life Strategy™.

That’s because the government depends on people continuing to save money for their retirements – and, in particular, in the special type of plan used in the Tax-Free Income for Life Strategy™.

Once they begin taxing money saved through the Tax-Free Income for Life Strategy™, that saving will come to a halt and add to the Social Security burdens the government already faces.

And here’s the best news of all.

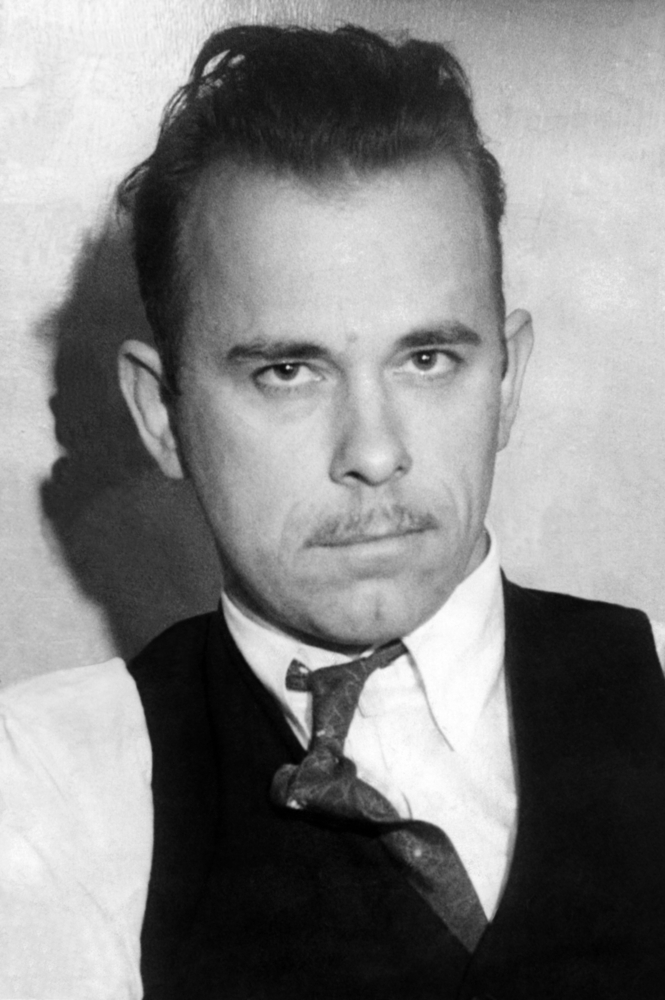

America’s retirement expert Bob Carlson has prepared a brand-new special report all about this little-known but potentially lifesaving strategy.

It’s called the Tax-Free Income for Life Strategy™.

This valuable special report is not available in any store, at any price.

It contains everything you need to know about the Tax-Free Income for Life Strategy™, including:

- Why this strategy works for almost anyone, whether they are retired, employed, or self-employed…

- The single most important step you can take, right now, to generate a tax-free income…

- The legal way to put up to $76,500 into this strategy every year…

- Why the super-rich and the struggling can BOTH use this approach…

- How to use IRAs with this strategy…

- A loophole that lets you turn a taxable 401(k) plan into tax-free income…

- And lots MORE.

And here’s the best news of all: You can get a copy of this valuable, eye-opening report without spending a single penny.

Get Your FREE Copy With

This Special Limited-Time Offer

You can get a copy of the Tax-Free Income for Life Strategy™ FREE – simply by accepting a risk-free trial subscription of Bob Carlson’s invaluable retirement newsletter, Retirement Watch, for a special low price.

Believe me, Retirement Watch is the only publication of its kind published anywhere in the world.

It should be the #1 “go to” resource for anyone retired or thinking about retiring one day.

It’s edited by my friend and colleague Bob Carlson, who is a walking encyclopedia of retirement strategies and know-how.

After earning both a law degree and a graduate degree in accounting from the University of Virginia, Bob set out to revolutionize how Americans plan for and live in retirement.

He wanted to create a service that would help retirees and pre-retirees help themselves.

In 1991, Bob launched Retirement Watch with the help of his lovely wife. Together they’ve grown it into one of the most trusted sources of information and help for retirees and those about to retire.

Along the way, Bob became a senior contributor to Forbes.com as well as an author of three popular books: The New Rules of Retirement, Personal Finance After 50 for Dummies (with Eric Tyson), and Invest Like a Fox… Not Like a Hedgehog.

Bob also served as chairman of the board of trustees of the Fairfax (Virginia) County Employees Retirement System (FCERS), from 1995 to 2023, and was a trustee of the Virginia Retirement System, a $42 billion pension fund, from 2000 to 2005.

The point is, Bob Carlson knows retirement inside and out.

His aim is to arm Americans with the most up-to-date information, strategies, and tactics to get the absolute most out of their retirement.

But don’t simply take our word for it.

Here’s what Bob Carlson’s happy subscribers write to tell us…

Richard R., Marlton, NJ, says:

“The best, most useful financial advice newsletter that I get.”

Mark F., Poway, CA, adds:

“I’ve given Retirement Watch subscriptions as gifts to five different people, because it’s THAT good. Complex subjects that keep changing, and Bob gives it to us up front. Succinct steps, and action plans – no other newsletter does this. I take 40 different investment newsletters, and Retirement Watch is the first one I read every month. Best investment you can make today.”

Sandy K., CFA, CFO, says:

“As a Wharton graduate, money manager, chief financial officer, and chartered financial analyst, I didn’t think I needed help in making investment choices and planning for my retirement. I was wrong. I have been a subscriber to Retirement Watch since 1997. I trust Bob Carlson completely and follow his investment, tax, and planning advice personally.”

Paul M. of Arizona wrote to tell us:

“For anyone in retirement or about to start retirement (as is my case), I can’t imagine a better one-stop resource. Even when I email Bob with a question, he responds promptly and thoroughly. I have found such a level of personal service and guidance to be very rare in the world of financial newsletters that I have subscribed to over the years. Retirement Watch will be part of my retirement plan until I’m pushing up daisies!”

Todd W. of Glendora, CA, couldn’t be more thrilled:

“Retirement Watch is now my one and only investment guide.”

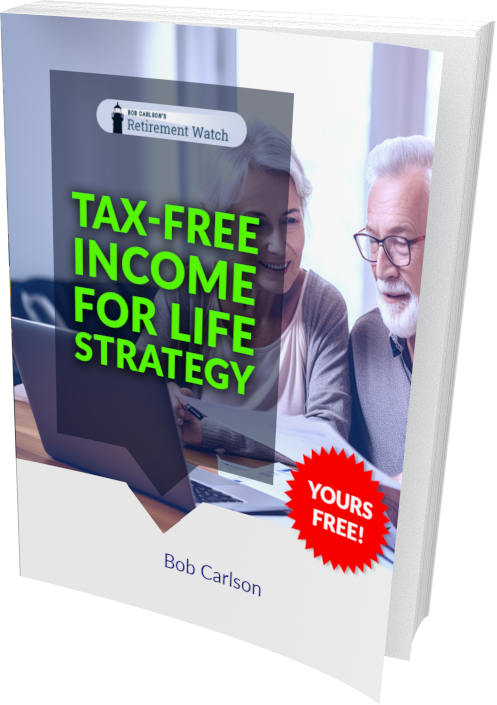

Plus, as part of this special offer, you’ll also get a SECOND gift, Securing Your Retirement Income.

Secrets to Boosting Social Security Benefits by up to 76%!

Another way to enjoy a more prosperous, worry-free retirement is to maximize what you collect from Social Security.

Before retirement, most people think Social Security won’t be an important part of their retirement cash flow.

Yet 34% of current retirees estimate that Social Security provides 90% or more of their retirement income.

And for most American retirees, Social Security provides a meaningful portion of their retirement income; it is the only guaranteed lifetime income for many people.

Yet many people don’t realize just how much flexibility they have and how much their choices change the amount of benefits they collect.

And retirees can substantially increase lifetime cash flow by making the right decisions about Social Security!

Also, the choices that will maximize income have changed over time. Last decade’s rules of thumb are not ideal for today’s retirees.

For example, a new study conducted by researchers at Johns Hopkins University found that only 4% of people start collecting Social Security benefits at the most advantageous time.

Most people begin taking benefits as soon as they can… at age 62.

Yet one study shows that America’s retirees miss out on as much as $3.4 trillion by claiming Social Security too early.

That’s cash Uncle Sam gets to keep for himself.

And yet waiting until age 70 to collect a higher payment can also be the wrong move for many.

Recent studies suggest lifetime payouts are maximized if the lower-earning spouse begins taking his or her earned retirement benefits early, say when first eligible at age 62 – and then the higher-earning spouse waits until at least age 68 before taking benefits, preferably age 70.

Bob Carlson lays out all the details in another special report called Securing Your Retirement Income.

You can get a copy of this report free of charge as well.

You’ll discover:

- How to get up to 76% MORE from your Social Security payments.

- A simple way to collect a tax-free second income while you delay collecting Social Security.

- One simple move that can put an extra $25,000 – or more – in your pocket, even if you’re not married.

- Why the traditional 4% annual retirement withdrawal rate is often completely wrong for people today… and what to do about it.

- And lots MORE.

The great thing about Securing Your Retirement Income is that Bob covers everything you need to know, in detail.

If it’s a topic that affects your retirement money… a new tax law, a legal Social Security loophole, or a brilliant way to pay for long-term care in the future…

… Bob Carlson tells you all about it and spells out what your options are.

Best of all, you can get a copy of Securing Your Retirement Income right away along with the Tax-Free Income for Life Strategy™– and you can start putting these strategies to use in your own life immediately.

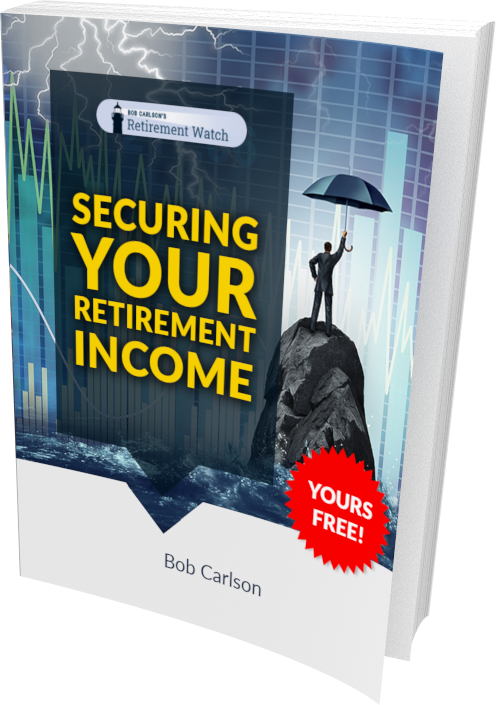

And as a THIRD free gift, Bob will also send you his special investing report – Planning Your Dream Retirement.

The Planning Secrets of the Super-Rich Can Boost Your Income Even MORE!

One thing the wealthy do that many middle-class folks do not is… plan.

The truth is, estate planning and setting up the right legal structures for your finances can make a HUGE difference in the quality of your retirement.

It can save you literally hundreds of thousands of dollars in taxes… and can help you generate a lot more income while you’re retired.

Many wealthy people set up special trusts that are designed to do two things: pass on their assets to their children or favorite charities in a simple, easy way… and also provide them with a secure income for the rest of their lives.

In addition, estate planning ensures that you never pay too much to the government.

For example, Bob Carlson has one strategy he calls The $125,000 Solution: The Tax-Free Lifetime Income Stream.

Since 1980, more than a million Americans have used this strategy to:

- Pay for living expenses…

- Pay off their home mortgages or purchase second homes…

- Fund their golden years and have the retirement they deserve…

- Reduce their taxes…

- And MORE.

However, one million Americans who know about this strategy doesn’t seem like nearly enough, especially when you consider that the current population of the U.S.A. is more than 300 million.

Then there’s health care…

It’s also a key component of retirement and estate planning.

If done properly, you can potentially save millions of dollars – and guarantee that you get the right kind of health care when you need it, for as long as you live.

This involves making sure you have the right kind of Medigap insurance, life insurance, and other proven strategies.

You can also put together a plan to pay for long-term care in case you need it.

In fact, about 90% of retirees pay more out of pocket than they need to for their health and long-term care – and that means that, with proper planning, you don’t have to!

And you can get started with Planning Your Dream Retirement.

This invaluable guide cuts right to the chase and gives you tools you can use immediately.

In fact, it’s a complete, easy-to-understand, step-by-step guide that anyone can – and should – use to better their retirement finances.

You’ll discover:

- Three changes everyone should consider for their estate plan

- How to legally offset the spiraling costs of long-term care (LTC) medical expenses – saving potentially tens of thousands of dollars

- How to practically guarantee you never outlive your money in retirement

- Mutual fund tax secrets that 99% of Americans know nothing about

- And more

Bottom line: You can get not one but THREE valuable retirement guides… guides that could help you generate thousands of extra dollars a month tax-free while you’re retired.

All that we ask in return is that you try out Retirement Watch risk-free for 30 days.

Here’s Everything Your Trial Subscription Includes:

![]() Monthly Newsletters: Every month you get a new issue of Bob Carlson’s Retirement Watch, containing up to 16 pages packed with the most up-to-date information and simple solutions to make sure you never run out of money in retirement. It’s a powerful, unbiased resource chock-full of practical strategies, how-to techniques, and planning worksheets.

Monthly Newsletters: Every month you get a new issue of Bob Carlson’s Retirement Watch, containing up to 16 pages packed with the most up-to-date information and simple solutions to make sure you never run out of money in retirement. It’s a powerful, unbiased resource chock-full of practical strategies, how-to techniques, and planning worksheets.

Retirement Watch is also an easy read that will help you make informed decisions on great opportunities without you having to do all the research.

![]() Weekly Journal Updates: Once a week, Bob provides you with an update on the latest economic, tax, and planning developments affecting your retirement.

Weekly Journal Updates: Once a week, Bob provides you with an update on the latest economic, tax, and planning developments affecting your retirement.

Called “Bob’s Journal,” this weekly mini-newsletter goes out midweek and has the latest information on breaking news for the retirement world.

![]() Retirement Portfolios: You will have access to Bob Carlson’s very latest “Easy Chair” investment portfolios, custom-designed for retirees. They are focused on Income Growth, Balanced, Retirement Paycheck, True Diversification, and Sector portfolios.

Retirement Portfolios: You will have access to Bob Carlson’s very latest “Easy Chair” investment portfolios, custom-designed for retirees. They are focused on Income Growth, Balanced, Retirement Paycheck, True Diversification, and Sector portfolios.

Bob created these in a personalized way so members can meet their individual goals for income and growth over the long term.

![]() Live Teleconferences: There’s not a single other retirement editor I know who takes the time and effort to host live calls like these. And our readers tell me it’s one of the greatest perks of membership and the best bang for their retirement buck.

Live Teleconferences: There’s not a single other retirement editor I know who takes the time and effort to host live calls like these. And our readers tell me it’s one of the greatest perks of membership and the best bang for their retirement buck.

On these LIVE conference calls, you get a chance to ask your retirement questions directly while Bob updates you on the most pressing retirement issues of the day, along with our five investment portfolios.

These teleconferences are free and one of our most popular member benefits. You just go online, click on a button, and listen in. That’s all you have to do!

![]() Online Retirement Spending Calculator: The first step in retirement planning is to estimate how much you’ll spend, and the second is to estimate how much inflation will affect your spending. This online calculator is comprehensive, making it hard for you to overlook expenses and underestimate the cost of retirement.

Online Retirement Spending Calculator: The first step in retirement planning is to estimate how much you’ll spend, and the second is to estimate how much inflation will affect your spending. This online calculator is comprehensive, making it hard for you to overlook expenses and underestimate the cost of retirement.

It also lets you estimate inflation more precisely than other calculators, giving you the best shot at a long, wealthy retirement.

![]() Investing Master Class: From Bob’s good friends at Trusting Trading Institute. You’ll learn the seven pillars that can help you rig the markets for your success, three elements to increase your trading results in surprising ways, how you can better control your long-term profitability… and more.

Investing Master Class: From Bob’s good friends at Trusting Trading Institute. You’ll learn the seven pillars that can help you rig the markets for your success, three elements to increase your trading results in surprising ways, how you can better control your long-term profitability… and more.

You’ll also get a 30-45-minute one-on-one coaching session with one of their experts.

![]() Solutions

Database: Retirement Watch is unique in that it offers a database of articles about specific problems retirees and those about to retire typically face… along with specific solutions for each.

Solutions

Database: Retirement Watch is unique in that it offers a database of articles about specific problems retirees and those about to retire typically face… along with specific solutions for each.

These include annuities, estate planning, grandkids, health, housing, insurance, IRAs, portfolios, taxes, and even scams.

In addition, Bob has provided contact lists, which he calls Member Extras, with links to providers of solutions he trusts – for such problems as college planning, Social Security, health, and more.

![]() VIP Website Access: The best way to keep track of everything is on the Retirement Watch website.

VIP Website Access: The best way to keep track of everything is on the Retirement Watch website.

RetirementWatch.com features the most recent newsletter issue, Bob’s free special reports, a searchable archive of all past issues and reports, and many other membership perks.

![]() Expert Retirement Staff: At Retirement Watch, Bob and his staff know that it’s easy to make a mistake when it comes to securing your retirement.

Expert Retirement Staff: At Retirement Watch, Bob and his staff know that it’s easy to make a mistake when it comes to securing your retirement.

That’s why he employs a full-time staff that can answer your questions (sorry, no personalized financial advice).

Members who write to his team directly will get a written response within 48 hours, or they can call the toll-free help number provided.

Up to $409 in Free Gifts and Savings!

And It’s ALL YOURS Risk-Free

With This Special Offer

To recap, if you accept a risk-free 30-day trial right now, you will get your FREE copy of the Tax-Free Income for Life Strategy™.

This is the strategy in which you could start with ZERO money saved, begin to collect up to $3,900 a month in just five years, and never run out of money even if you live to be 95!

As an added BONUS, you’ll receive a 12-month subscription to Retirement Watch for the special low price of $87.

In addition to the Tax-Free Income for Life Strategy™, you’ll get not one, but TWO special retirement guides free:

- Securing Your Retirement Income

- Planning Your Dream Retirement

Each of these reports is valued at $99 – that’s a $297 value.

And you’ll get all three of them for free if you agree to become a member of Retirement Watch.

Regularly, you’d pay $249 for a full 12 months of Retirement Watch. But, today, you’ll pay just $87 for that same one-year membership!

That’s a whopping 69% ($172) off the regular price AND you get all three special reports free on top of that.

Join Today and You Risk Nothing

Here’s the best part of this offer: You get to try out everything risk-free!

Check out Bob Carlson’s Retirement Watch newsletter in detail before you make a commitment.

Read all the special reports you get – and all the bonus reports available in the Retirement Watch online archive.

Check out all the recommendations in the five custom-designed investment portfolios.

Put the entire package through its paces for a full 30 days.

Because you’re fully protected by our:

30-Day Risk-Free Membership

You must be 100% certain that membership is right for you, or we will give you a complete and total refund – no questions asked.

Even if you decide Retirement Watch isn’t for you within that first 30 days, you may KEEP everything we’ve talked about in this message FREE… as our gift for giving Retirement Watch a try.

What could be fairer than that?

So don’t wait. Just click on the button below and you’ll go to our secure order page.

This could be the most important financial step you take this year.

Best wishes,

Roger Michalski

Publisher, Eagle Financial Publications