If the rollercoaster swings in the stock market so far in 2020 have you worried – and they should – please give me a moment of your time.

American investors are going to see more rough times ahead.

It’s estimated that U.S. GDP could shrink at a staggering annualized rate of -30%, the worst since the Great Depression.

Already, 36.5 million Americans have filed for unemployment benefits – that’s 18.6% of the labor force.

And it’s going to get much worse before it gets better. As you read this message, the stock market may already have plunged again.

Yet as incredible as it may sound, if you play your cards right through this crisis… you could end up far wealthier when it’s over than you are today.

In fact, the coronavirus crisis could set you and your family up for life.

That may sound crass or hard to believe, but it also happens to be true.

As you’ll see in a moment, this historic global crisis has created unprecedented investment opportunities – opportunities that are similar to what occurred during the Great Recession a decade ago.

Only this time, the opportunities are much, much BIGGER.

If you follow the simple investing blueprint revealed in this message, you could end up 10 times wealthier AFTER the current crisis than you were before it.

And that’s a conservative estimate. You could potentially end up even wealthier.

Let me explain why…

This Time, It Really IS Different

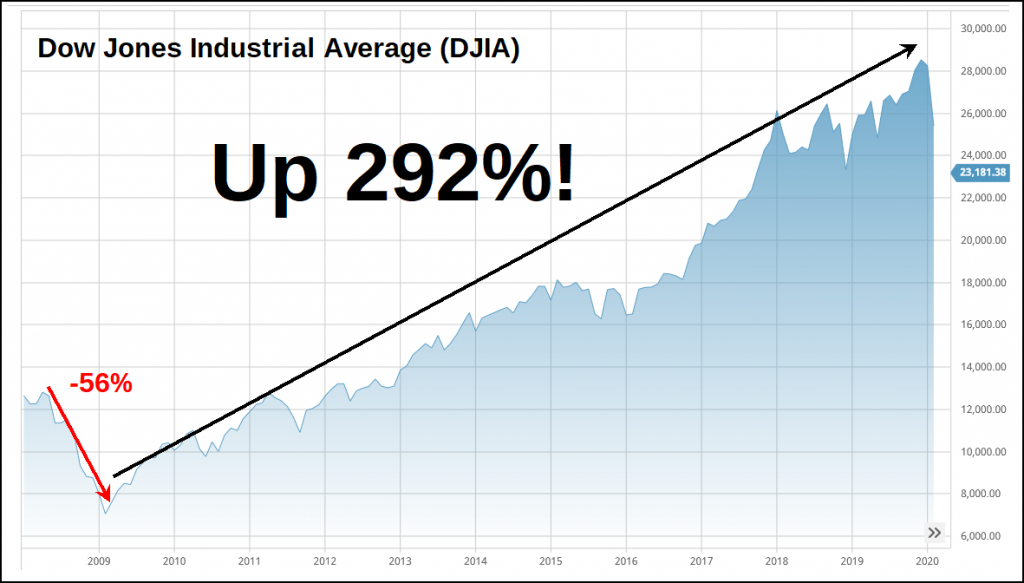

Back in 2008-2009, the average investor thought that, as the saying goes, “THIS time it might REALLY be different.”

The market had lost more than half of its value, and many individual blue chip stocks were down 70%, 80%, even 90% or more.

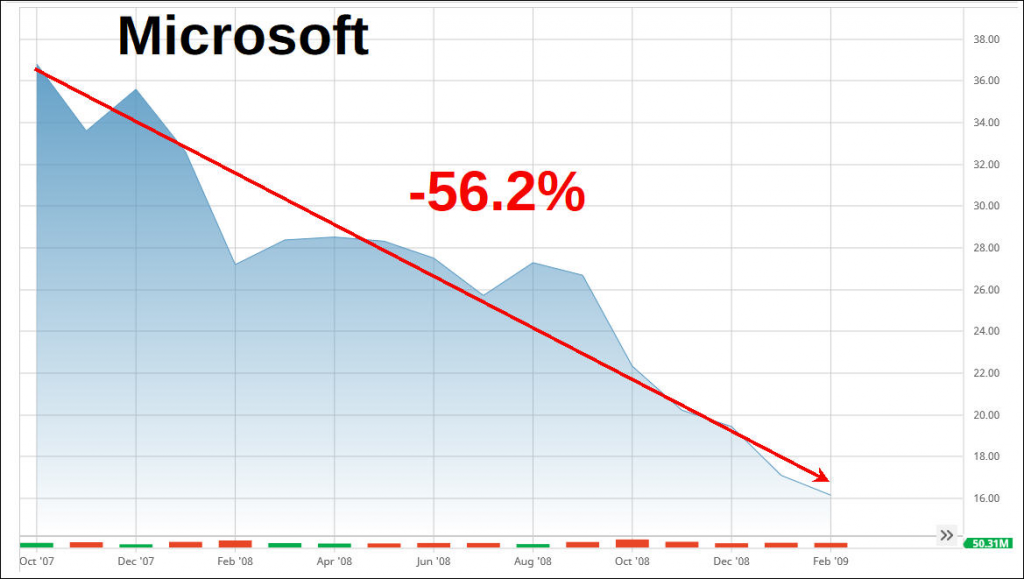

- Microsoft (MSFT), the computing giant that provides the software for most computers in America, saw the value of its shares plummet 56%.

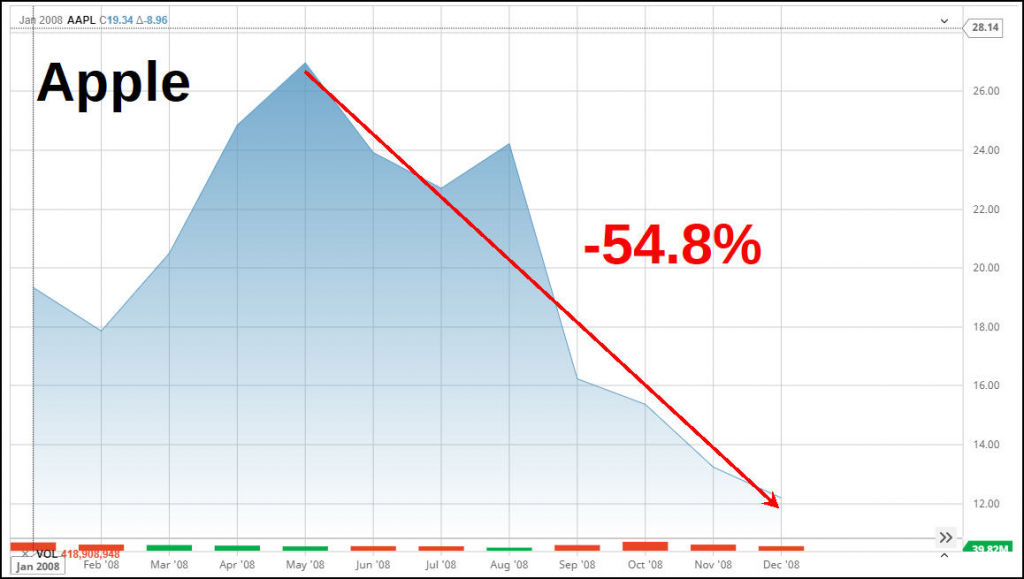

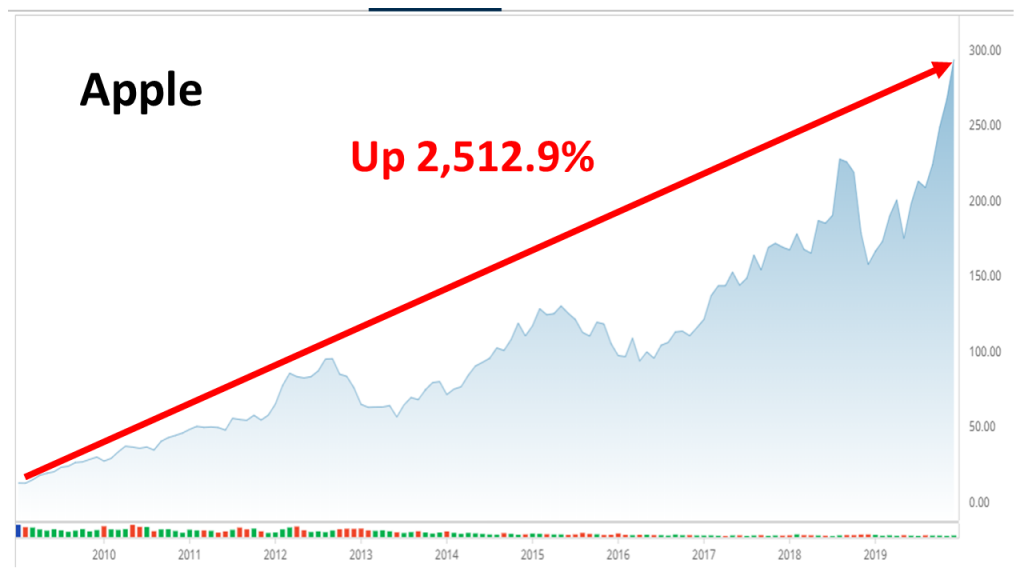

- Apple (AAPL) hit a high of $26.96 a share in May 2008 before losing half of its valuation, hitting $12.17 a share by the end of the year. That was a draw-down of 54.8%.

Stocks were hammered across the board in 2008-2009.

- Costco (COST) fell from $71.32 a share to $42.34, a loss of 41.4%.

- Amazon (AMZN) was in free fall, plummeting from $80.76 a share in August 2008 to just $43 a share at the end of November – down 46.7%.

- During the last stock crash of 2008-2009, Target (T) shares did a nose dive from $55.95 a share at the beginning of 2008 to just $28.27, a loss of 49.4%.

As news of the banking crisis spread like wildfire, the carnage only got worse.

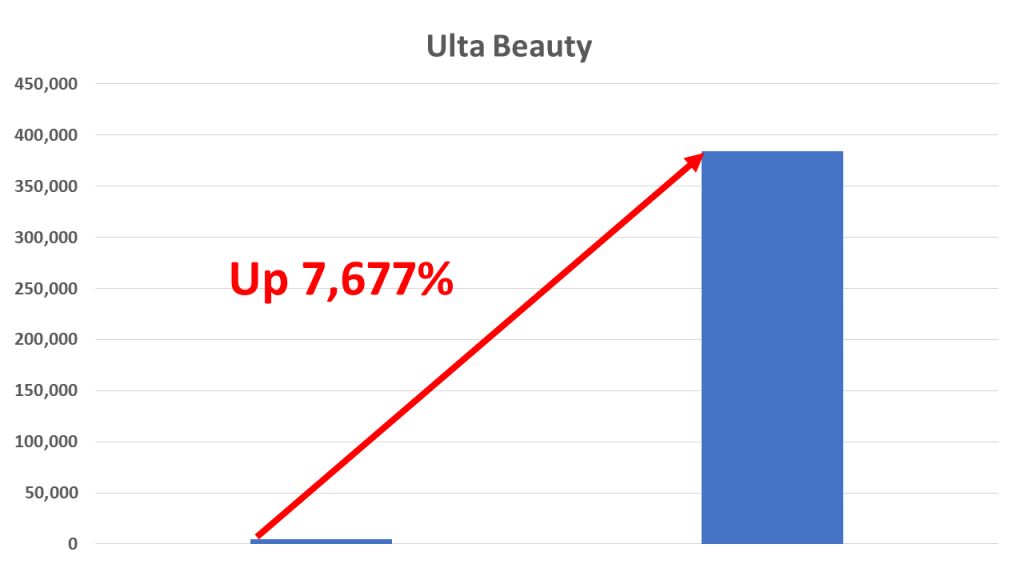

- Ulta Beauty (ULTA) fell from $14.26 a share before the crash to just $5.61 a share a few months later, a horrifying drop of 60.6%.

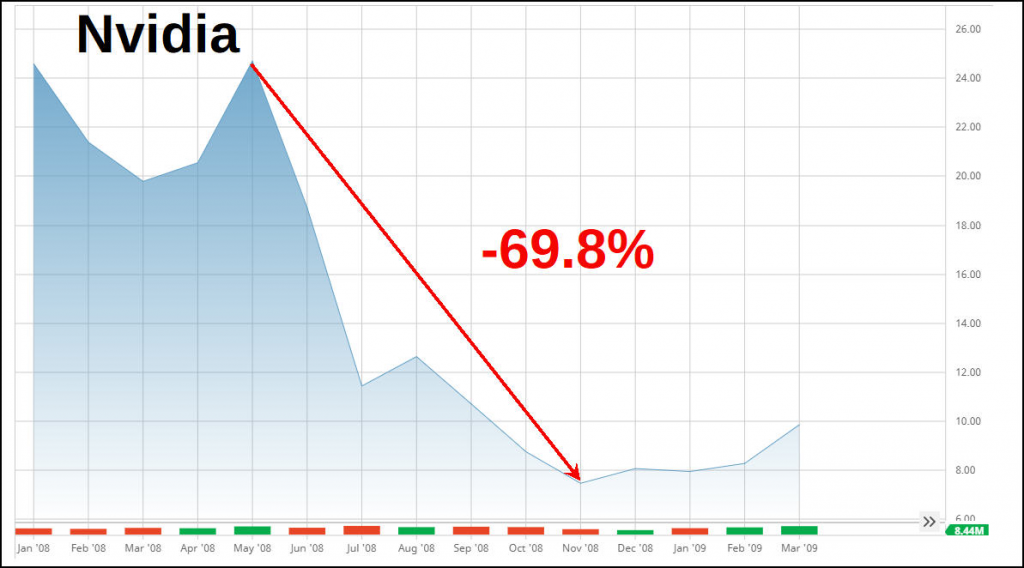

- Nvidia (NVDA), the chip manufacturer, lost a heart-stopping 69% of its value, plunging from a high of $24.71 a share to just $7.41.

- Trex (TREX), the company that makes alternative decking, saw the value of its shares sink 58% to just $1.92 a share.

It didn’t seem like any industry would be spared as the global banking crisis wiped out everything in its path.

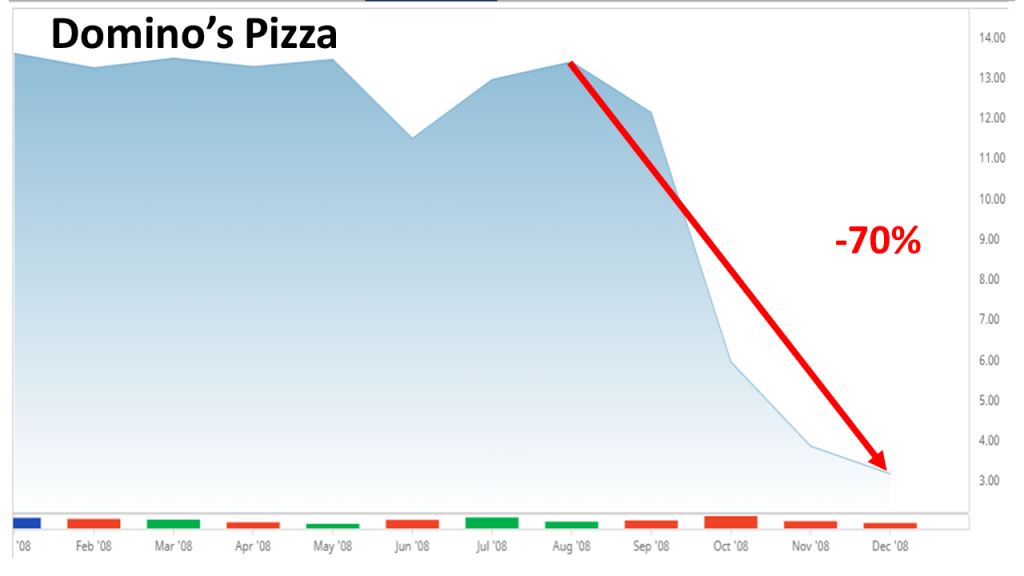

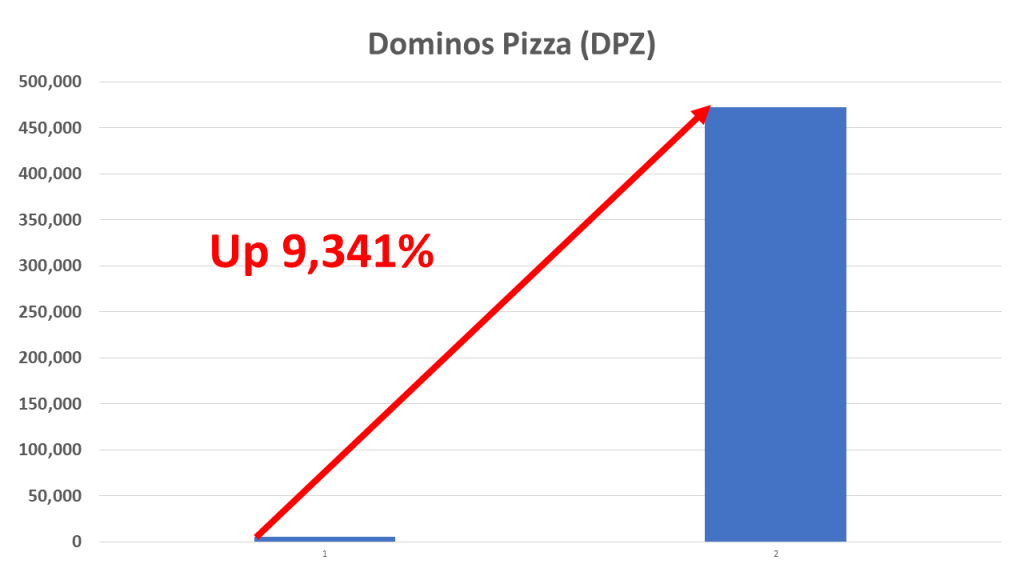

Another example was Domino’s Pizza.

Its shares dropped from $13.43 a share in July 2008 to just $3.94 a share in November – a stunning 70% loss in just four months.

Just like today, it was a very scary time back then for investors.

The people allegedly in charge, from the president on down, didn’t seem to know what they were doing.

Many investors and retirees were terrified they would run out of money.

People were selling shares, cashing in their index funds and heading for the proverbial hills.

And who could blame them? Every night, TV news commentators warned that the global economy was on the verge of collapsing.

But not everyone panicked.

In fact, a savvy few did just the opposite of what the TV experts were telling them.

These wily investors saw the U.S. government’s announced bailout plan… the more than $700 billion in liquidity being made available to failing banks.

So they did the opposite of what many other investors were doing…

And did anything they could to raise some cash.

Then they bought as many shares of America’s most profitable companies as they possibly could, often for pennies on the dollar!

The net result was an astonishing transfer of wealth.

All of that government bail-out cash fueled the largest rally-back in history… a supercharged bull market that lasted for 12 long years… and a tiny handful of small investors got very, very rich.

Ordinary people – doctors, plumbers, even drywall hangers – became wealthier than they ever thought possible.

By buying America’s best, most profitable companies when everyone else was running for the hills…

Even as the government was pumping literally HUNDREDS OF BILLIONS into the economy, these investors made out like bandits.

I know that sounds hard to believe, but it’s 100% true.

Everyone knows that stocks like Microsoft and Apple bounced back.

Microsoft has handed investors who bought shares back then for $16 each – at a 50% discount off recent highs – gains of 980% in the years since. The shares now are worth $183 each.

The same thing is true with Apple. When Apple’s shares plummeted 54%, you could have bought some for just $12.17 apiece.

Today, even after AFTER the coronavirus wipeout, those shares sell for around $318 each.

That means every $5,000 invested in Apple after the 2008 crash would be worth $130,649 today – a gain of 2,512.9%.

And it’s not just the big name tech-stocks that have made investors fabulously wealthy either.

Remember Domino’s Pizza?

The company that lost 70% of its value in just four months?

Well, after the Federal bailout kicked in, Domino’s made a comeback.

Big time.

During the 2008-2009 wipeout, you could have picked up all the Domino’s shares you wanted for just $3.94 a share – and people did!

Today those shares are worth $372 each.

In fact, since that low point, Domino’s stock is up 9,341% – or 93 times the initial investment.

That means every $5,000 invested in Domino’s when it tanked is now worth $472,081.

And every $20,000 invested is now worth $1.8 million!

The fact is, the 2008-2009 Great Recession Stock Market Crash and Government Bailout was the opportunity of a lifetime for those smart enough to see it.

At the time, it seemed like the end of the world. And it didn’t end overnight. In fact, the recovery took years.

Yet people who had very little savings, but were able to cobble together some extra cash, were able to set themselves up for life.

Here’s another example for why that’s true: Ulta Beauty (ULTA).

Everyone knows you can get rich investing in the latest high-tech breakthrough.

But you can also get rich investing in… lipstick!

In the Great Recession Stock Crash, Ulta shares took a nose dive from $30 a share to just $4.50 – a stomach-churning selloff of 85%.

As I prepared this message, everyone is talking about stocks like Carnival Cruise Lines (CCL) and Occidental Petroleum (OXY) being down 75% since the coronavirus hit.

But Ulta was down even MORE, a stinging 85%.

That’s actually a BIGGER loss than almost any large-cap stock in the recent Coronavirus wipeout.

Again, many investors sold at the bottom. But not everyone.

The savvy few saw a HUGE opportunity.

They took a long, hard look at Ulta’s balance sheets and grabbed as many of those low-priced shares as they could.

And today, their children will thank them – and eventually their grandchildren will thank them.

Since that day, Ulta shares skyrocketed to a high of $350 a share – a gain of 7,677% or 76 times your money.

Yes, every $5,000 invested in Ulta, after it tanked 85%, grew into $383,850.

I could go on and on, but here’s just one more example:

There is probably nothing as ordinary as decking. But when the banks are going broke, nobody is thinking about putting new decks on their houses.

Yet if you had bought shares of Trex (TREX) after they had lost 58% of their value – selling for a steal at just $1.92 each – today you could afford to build a deck for everyone you know.

Trex shares are now worth $127 each – or 6,514% more!

Every $5,000 flyer you took on Trex back when they were on sale would be worth $330,729 today.

I’ve just pointed out the famous brands you probably know.

There are literally HUNDREDS of other examples of huge, life-changing gains made since the last, big market wipeout.

And here’s what I want you to understand: We’re about to do it all over again! Only this time, it’s going to be much BIGGER.

That’s because the bail-out and fiscal stimulus being used to rescue our economy from the coronavirus is going to be at least TEN TIMES larger than the bail-out of the banks in 2008-2009.

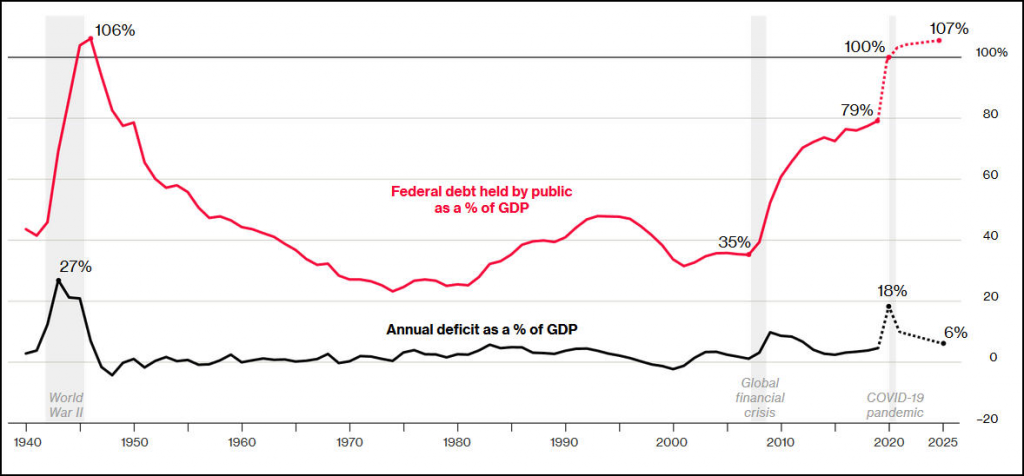

During the Great Recession, the U.S. government spent $700 billion and the federal debt rose to 35% of GDP.

Today, current estimates are that the government will spend $6 TRILLION on the Corona Recovery – and the federal debt will reach levels not seen since World War II, about 106% of GDP.

Make no mistake: This massive cash stimulus is going to catapult the right stocks – now trading at 50 cents on the dollar or less – into the stratosphere, just as it did during the Great Recession 10 years ago.

It could also set you up for life, whether the market goes up from here on out, with additional sell-offs and more buying opportunities.

Let me explain.

I Haven’t Seen Investment Opportunities

Like This Since 2008

My name is Roger Michalski.

I’m the publisher of Eagle Financial Publications, and I remember the 2008-2009 stock market crash like it was yesterday.

In a series of emergency measures, the U.S. government made available an unprecedented $700 billion in funds, through the Emergency Economic Stabilization Act, to 982 failing companies and institutions.

Our number one economic expert and stock picker, Dr. Mark Skousen, advised us through the entire ordeal.

Like the coronavirus crisis this year, the banking crisis of 2008-2009 was a GLOBAL catastrophe that impacted almost every country.

And as is true today, the media was in a feeding frenzy.

“Is 2009 Another 1929?” asked the German magazine Der Spiegel. “The current crisis shows uncanny parallels to the Great Depression.”

“The collapse of Lehman Brothers almost destroyed the world financial system,” wrote economist Paul Krugman in The New York Times, “And we can’t risk letting much bigger institutions like Citigroup or Bank of America implode.”

Just like today, the pundits and media outlets insisted that NOTHING would ever be the same again.

“The crash of 2008 continues to reverberate loudly nationwide – destroying jobs, bankrupting businesses, and displacing homeowners,” declared The Atlantic Monthly. “On the other side of the crisis, America’s economic landscape will look very different than it does today.”

It was also an election year, pitting an unpopular Republican candidate, Senator John McCain (more of the Bush status quo), against a Democrat the media loved and adored, Senator Barack Obama.

Every night on the TV news, the media showcased a parade of disasters to further weaken then President Bush.

Banks were failing left and right, the TV networks claimed.

There were long lines at ATM machines for people to get cash – longer lines at food banks and soup kitchens.

There was talk of a possible run on the banks – and the government seizing bank and retirement accounts.

“Financial institutions in the U.S. and in advanced economies are going bust,” warned an editorial in Forbes Magazine.

Then, as now, people spoke about a possible second Great Depression.

Some advisers said investors should buy gold and guns – and get the heck out of Dodge.

Yet where many saw impending disaster, a farsighted few saw HUGE, historic, life-changing opportunities – and one of them was the famous economist, author and investment adviser Dr. Mark Skousen.

As a disciple of Austrian free market economics, Dr. Skousen was opposed to corporate bailouts.

But as an economist, Dr. Skousen knew what all that bailout cash flooding the economy would do.

A rising tide lifts all ships, as John F. Kennedy so wisely said, and the $700 billion banking bailout known as TARP, short for the Troubled Asset Relief Program, was one of the most “risingest” of tides in history.

“Judging from the unrelenting selling during the past three months, I see unprecedented bargain opportunities in our high-income funds, stocks and other funds,” Dr. Skousen wrote in December 2008. “The best strategy in this treacherous bear market is to invest in a well diversified portfolio of quality income-producing stocks and funds.”

Dr. Skousen also insisted that the flood of cash from government bailouts and stimulus would likely trigger a historic rallyback – one that quickly turned into the longest bull market in history.

“Last month, the Fed pumped more than $200 billion into the banking system,” he pointed out in October. “Congress is working on a massive new government bailout of the banks with a resolution not unlike the one that dealt with the S&P crisis in the late ’80s… Injecting more fiat money into the monetary system is bullish for gold and our income investments, which are deeply undervalued.”

Dr. Skousen knew that some companies would benefit far more from the $700 billion in Federal stimulus than others – and if investors picked the RIGHT STOCKS during the wipeout, they could end up multiplying their net worth several times over.

And that is PRECISELY what happened.

Some stocks hit bottom and stayed there. But literally HUNDREDS of America’s most profitable companies rebounded and made savvy investors up to 10, 20, even 50 times their investments.

For example….

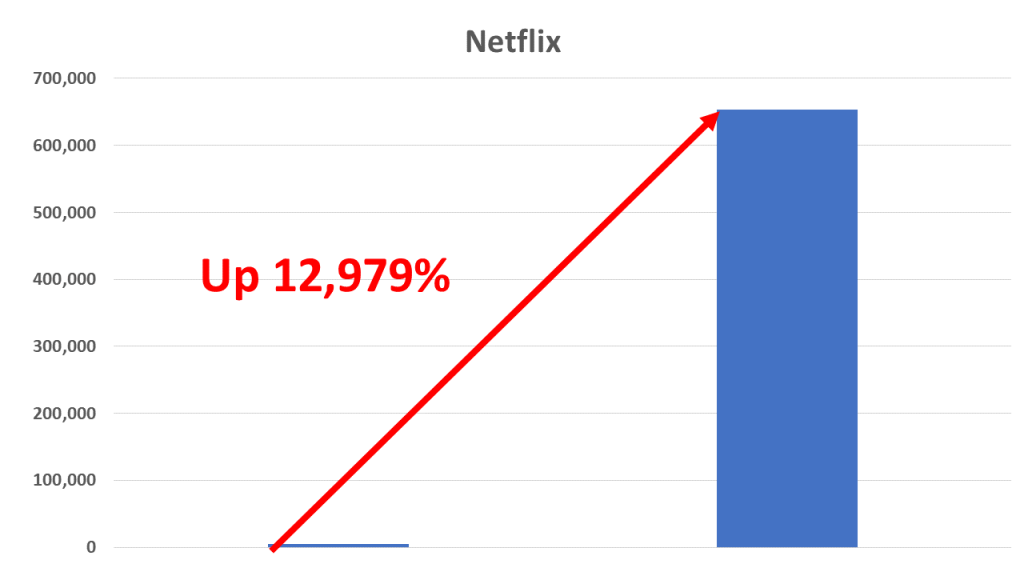

Netflix (NFLX) crashed in 2008, bottoming out at around $3.28 a share.

Yet had you taken a chance on Netflix back then, you could have bought 1,500 shares for only $5,000.

Today Netflix sells for $429 a share.

Your $5,000 investment during the 2008-2009 crisis would be worth $653,963 today – a gain of 12,979%.

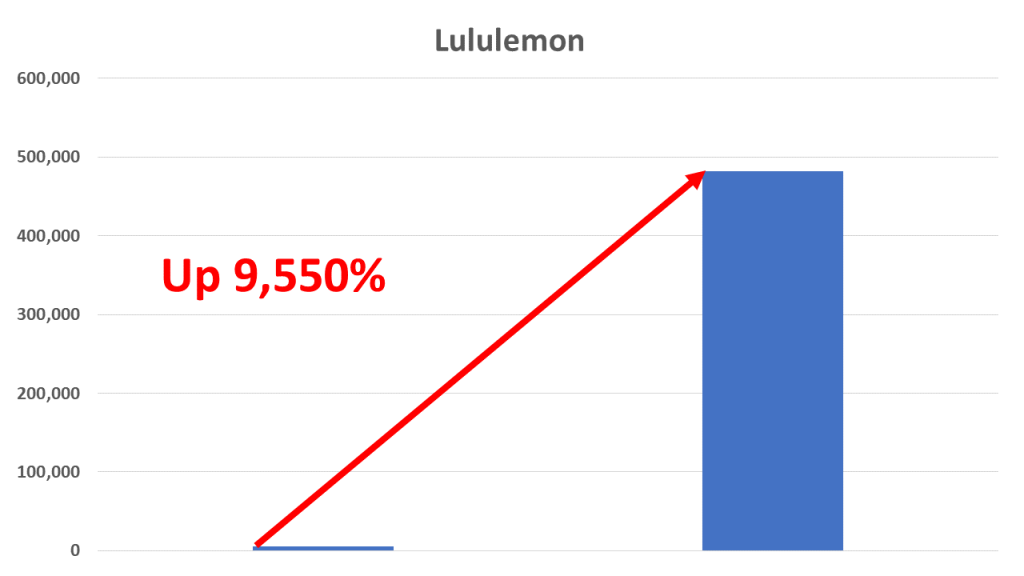

Lululemon Athletica (LULU) is another example.

The global banking wipeout was not a good time for yoga gear.

Lululemon stock cratered, plunging from $25 a share in 2007 to just $2.86 a share in February 2009 – a decline of 88%.

Again, a $5,000 flyer on Lululemon would have bought you 1,700 shares.

Today, even after the Coronavirus crisis, Lululemon sells for $276 a share.

A $5,000 investment back then would be worth $482,517 today – a gain of 9,550%.

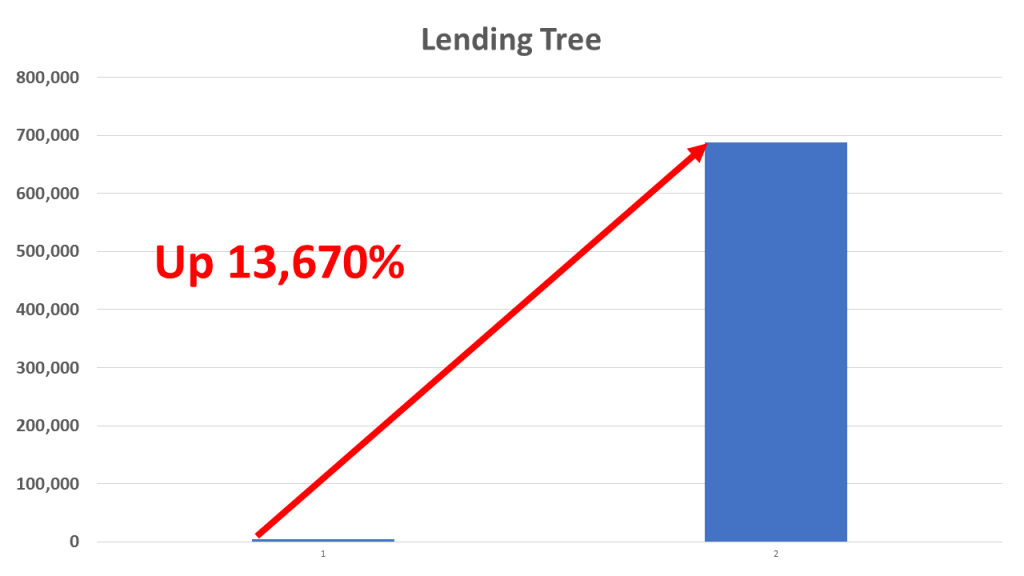

Lending Tree (TREE) is another example. It hit bottom in November 2008 at just $1.83 per share.

Today, those shares sell for $252 – or 13,670% more.

That’s enough to turn every $5,000 into $688,000.

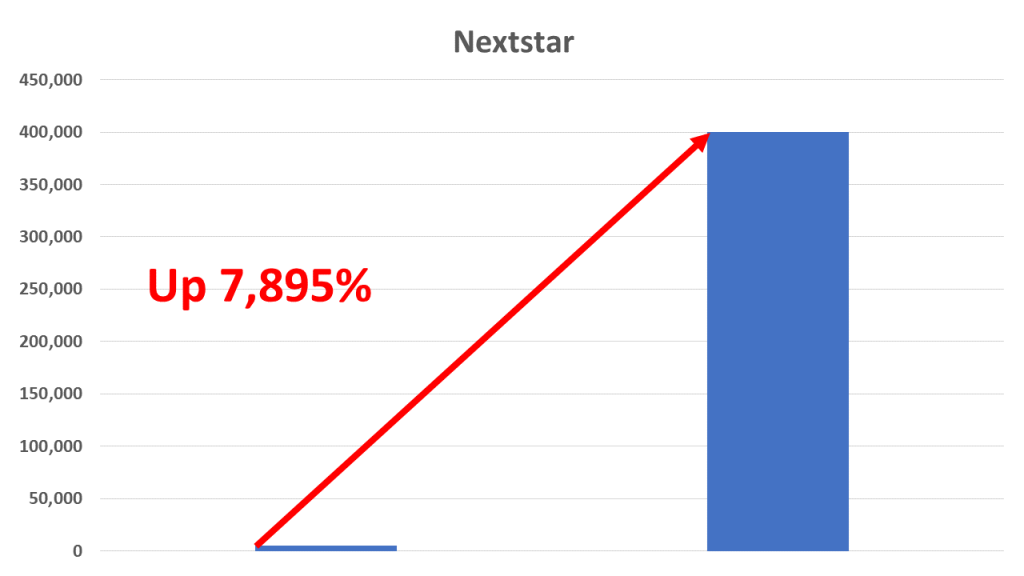

In 2009, the shares of Nextstar Broadcasting (NXST) lost almost 92% of their value, falling from $14 a share to just a buck.

You could have bought 5,000 shares of Nextstar, which owns TV stations throughout the Midwest and south, for $5,000.

Today Nextstar shares sell for $79.95 – or 7,895% more. Your $5,000 investment today would be worth $399,750.

Ever hear of a company called Entegris (ENTG)?

It’s a leading provider of “materials management solutions” for the semiconductor industry.

Translated, that means they make sophisticated electronic components for computers and industry.

The company has $1.5 billion in sales, net profits of $241 million and its stock is up 41% over the past year, even with the coronavirus crisis.

Well, during the LAST global economic crisis, the company saw the values of its stock plummet from $11.83 a share to just 86 cents – a decline of 92%.

Talk about a fire sale and buying shares for pennies on the dollar!

Here’s what happened after the 2009 crisis ended. Entegris shares continued to rise in value and never looked back. They are up 6,338%, over the past 10 years, to $58.50 a share.

Every $5,000 invested in Entegris during the last crisis would be worth $40,116 today.

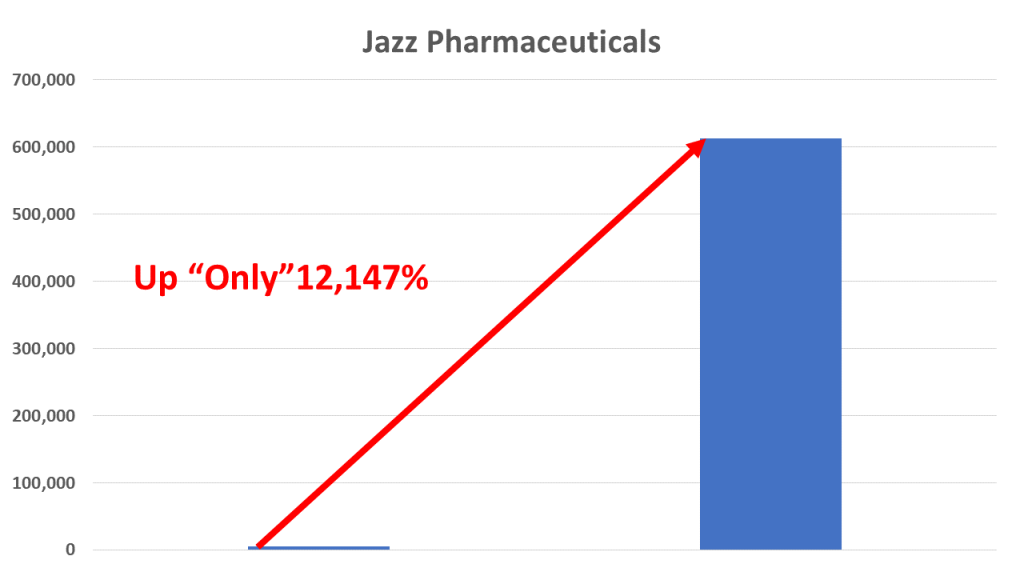

Here’s another example: Jazz Pharmaceuticals (JAZZ).

During the 2008-2009 crash, Jazz Pharmaceuticals shares fell from a high of $15.51 a share all the way down to just 89 cents in March 2009.

But, within just six years, those same shares were selling for as much as $192.

A $5,000 investment back when Jazz was selling for rock-bottom prices could have grown into as much as $1,078,000 in 2015 – for a total return of 21,473%.

The stock has since pulled back and now sells for only $109 today, so had you held onto Jazz shares, they would only be worth $612,359 today. That is a return of “only” 12,147%.

If You Missed Out on These Kinds of Profits, Now You Have a Once-in-a-Lifetime Second Chance!

Now America faces ANOTHER global economic crisis… a crisis that, once again, the experts say could turn into a Great Depression.

All of the so-called experts are telling investors to head for the hills… to buy gold and guns… and to wait for the coming destruction of life as we know it.

Wealthy investors are literally fleeing to retreats on isolated islands… or to places like Wyoming.

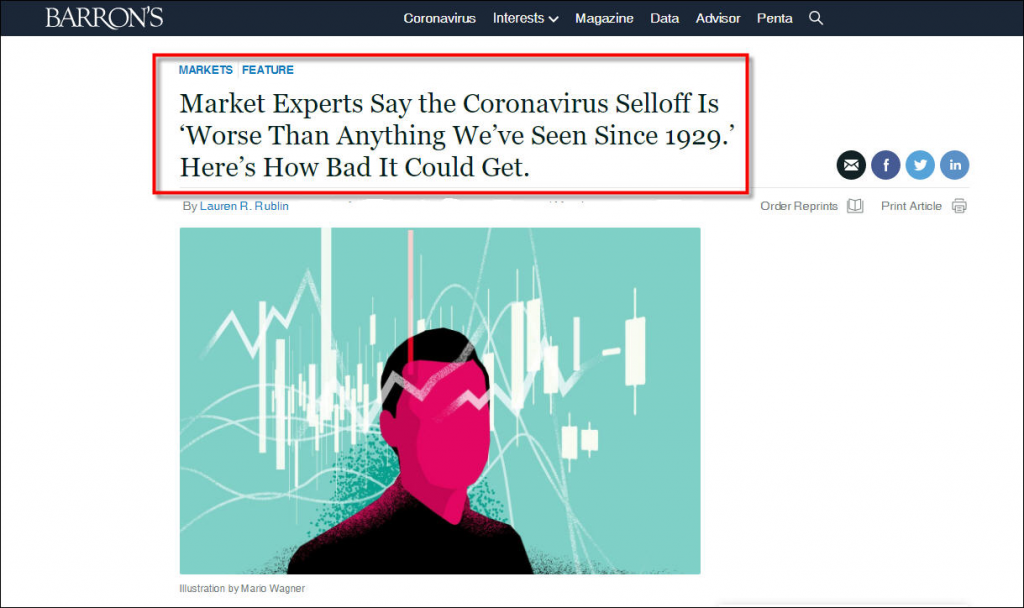

An article in Barron’s recently said that the stock market after the coronavirus is…

“Worse Than Anything We’ve Seen Since 1929.”

Every night, stock analysts on CNBC explain why there is more volatility in store.

As Yogi Berra once said, it’s déjà vu all over again!

But cooler heads know that even with HUGE downturns in the market as a whole, this is once again the opportunity of a lifetime.

Enormous Opportunities… But Also Risks

Of course, as in 2008-2009, you can’t go out and simply buy every stock that is selling for 30%, 40%, even 50% less than last year.

That would be insane.

Some stocks lose 50% of their value for a reason – and then lose even more.

Plus, a number of stocks will benefit disproportionately from this historic U.S. government bailout – companies that were enormously profitable in the past and will be again.

That’s why we here at Eagle Financial Publications believe that the Corona Selloff and Subsequent Boom represents a rare, once-a-decade SECOND CHANCE.

It’s an opportunity to take advantage of huge discounts in America’s most profitable companies to make life-changing gains.

The Amazing Team of

Dr. Mark Skousen and Jim Woods

And here’s the truly amazing aspect of this:

The same world-renowned economist who helped us through the LAST global economic crisis – Dr. Mark Skousen – is here to help us through this one as well.

Mark Skousen is the CIA-trained Ph.D. economist and world-renowned investment adviser famous for his commitment to free market principles.

He’s a dyed-in the-wool value investor who believes that solid fundamentals are the key to successful investing and to multiplying your net worth – even during times of economic turmoil.

Dr. Skousen is the author of more than 25 books on economics and investing, including the bestseller The Making of Modern Economics and The Maxims of Wall Street. He’s also taught at Columbia Business School.

However, unlike in 2008, in the current crisis Dr. Skousen is joined by renowned stock picker and momentum investor Jim Woods, recently ranked the world’s #1 stock picker by TipRanks, which grades the results of over 7,429 investment analysts and stock pickers all over the world.

Since 2012, Jim has racked up an impressive win rate of 73%.

He formerly worked with Investor’s Business Daily founder William J. O’Neil, helping to author training courses in the CANSLIM stock-picking methodology,

And he is the author of a number of books on investing, including, “The Wealth Shield: How to Invest and Protect Your Money from Another Stock Market Crash, Financial Crisis or Global Economic Collapse.”

Naturally, Jim agrees with Mark that fundamentals are crucial, but he favors technical indicators, emphasizing the effect of what we like to call “fast money.”

Jim believes that money flow – either from massive buying by institutional investors or cash bailouts like we saw in 2008-2009 – can propel the right stocks into the stratosphere while leaving other, equally worthy companies in the dust.

Over the past several weeks, Jim has been working with Dr. Skousen on a detailed, step-by-step plan to rescue your financial future.

They’ve taken advantage of their complementary stock-picking systems to identify the most valuable investing opportunities for the Coronavirus crisis – both in terms of their fundamental value AND their potential for a strong rally – on the basis of new federal spending.

They’ve put together a detailed, three-part plan that they call “The Corona-Boom Millionaire Portfolio.”

This top-secret portfolio of investment opportunities takes advantage of historic low prices on essential American companies and massive Federal stimulus spending to help you rebuild your finances in the wake of this pandemic.

The first phase of the strategy is to help you target the very best U.S. stocks – the most profitable, most essential American companies.

Using their proprietary stock selection systems, these two experts sift through all large- and medium-cap stocks, looking for the most profitable companies in America – companies that consistently earn BILLIONS of dollars in profits every year.

The second phase of the Corona-Boom strategy is to cross-tabulate these “recession-proof” winning companies with an analysis of recent price declines.

Dr. Skousen and Jim Woods identify the country’s most profitable companies that are currently selling at HUGE discounts. Then, they help their followers systematically acquire these surefire stocks for the very best prices.

The third phase of the Corona-Boom strategy is to identify those stocks likely to benefit the most from this historic $6 TRILLION in Federal stimulus – such as financial services, healthcare and communications services.

In other words, Dr. Skousen and Jim Woods uncover super-profitable companies selling at enormous discounts that are the most likely to soar on the sea of government stimulus – just like in the 2008-2009 bailout.

Only when these two stock-picking experts agree that a stock is a potential Corona-Boom blockbuster do they finally recommend it for their Corona-Boom Millionaire Portfolio.

Grabbing 50% to 100% Gains on

Stocks in Just Months (Not Years)!

Here’s a perfect example of the type of stock Dr. Skousen and Jim Woods recommended during the height of the Coronavirus crisis: Zoom Communications (ZM).

Zoom is a video and web conferencing company with mobile apps for iPhone, Android, iPad, Apple Watch and Apple TV.

And it’s perfectly poised to cash in during the Coronavirus panic.

Revenues have nearly DOUBLED year over year to $600 million… and net profits have nearly TRIPLED.

Yet many companies have profits like that and go nowhere.

What makes Zoom Communications unique is that it’s caught fire with the public during the Coronavirus panic… and big institutional investors sat up and took notice.

As a result, the stock has been soaring.

In the first months of 2020, the stock shot up from $113.46 a share, when Dr. Skousen and Jim Woods recommended it on February 24, to $150.64 – a gain of 32.7% in just 19 days!

Here’s another example: Beyond Meat (BYND).

This food company did a moon shot in recent months.

When Dr. Skousen and Jim Woods first recommended it last year, the shares were selling for around $88.30 each.

When they took profits two weeks later, the shares were selling for $123.35.

That was a fast money profit of 39.6% in just 14 days!

If you had invested $5,000 in Beyond Meat shares, you could have walked away with an extra $1,980 in your pocket.

The two stock-picking virtuosos have been doing this over and over again.

Here’s another example: Match Group (MTCH).

Match Group is a big company that owns many of the online dating sites.

With $2 billion in sales, the company nets around $500 million in profits every year.

And the stock, of course, has done very well.

When Dr. Skousen and Jim Woods recommended it, the shares were selling for only $18.90.

When they took profits just a few months later, the shares were worth $39.66.

They more than doubled their money in less than a year with a profit of 109.8%.

That means, on this one play alone, you could have turned:

- Every $1,000 invested into $2,090…

- Every $5,000 into $10,450, and…

- Every $20,000 into $41,800

Solid Fundamentals x Share Price Momentum

= Mega Profits

Dr. Skousen and Jim Woods identify literally dozens of opportunities like these every year.

And these are the kinds of returns you can expect from the Corona-Boom.

Now, I’ll tell you in a moment how you can get instant access to Dr. Skousen and Jim Woods’ entire portfolio of stock picks just like these… handpicked for the Corona-Boom that is coming with $6 trillion in federal spending unleashed.

But, before I do that, let me tell you how Dr. Skousen and Jim Woods are able to supercharge these incredible profits even MORE.

Small, Inexpensive Option Plays Can Often

Double Your Money in a Few Weeks!

One of the things that both Dr. Skousen and Jim Woods like to do with their stock recommendations is to supercharge the profits with low-cost option plays.

Of course, many of their followers only invest in the stocks.

However, Dr. Skousen and Jim Woods typically look for extremely inexpensive call options to add to their recommendations as extras for those with a greater tolerance of risk.

Plus, these option plays let you try out Dr. Skousen and Jim Woods’ picks for as little as $50 to $200 per trade.

If the option play goes against them, then you only lose a couple hundred dollars.

But if the stock rises in value, as Dr. Skousen and Jim Woods predict, then these inexpensive options can multiply your profits several times over.

And given the amount of money with which the U.S. government is currently flooding the economy – to the tune of TRILLIONS of dollars every month – the profits from these option plays could potentially be even BIGGER.

Here’s a real-life example of the kinds of profits I’m talking about:

On February 27, 2020, the stock market was in free fall.

Yet Dr. Skousen and Jim Woods recommended shares of Zoom Communications (ZM), as we saw earlier.

But they did something else as well.

At the same time, they also recommended an inexpensive option play on the same shares – the May 15 $125 call options.

At the time, the shares were selling for only $113.46 each, so these were “out of the money” calls.

The price for the options was $11.42 – or $1,142 per contract.

In other words, you could control 100 shares of Zoom Communications for a tenth of the cost of the underlying shares: $1,142 instead of $11,346.

If the value of the shares climbed higher, the value of the options would as well – but at a higher rate.

Well, that is precisely what happened.

Due to the Coronavirus Crisis, everyone across the world was locked down and turning to companies like Zoom Communications for easy communications.

The price of Zoom shares jumped 32.7% over the coming month, but the options went crazy.

The Zoom options bought for $11.42 shot up to $45.40 each by March 23, a gain of 297.5%.

As they usually do, Dr. Skousen and Jim Woods recommended that everyone making this trade take profits on half of their position.

The next day, the shares and the options pulled back – and the rest of the options were stopped out at “only” $26.60 or a 132.9% profit.

Overall, the trade netted 215.2% profits, in just 26 days.

Had you invested in, say, five contracts for $5,710, you would have walked away with $12,327 in profits.

Those sorts of profits are hardly unique. In fact, they’re relatively common.

Just a few weeks earlier in January, Dr. Skousen and Jim Woods recommended an option play on Adobe (ADBE) shares.

They recommended the March 20 $340 calls – then selling for only $11.60 each.

Again, to control 100 shares of Adobe stock – then selling for $332.58 – you would have had to shell out a whopping $33,258.

But for just $1,160, you could control 100 shares with an out-of-the-money call option.

Well, just as with Zoom Communications, the Adobe shares soared – to $355.39 per share.

That was a gain of 6.86% in just 18 days.

But the Adobe call options did better – 24 times better, in fact.

The options bought for only $11.60 soared in value first to $34.14 on February 10, for a gain of 194%.

Then the stock kept climbing higher and higher. Finally, there was a pullback on February 24 and the value of the options fell to $28.64 – or a gain of 146.8.

The trade worked out to net gains of 170.6% in just 49 days – enough to turn every $1,060 into $2,862… and every $5,800 into $15,660.

Not too bad for a month and a half.

Also in February, Dr. Skousen and Jim Woods took profits on another trade where the gains almost DOUBLED.

Earlier, at the end of October, they had recommended shares in a financial company called Brookfield Asset Management (BAM) – then selling for around $54 a share.

At the same time, they recommended out-of-the-money call options on those shares – March 20 $60 calls – then selling for the low price of only 62 cents – or $620 for a contract of 100 shares.

As Dr. Skousen and Jim Woods predicted, BAM shares took off – gaining 13.7%.

But the call options went berserk.

The options Skousen and Woods recommended on October 28 for 62 cents more than DOUBLED in value a month later – to $1.33 a share on November 26.

Dr. Skousen and Jim recommended that their subscribers take profits on half of their position for a one-month profit of $114.5%.

But the stock, and the options, kept rising in value over the following 60 days.

Finally, on February 10, the call options were trading for $4.00 each and Dr. Skousen and Jim Woods recommended that investors sell the rest of their position for a gain of 545.1%.

Overall, the two netted a total gain of 329.8%, enough to turn $5,000 into $21,450… and $10,000 into $42,900.

And here’s the best news of all: Along with their Corona-Boom stock recommendations, Dr. Skousen and Jim Woods are also including inexpensive call option trades like the ones just mentioned.

That way, you can potentially make thousands of dollars each month in regular income, while you wait for big moves in the underlying stocks.

Of course, not all option trades are profitable.

That’s why both Dr. Skousen and Jim Woods agree that you should never trade options with money you can’t afford to lose.

Yet in many cases, these option trades can make 5, 10, even 20 times more than the enormous gains from the stocks themselves – and in a matter of days or weeks, not months.

Small amounts of money – just $1,000 or $2,000 – can often turn into much larger amounts.

Now, if you’ve never traded options before, don’t worry.

It’s all explained in a SECOND valuable resource that Dr. Skousen and Jim have prepared, “The Little Black Book of Option Secrets.”

And I’d like to send you this extra Special Report to you – free of charge – today.

This 15-minute read reveals everything you need to know about how Dr. Skousen and Jim Woods supercharge their already sizable profits with carefully selected option plays.

Believe me, you want to know about option recommendations like these.

You’ll find out all about options and how they can boost profits from stock picks in your copy of “The Little Black Book of Option Secrets.”

Introducing Dr. Skousen and Jim Woods’

Fast Money Alert Advisory Service

I’d like to send you BOTH the complete portfolio of current Corona-Boom stock recommendations – the Corona-Boom Millionaire Portfolio — as well as all of Dr. Skousen and Jim Woods’ most recent option recommendations.

What’s more, you can continue to get ongoing updates and recommendations when you agree to a risk-free test drive of their investment advisory service, Fast Money Alert.

There are DOZENS of Corona-Boom stock and option opportunities right now.

Dr. Skousen and Jim Woods have tracked down the most profitable companies, selling at the biggest discounts…

And then identified the ones most likely to benefit from the $6 trillion federal bailout of the economy.

With additional option trades, they are squeezing every last drop of profit from each of them.

There’s no service anywhere quite like Fast Money Alert.

Dr. Skousen and Jim Woods’ readers have also been booking double- and triple-digit gains even when the market as a whole has been in free fall.

Just to give you an idea:

- Mark and Jim led their subscribers to 110% gains on Pan Amer Silver Corp (PAAS)…

- They showed people how to more than double their money in just 63 days with ASML Holdings (ASML), a Dutch semiconductor company…

- And they led investors to gains of 329% in just over three months with the gold company Anglogold Ashanti (AU).

In fact, over the past 24 months, subscribers to Fast Money Alert could have also bagged HUGE gains on stock and options plays like:

- 283.7% in just 76 days on Booz Allen Hamilton Holding Corp (BAH)

- 248.7% in just 14 days on Beyond Meat (BYND)

- 241% in 113 days on Planet Fitness (PLNT)

- 201.3% in 88 days on Red Hat (RHT)

- 197.5% in just 28 days on Fastenal Company (FAST)

- 179.8% in 56 days on Intel (INTC)

- 147.3% in 49 days on Ciena Corp (CIEN)

- 113.8% in just 23 days on Stitch Fix (SFIX)

- 109.9% in 84 days on Mastercard (MA)

Just to name a few examples.

In order for you to take advantage of the latest Corona-Boom opportunities that are now available, Dr. Skousen and Jim Woods are opening up access to their Fast Money Alert service by invitation only.

Their research and recommendations come with no obligation.

For 30 days, you’ll have the chance to try out every single one of the recommendations Dr. Skousen and Jim Woods share exclusively with their subscribers.

The minute you agree to a risk-free test drive of Fast Money Alert, you’ll immediately receive 30 full days of unrestricted access to the following:

- A FREE copy of Dr. Skousen and Jim Woods’ best recommendations for cashing in on the Corona Recovery & Boom, found in their brand-new Special Report, The Corona-Boom Millionaire Portfolio: These are stocks in super-profitable companies that Dr. Skousen and Jim Woods believe will benefit the most from the $6 trillion in government bailouts.

- The Complete List of All Fast Money Alert Trades, including non-Corona picks: This includes detailed write-ups on ALL of Dr. Skousen and Jim Woods’ best picks, shares of the world’s biggest, most profitable companies that are already climbing despite the coronavirus pandemic.

- New Recommendations: You’ll also be on the VIP list to receive two to three new Corona-Boom stock and option trades each month, sent directly to you via email or text the moment Dr. Skousen and Jim Woods identify them – all potential 100% to 500% winners. Each alert includes full instructions on every recommendation they make.

- Weekly Updates On All Recommendations: The great thing about Fast Money Alert is that you’re never left hanging. Dr. Skousen and Jim Woods keep you updated on all current positions on an ongoing basis and whenever there is a change in the market. That way you can stay a step ahead and maximize your profits.

- The valuable dossier on Dr. Skousen and Jim Woods’ options trading techniques, strategies and tips, The Black Book of Option Secrets: You’ll be ready to capture triple-digit profits with Dr. Skousen and Jim Woods’ regular option recommendations.

- LIVE Teleconferences with Dr. Skousen and Jim Woods: Both Dr. Skousen and Jim Woods host live teleconferences, so they can keep their readers and subscribers up to date about what’s happening with the Coronavirus economy and more. Plus, they’re able to alert subscribers in particular to new recommendations coming down the pike.

- The Fast Money Alert Members-Only Website: This is where Dr. Skousen and Jim Woods post all the “under-the-radar” profit opportunities they’ve uncovered for their readers. You’ll find every alert they’ve ever issued fully accessible.

- Past Profit Dossiers and Special Reports from Dr. Skousen and Jim Woods: You’ll also be given access to special investment reports created by Dr. Skousen and Jim Woods (or their teams) that highlight money-making investment strategies and specific investment opportunities. You can download these, read them and use them however you wish. They’re yours FREE for the taking as part of your 30-day period of access to the service.

- Dedicated Support Line: During your risk-free test drive, you’ll also have access to the same outstanding customer support all subscribers get. If you have a question or trouble with a trade, simply give us a call at 866-482-7689 – Monday through Friday between 9:00 a.m. and 5:00 p.m. (ET) – and we’ll make sure you get your question resolved.

Lock In the Highly Discounted

Special Subscriber Rate Today

Now, you may have wondered how much all this will cost.

To have access to a complete blueprint for surviving and prospering during the global Coronavirus Crisis…

To get trade alerts and research produced by two of the most successful stock pickers in the entire world…

And to also enjoy potentially doubling, even tripling, your money in a matter of months with ongoing option trades during the Coronavirus crisis, recovery and boom.

Of course, Dr. Skousen and Jim Woods could easily charge $5,000 a year or more for access to their proprietary research and recommendations. Many services do.

What’s more, top hedge fund managers routinely charge 20% of profits for their trading recommendations – and often with a fraction of the results produced by Dr. Skousen and Jim Woods.

However, you won’t have to pay anything close to that!

We’d like to make you a very special offer today and simply give you $1,000 off the regular price of $1,995 a year.

That means you can get Dr. Skousen and Jim Woods’ complete blueprint for surviving and prospering during the Coronavirus Crisis – and an entire year of their ongoing guidance, advice, research and recommendations – for the low price of only $995.

At that price, the gains from just a single recommendation could be enough to pay for your entire subscription!

And if you’d like an even BETTER value, you can get 58% off the regular price and lock in a subscription cost of just $1,695 for two years for as long as you wish to continue.

Keep in mind that the recommendations you’ll get have the potential to earn between 50% and 300% in a matter of weeks – both the stock picks and the bonus option trades.

And you don’t have to take my word for it either.

Current subscribers put it best:

Eddie P. of Ft. Lauderdale, Florida, just wrote to tell us:

Ray A.R. of Longmont, Colorado, also wrote to say:

Dub A. of Houston, Texas, emailed to say:

Raymond J. of Bloomfield, Michigan, is also happy, saying:

Test Drive Fast Money Alert 100% Risk-Free for the Next 30 Days with This Unique DOUBLE Guarantee

Best of all, Dr. Skousen and Jim Woods have decided to create a unique DOUBLE guarantee that, to me, fits a service like this.

If you accept a risk-free 30-day test drive of Fast Money Alert today, you’ll get instant access to ALL of Dr. Skousen and Jim Woods’ current recommendations, including:

- Their COMPLETE portfolio of current Corona-Boom investments

- Every option trade recommendation they make going forward

- All of their Special Investment Reports

- Weekly updates and analysis

- Live teleconferences

- And their ongoing help and guidance

Plus, you can try out all of their current stock AND option recommendations immediately with real money or just “paper trade” them to see how they do!

I’m convinced that you’ll be delighted and amazed by the results you see.

Yet in the unlikely event that you decide these recommendations are not for you, just give us a call within 30 days and we’ll refund your entire subscription fee – 100% of it – no questions asked.

That’s not all.

Second, if you don’t DOUBLE your money at least once a month on average going forward – that is, 12 times a year…

Dr. Skousen and Jim Woods will flat-out give you a SECOND YEAR of Fast Money Alert FREE!

That alone is worth $1,995 – and yet it’s included free in this offer.

But Hurry! This Corona Fire Sale Opportunity

Will NOT Last Long

The fact is, there is a real urgency to take action. The Corona-Boom opportunity will NOT last forever.

Stocks currently selling for 50% or more off their recent highs are already beginning to rebound – and the potential for staggering gains we’ve discussed in this message will decline.

In fact, if you don’t act quickly, you could potentially MISS OUT on the greatest investment opportunity in a generation.

Plus, as you’ve seen, some of Dr. Skousen and Jim Woods’ recommendations have already helped subscribers more than QUADRUPLE their money in just a matter of weeks.

So that means it’s now up to you.

You get to try out these recommendations for yourself risk-free for 30 days.

I know you’ll be thrilled when you discover the life-changing profits these recommendations can provide you with every week:

- 329.8% profits you could have made on Brookfield Asset Management

- 248.7% profits you could have made (in just 14 days) on Beyond Meat

- 215.2% profits you could have made on Zoom Communications

Current subscribers are already collecting profits with gains like these.

As I prepared this message, one trade is already up 90%… and another is up 260%.

And now you can do the same simply by clicking the button below right now.

You’re not making any commitment at this point.

When you click the button below now, you’ll be taken to a secure order page where you’ll be able to review ALL of the benefits that come with your 30-day trial.

So, I urge you to click the button below right now.

Mark my words: The Corona Recovery and Boom could be the greatest investing opportunity of our lifetimes.

It’s a rare chance to potentially grow up to 10 times richer. Don’t miss out.

Sincerely,

Roger Michalski

Publisher, Eagle Financial Publications