Tired of the Rollercoaster Stock Market?

Here Are 6 Stocks That Have Gone Up…

No Matter What!

While the S&P 500 is close to break even over the past year,

these large-cap “Always-Up” blockbusters were up 28.2%…

34.6%… 42.2%… 47.9%… 74.6%… even 101.6%!

Hello. This is Jim Woods.

I’m here at the Ritz Carlton Hotel in the sunny and picturesque town of Laguna Beach, California…

Today, I’d like to have a brief talk with you about your investments and what’s going on in the stock market.

Especially if you’ve taken a beating on your investments lately, please pay close attention.

In the next few minutes, I’m going to introduce you to not one but SIX blockbuster Stocks That Have Gone Up…

WAY UP…

Over the past several years…

Even when the S&P 500 has plunged.

I call these… “Always Up Stocks.”

As incredible as it may seem, stocks like these really DO exist!

Stocks that have made 34.6% in the past year… 42.2%… 47.9%… 74.6%… even 101.6%!

Of course, these stocks all had temporary declines in the past year.

But, over time, these “Always Up Stocks” have consistently risen higher and higher.

And they’re not odd-ball small-cap stocks you’ve never heard of, either.

The stocks I’ll tell you about in a minute have a market cap of between $5 and $250 billion – and they are the leaders in their fields.

What is different about these stocks is that they go up in value…

In good times and in bad…

When the economy is red-hot and when it barely has a pulse.

These “Always Up Stocks” can make you money when other investments fail you.

They can also provide you with an impenetrable fortress against market volatility.

Let me show you what I mean…

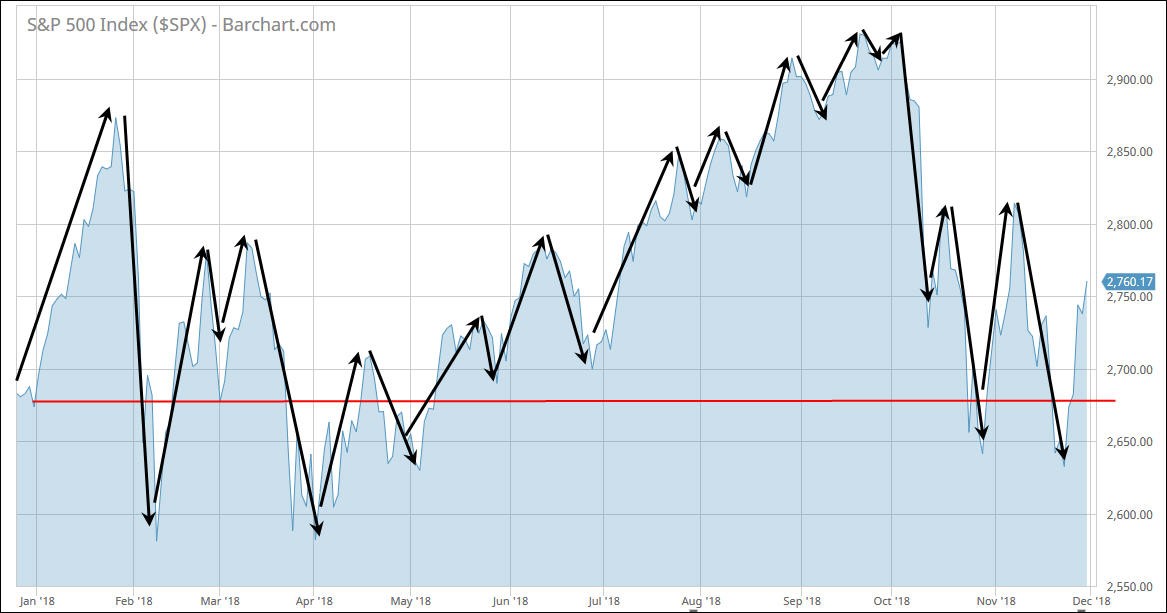

Take a look at this chart of the S&P 500.

As you can see, it’s been a rocky ride for index investors, and investors as a whole, over the past 12 months…

The S&P 500 began 2018 plunging 10% in late January.

It then rallied in February and March, before plunging again in April, hitting a low of 2,580 on April 2nd.

The rest of 2018, the market fought its way upward with a series of big dips along the way.

Finally, after hitting a record high of 2,930 on September 20th, the market saw a long-dreaded correction in October, plunging again 10%.

As I am recording this message, the S&P 500 is now up just 1.1% over the past 12 months, down 7.7% over the past three months.

And it goes without saying that the financial media have been FULL of dire predictions and ominous questions about what this means for the future…

- Will this choppy volatility continue?

- Are we entering a new era of lowered performance?

- Is another crash on the scale of 2008 just around the corner?

Yet here’s what many analysts in the media are NOT telling you:

During this same period of volatility in the market indexes as a whole, there have been literally hundreds of stocks that have been posting RECORD highs…

Even as the stock market as a whole continues to struggle.

Let me show you a few examples you’ll probably recognize…

Clorox (Symbol: CLX)

Clorox has a market cap of $20 billion, annual sales of $6 billion and trades on the New York Stock Exchange.

This is NOT a penny stock.

Yet Clorox has ignored the S&P 500 index entirely and just keeps going higher and higher.

It’s not a HUGE winner — up just 22% or so for the past year — but it keeps making money even when the market indexes are tanking.

In October and November 2018, Clorox just kept hitting record high after record high.

It kept Going Up No Matter What.

There have been up and down moves, of course, but in general the stock has just continued to climb higher and higher.

Apparently, people still need to bleach their clothes even when the Dow is falling.

And Clorox is hardly unique.

Here’s another example I love: El Pollo Loco (Symbol: LOCO)

This is a chicken fast food chain that is really big out here in California.

They serve this delicious Tex-Mex style roasted chicken with flour or corn tortillas and home-made salsa.

People here out west can’t get enough of it!

Well, a year ago, El Pollo Loco was selling for around $9.89 a share.

It’s been climbing steadily ever since, with a few dips here and there.

Recently, when the market as a whole took a tumble, El Pollo Loco did a moon shot: it jumped $4 before settling down around $15.50 a share.

That was a gain of 56% in just a year.

Here’s another example: U.S. Cellular (Symbol: USM)

It’s up 53% in the past year as well.

And it’s up 25% in just the past three months.

As you can see in this chart, USM continued to climb higher and higher even when the market as a whole was plummeting.

It began the year selling for around $35 a share and just climbed steadily upwards.

Right now it’s about $57 a share.

Here’s another fun example: Crocs (Symbol: CROX)

You know Crocs, those plastic clog-like things people wear?

Well, a year ago, Crocs was selling for around seven bucks.

By last summer, it was trading around $17 a share.

Yet here’s what many people don’t realize:

When the stock market took a dive in October, Crocs took a small dip, but then it just kept moving higher!

In fact, in early November, it jumped $6 a share to a record high and is now trading around $26.60 per share.

That means it’s up a whopping 144% in just the past year.

Now, I’m NOT saying you should invest in trendy plastic footwear.

No, I have specific criteria for identifying “Always-Up Stocks” like these… and I’ll share my latest picks using these criteria in a moment.

I’m just illustrating for you that, even in this highly volatile market, there are quite a few stocks that just keep moving higher and higher.

And there is still A LOT of money to be made in stocks… if you know where to look.

Much of the recent declines in the stock market have been concentrated in certain sectors of the market, such as the so-called FAANG stocks (Facebook, Apple, Amazon, Netflix and Google).

These badly performing sectors have dragged the market averages down.

And so, if you’re an index investor who invests solely in mutual funds, you’re likely not very happy right now.

But, unlike in 2008, when only a handful of stocks went up during the general wipe-out, today’s volatile market is much more diverse.

Overall, U.S. companies are seeing some of their best days ever.

Over-priced, over-hyped digital giants like Facebook and Google are dragging the market averages down, but individual stocks in other sectors are going gangbusters.

And I want to tell you about six of the very best Stocks That Have Gone Up No Matter What…

That YOU can use to make a tremendous amount of money in 2019.

Not only will the stocks themselves likely outperform the market as a whole… you could potentially double your money over the coming 12 months.

As I mentioned earlier…

One of the stocks I’ll tell you about was up 101.6%… in the past year.

Another was up 74.6%…

Still another gained 47.9%…

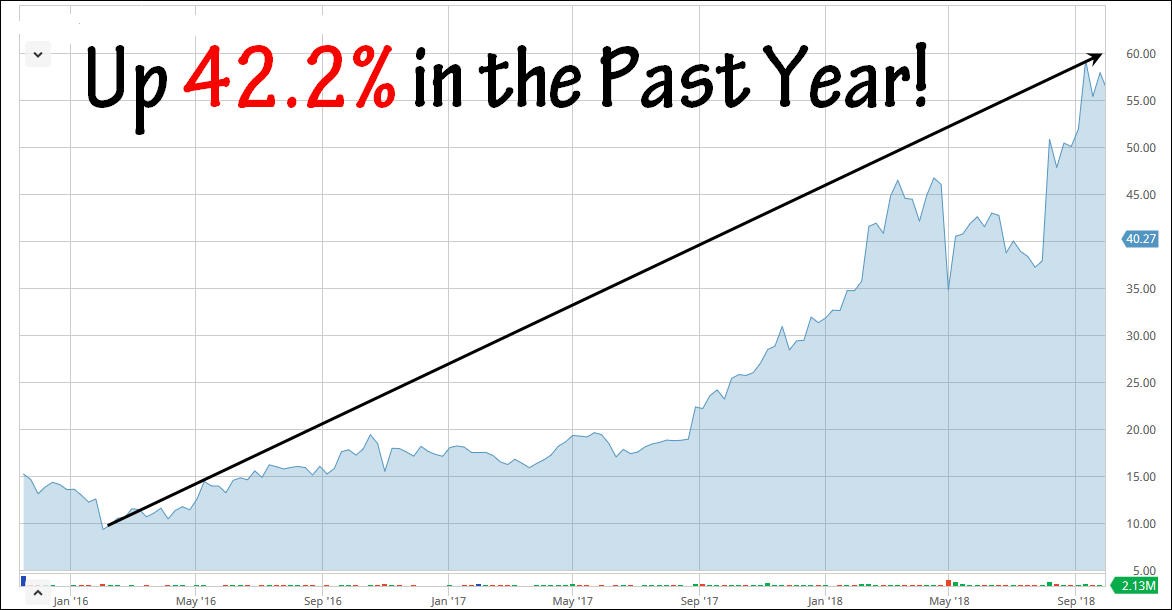

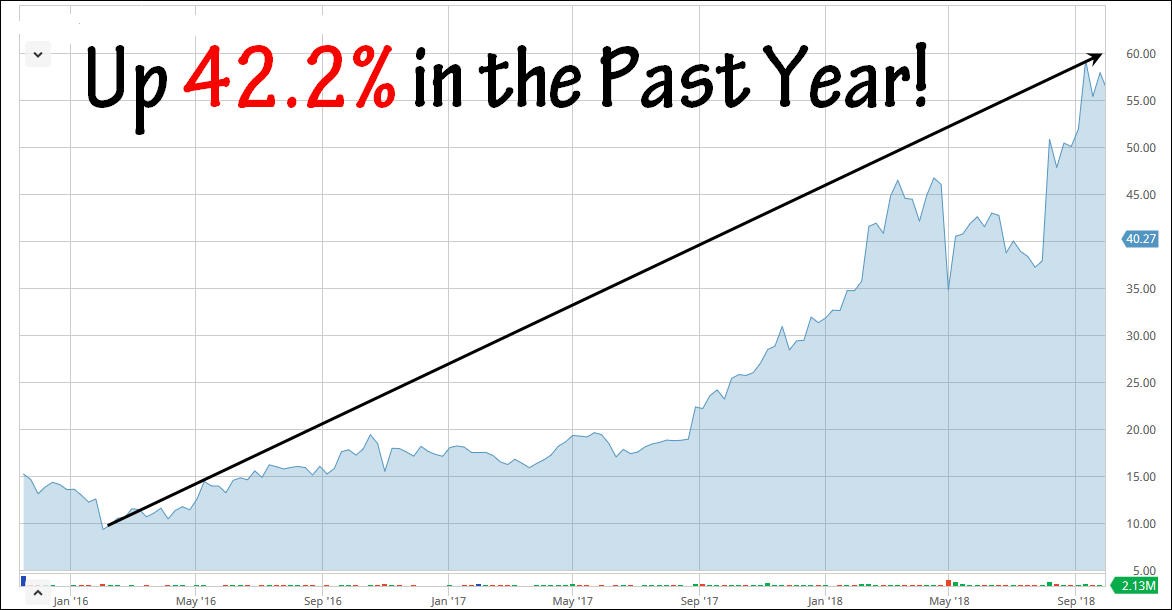

And another saw profits of 42.2%…

Plus, you’ll even find out how to place some low-cost trades on these stocks that could multiply your investment by 100% to 300%… in just a matter of weeks!

I’ll tell you more about that in a moment.

But first, let me tell you just a little bit more about who I am…

As I mentioned earlier, my name is Jim Woods.

You may have heard of me if you attend the Money Show or follow the financial news.

The independent firm TipRanks currently ranks me the #4 financial blogger in the world out of more than 6,000 reviewed.

I’m telling you this not to brag, but so you’ll take what I am about to tell you seriously.

For more than 25 years, I’ve been an obsessive student of the markets.

After finishing college, I joined the U.S. Army as a paratrooper.

But after the Army, my first real job was working at Investor’s Business Daily in Los Angeles.

After working at Investor’s Business Daily for seven years, I was then “in the trenches” as a trader at a private hedge fund.

From there, I went on to be a client advisor with Morgan Stanley, before finally becoming a full-time market analyst and financial newsletter editor, working first for the Fabian family and then at Eagle Financial Publications.

My time at IBD, Fabian and Eagle taught me a very important lesson… and it may surprise you: being too cautious hurts your financial future even more than a crash.

For example, right now everyone is worried about another big sell-off in the markets.

And not without good reason.

We’re now officially in the longest bull market in history, and in the past few months we’ve seen HUGE volatility… with the Dow losing, and gaining, up to 800 points in a day.

And, yes, these kinds of rollercoaster moves test everyone’s nerves.

Yet study after study has proven that being OUT of the market usually hurts your long-term finances far more than riding out a down market.

In one study of 15 separate markets, missing just the 10 best-performing days resulted in portfolios 50.8% less valuable than portfolios that caught them.

In addition, another study found that being in the best 25 trading days since 1970 produced the vast majority of market gains.

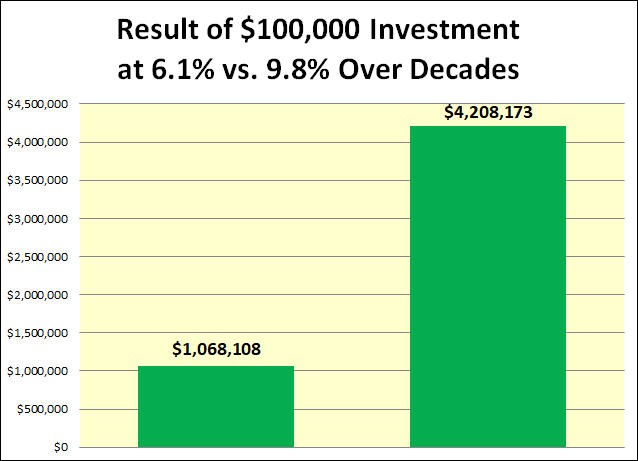

Being in the market during those 25 up days resulted in a 9.8% annual return.

Missing those days: just 6.1%.

And in dollars and cents, missing these best trading days means literally millions in lost profits for your future.

For example, an investor who started with a modest $100,000 portfolio…

Who was invested in the S&P 500 during the 25 best trading days and enjoyed the better 9.8% annual return…

Ended up with an extra $3.1 million MORE over time compared to someone who missed the best performing days in the market.

And that extra $3.1 million can make a huge difference during your retirement:

Over 25 years of retirement, you could withdraw an extra $10,000 per month from that additional $3.1 million – and still not run out of cash!

That’s why what I want to show you right now is so important.

You see, by focusing too much on the AVERAGES – the market indexes like the Dow Jones Industrial Average or the S&P 500 – investors can get a distorted view of what’s REALLY going on in the markets.

And as I mentioned earlier, the performance of a few big stocks – such as Google and Amazon – can trigger an emotional chain reaction in the markets that doesn’t actually reflect the reality on the ground.

And the reality on the ground is that many stocks are SOARING right now…

So investors who are sitting on the sidelines are cheating themselves of a far more prosperous future.

In fact, there are SIX stocks in particular that every investor should own right now.

They are, quite simply, Stocks That Have Gone Up No Matter WhatTM.

- They’ve been up over the past few months when the market averages have plummeted.

- They’ve been up over the past year.

- They’ve been up over the past THREE years.

- And, depending on the stock, some of them have been up – WAY up – over the past 5, 10, and even 20 years!

Put simply: these are the kinds of investments that can help you sidestep the market rollercoaster and enjoy a smooth ride in retirement.

They have gone UP when other stocks have plummeted… and they give you the confidence to stay in the market so your OTHER investments eventually come back.

In other words: These are the kinds of stocks that stiffen your spine.

So, without further ado, let me tell you about them…

“Always-Up Stock” #1:

The $17 Billion Beauty Company that’s Up 32% in the Past Year and Has Made Investors 41 Times Their Money Over a Decade

This stock has done amazing all year… as it has done virtually every year for the past decade.

It just happens to be a leader in its niche… one that has been red-hot for years.

And that niche is beauty.

This company sells high-end beauty products for women.

We’re talking expensive cosmetics… skin moisturizers… anti-aging serums… perfumes…

And no matter what happens with the economy as a whole, this company makes money.

A lot of money.

In fact, in October and November 2018, when the S&P 500 was plummeting, this stock hit record highs.

It’s up 34.6% for the past 12 months – or 25 times more than the S&P 500 as I record this.

And that’s nothing new!

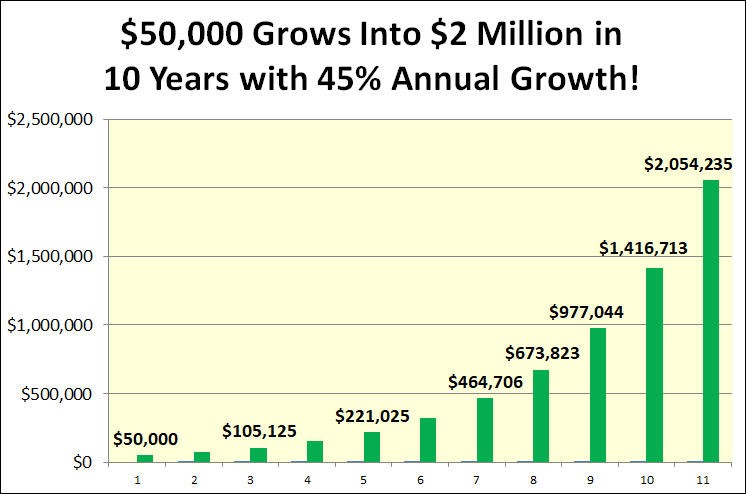

In fact, shares of this company have averaged a 45.3% annual return for the past 10 years running.

Since 2008, the stock has seen total returns of 4,122% — or 41.2 times your money.

No, that’s not a misprint: 41 times your money!

Sounds unbelievable, doesn’t it?

I could barely believe it myself when I first discovered this Always-Up Stock.

But here’s a screen shot of the actual Morningstar trailing returns for this stock…

As you can see, over the past 10 years, it’s averaged 45.3% a year.

And here’s what it means in dollars and cents:

Every $5,000 invested in this stock a decade ago would be worth $211,000 today… and every $50,000 would be worth $2.1 million.

As you can see, owning a stock like this can make an enormous difference in your overall financial situation.

And that’s why I’ve prepared a brand-new dossier with detailed information on this overachieving blockbuster stock – and five others just like it.

It’s called, appropriately enough, Always-Up Stocks: 6 Stocks That Have Gone Up No Matter What.

Pretty direct title, don’t you think?

While past performance is no guarantee of future results, I believe this stock will continue to make eye-popping gains throughout 2019 and beyond.

That’s why it’s the first in my new special report, Always-Up Stocks: 6 Stocks That Have Gone Up No Matter What.

(I’ll tell you how to get a free copy in just a moment.)

But first, let me give you an example of ANOTHER stock that has continued to climb higher even when the market as a whole has struggled.

“Always-Up Stock” #2:

The $5 Billion Fitness Chain That Has

Soared 74.6% Over the Past 12 Months!

I absolutely love this stock!

For one thing, it’s in an industry that I wholeheartedly support: health and fitness.

But, more importantly, it’s up a whopping 74.6% over the past year!

Think of that: 74.6% when the market as a whole is up little more than 1%.

With a market cap of $5 billion, this fitness company has more than doubled its sales over the past four years.

And it’s averaged 54.9% a year for the past 3 years.

What is the company’s secret?

In a word: customer service.

Unlike many fitness centers, this company’s 1,608 franchises really do put its customers first.

As a result, the company has been consistently ranked as the number one customer service provider for fitness centers.

Retention rates are off the charts.

And that superior performance can be seen in its financial statements.

The company’s revenues have more than doubled in the past five years.

And its stock just keeps climbing higher and higher, seemingly oblivious to the latest catastrophe on Wall Street.

I believe it’s a no-brainer addition to any investor’s portfolio – especially someone who wants the protection that consistent gains give to a portfolio…

Just like the next recommendation…

“Always-Up Stock” #3:

The Discount Retailer That Has

DOUBLED in Value Over the Past Year!

My third recommendation for you is a specialty discount retailer with $6 billion in shares outstanding and quarterly earnings growth, year over year, of 49%.

It’s more than DOUBLED investors’ money over the past year… during one of the worst years the stock market has seen since the 2008 stock crash.

The company has annual revenues of $1.4 billion… net income over $100 million… and it’s growing like there’s no tomorrow.

Discount retailers have often been a good hedge during uncertain times.

During the 2008-2009 stock market crash, Dollar Tree was one of the stocks that recovered the quickest and ended the year way up.

And this stock is a lot like that.

While the market as a whole struggled in 2018, this stock kept going higher.

It’s averaged 53.7% a year for the past 3 years in a row… and 14.6% for the past 5 years.

It’s another great Always-Up Stock to add to your portfolio in 2019.

I tell you all about it in my new, in-depth dossier called Always-Up Stocks: 6 Stocks That Have Gone Up No Matter What.

And here’s another one that I describe in detail in this report:

“Always-Up Stock” #4:

A $19 Billion Spice Company That

Has Earned 18% a Year for a Decade!

Founded 129 years ago, my next recommendation is a blue chip with a market cap of $19 billion.

It manufactures spices, herbs and condiments for the restaurant industry.

If that sounds pretty boring, take a look at this chart going back 20 years.

As you can see, this is also a stock that, over time, has always gone up.

The 2008 stock market wipe-out was nothing more than a minor, temporary blip on a trajectory that rises like a hockey stick, especially in the past 12 months.

Overall, this stock has risen an average of 18.57% a year for the past 10 years.

And it shows no sign of slowing down, either!

It has annual sales of $5 billion.

Net income after taxes of $895 million.

And a history of consistently rising dividends – always a good sign.

That’s why I believe this stock could be another heavy brick in the towering fortress that should be your portfolio – a fortress that will let you withstand anything the market throws at you.

Okay, I know we’re running out of time, so let me just briefly mention two more.

It won’t take long, I promise.

This next one is one of my favorite picks, because it shows how real life can trump even market hysteria.

“Always-Up Stock” #5:

A Match Made in Heaven!

My fifth pick for your 2019 portfolio is, believe it or not, a social networking stock…

But it’s not just any social networking stock.

This company has a market cap of $11 billion – and annual revenues of $1.5 billion.

And no, it’s not Facebook or Twitter.

The company hasn’t been around for very long, of course, but, over the past three years, it’s posted an average annual gain of… 41.4% a year.

And like all of the stocks I’ve shown you today, this company’s shares have continued to climb higher and higher no matter what.

Over the past 12 months, it’s gained 42.2%.

Okay, you’ve been very patient.

I’ve saved one of the best for last.

“Always-Up Stock” #6:

A $270 Billion Health Care Giant That

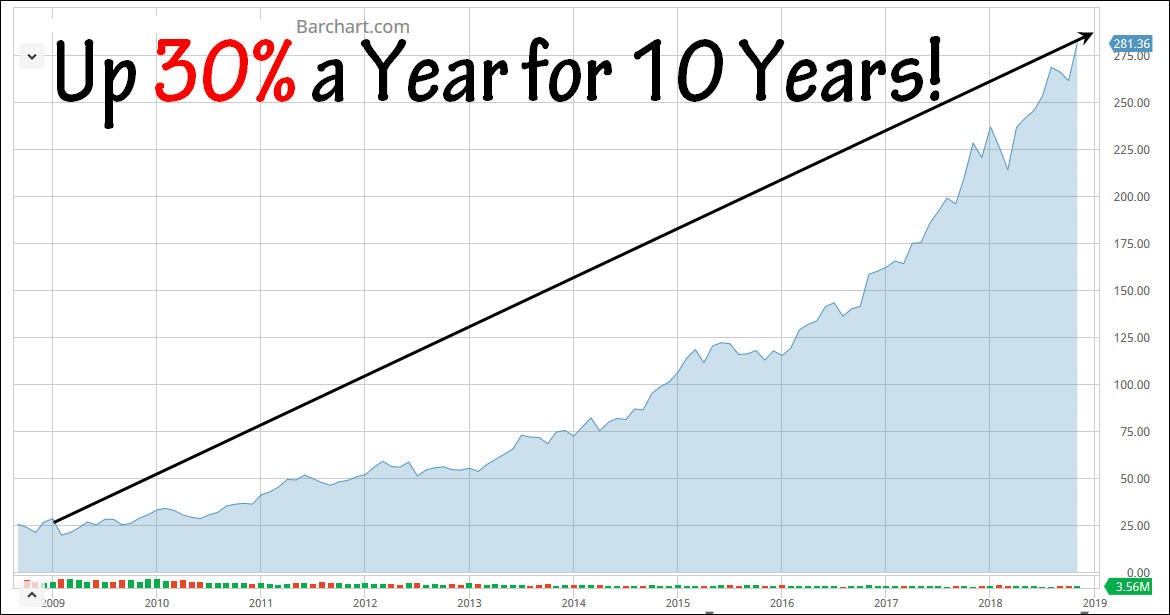

Has Averaged 30% Per Year for 10 Years!

My sixth recommendation for a Stock That Has Gone Up No Matter What is a health care company.

But not just any health care company.

This company is the bluest of all blue chips, with a market cap of $270 billion.

Its annual revenues top $220 billion.

Yet this company’s shares perform almost like those of a small tech stock.

It’s “only” up 28% over the past 12 months… but it’s averaged 30.1% a year for the past decade!

And that’s why its ten-year chart looks like this:

So, I hope I’ve proven to you that there really ARE Stocks That Have Gone Up No Matter What… and that it’s worth your while knowing about them.

As a financial fortress against the volatility, you should invest a portion of your portfolio in these “Always-Up Stocks.”

But there is something else you can do as well.

There is a way you can leverage the consistent gains these over-achieving stocks produce to make even BIGGER profits on an ongoing basis… as in 5 to 10 times bigger.

And you can do this with low-cost OPTIONS.

Now, I know what you may be thinking… options are risky, right?

And I won’t kid you. They can be risky.

As you probably know, 3 out of 4 options expire worthless.

Yet here’s something the so-called experts don’t tell you about options: they can also be ridiculously cheap…

And by ridiculously cheap, I mean just 10 to 20 bucks… and sometimes just 10 to 20 CENTS.

They can be cheap enough to justify the additional risk… if you know what you’re doing.

So, what professional traders often do is to COMBINE solid stock picks like the ones I’ve just shared with you… and ADD a few select option plays on these same stocks.

That way, if they’re right about the movement of the underlying stocks…

And these “Always-Up Stocks” continue to rise in value as they typically do…

Then shrewd traders can pocket literally thousands of EXTRA dollars in a matter of weeks.

Let me show you what I mean…

Here’s an option trade I recommended in November 2018.

It was on the blockbuster beauty stock I just told you about at the beginning of this message.

And this was one of the few that are more expensive.

Now, at the time the market as a whole was tanking.

Here’s a chart of the S&P 500 around this time…

As you can see, it was heading straight down.

Everyone was jittery.

But I knew that this was one of those Stocks That Have Gone Up No Matter What.

As a result, I recommended that my readers and followers buy calls options on this stock.

At the time, the stock was trading for around $285 per share.

So, I recommended everyone buy the March $300 call for $21.40.

Well, as I suspected, the market continued to go down, but this beauty gangbuster defied the averages and went in the opposite direction: straight up.

By November 19th, the market was in free fall. But this stock was selling around $313 per share, well ABOVE the option strike price of $300.

So, I recommended taking profits.

We made a quick 54% profit… in just 12 days.

In other words, we were able to make in two weeks what this stock typically makes in a full year!

One contract, controlling 100 shares, would have netted you $1,160.

If you had invested in, say, five contracts, you could have made $5,800 in just under two weeks.

Pretty sweet!

You can see why I like investing in Stocks That Have Gone Up No Matter What – and trading options on them as well!

But that was a relatively small gain percentage-wise.

With these “Always-Up Stocks” you can make more. A lot more.

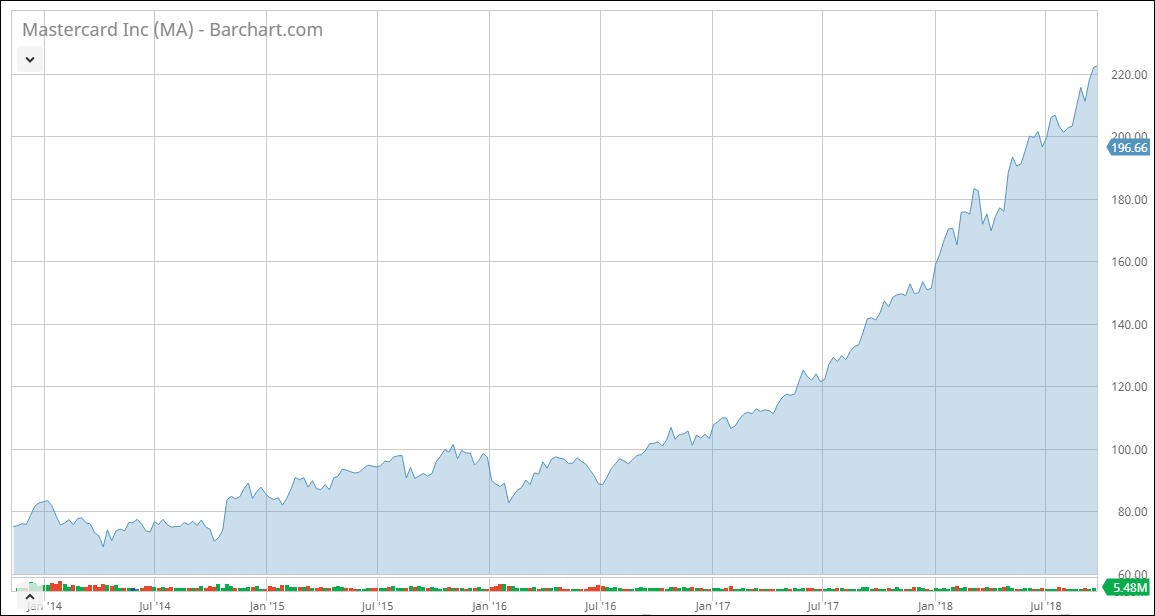

Here’s another example: MasterCard (Symbol: MA)

In April, I recommended the July $185 call on MasterCard for just $6.52 each.

Why would I do such a thing?

Well, MasterCard is one of those stocks that just keeps going higher and higher.

Take a look at its five-year chart:

As a result, I was confident that this was a fairly low-risk way to make some extra money.

I recommended the calls when they were selling for around $6.52 each in early April.

By early July, the stock had continued to climb higher, just as I suspected it would.

When the stock was trading for $10 over the option strike price of $185, I recommended taking profits on the trade.

We sold the calls at $13.69.

Anyone who made this trade could have pocketed a minimum of $717 in profits on a single options contract.

Had you invested in five options contracts controlling 500 shares, you could have picked up an extra $3,885 in just three months!

You know what they say, an extra 4 or 5 grand here, another 4 or 5 grand there… and pretty soon you have some real money in your pocket.

And here’s another quick example…

As I mentioned earlier, in late January and early February 2018, the market took a big tumble with the S&P 500 falling almost 10% in about two weeks.

But once again, this was just the market AVERAGE…

There were PLENTY of stocks that I knew would almost certainly continue climbing higher, based on their incredible earnings growth and total domination of their industries.

And one of these stocks was… Intel (Symbol: INTC)

As a result, I took advantage of the plunging market to recommend some dirt-cheap options on Intel shares.

I told my private group of subscribers that they could pick up Intel June $50 calls for just $1.24 each.

That meant you could control 100 shares for a whopping $124.

You could control 1,000 shares for just $1,240.

That works out to a 97.1% discount off the cost of owning the shares.

Or, put another way, you could control 100 to 1,000 shares of Intel for only 2.86% of the purchase price.

When I recommended the $50 calls, on February 5, Intel shares were selling for 43 bucks.

Well, you know what happened next. The market rallied… but Intel rose even faster.

By early April, when Intel was selling way above $50 per share, the calls had shot up from $1.24… to $3.47 each.

We closed out the trade, earning a very nice 179.8% gain in just 54 days.

If you had risked $1,240 to control 1,000 shares, you would have walked away with an extra $2,229.

Had you risked $6,200 to control 5,000 shares, you would have walked away with $17,345 – or $11,145 in profits!

So, while it’s true that options can be risky, it’s ALSO true that options are where many professional traders make most of their money.

That’s because if you’re careful to select stocks that tend to go up even in a down market, you greatly increase your odds of having winners.

I hate to bore you, but let me show you just ONE more example.

(I can talk about this stuff all day long.)

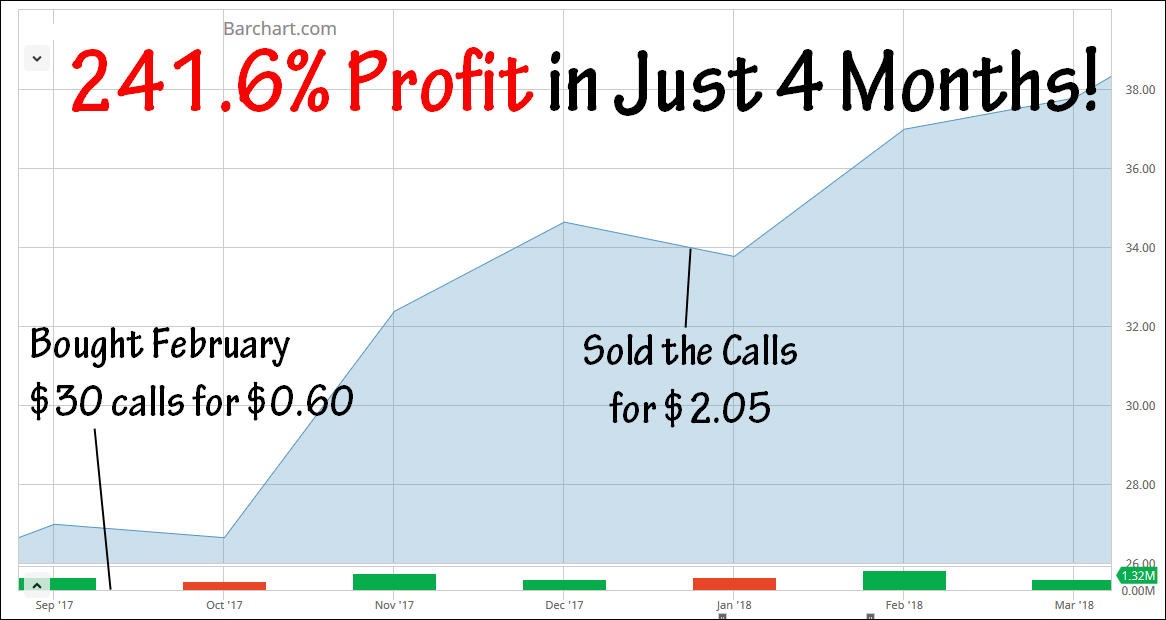

I love this trade because it’s in one of the “Always-Up Stocks” I just told you about today.

Here’s what its longer-term chart looks like…

As you can see, this stock just keeps going up no matter what…

And that’s why I knew it was PERFECT for an option play.

I recommended the February $30 calls when they were selling for just 60 cents each.

Talk about cheap!

To control 100 shares would cost just $60… and to control 1,000 shares just $600.

If you really wanted to go crazy, you could have controlled 10,000 shares for just $6,000.

And just as I thought, this stock kept going up… like it always does.

I recommended the calls for 60 cents each. That’s about a 98% discount off the cost of owning the underlying shares.

About four months later, we sold the same calls for $2.05 each.

That was a profit of 241.6% in just 113 days.

Had you taken a flyer on this and locked in 10,000 shares for $6,000, you could have walked away with $20,496.

Again, this is why I LOVE options.

It just takes one or two trades like these before you really see how they can boost the performance of your portfolio….

When you can pick up options for 60 cents, as in this example, you’re not risking a lot of money – a minimum of $60 per trade.

Yet, as you can see, the profits can be substantial.

And here’s the best news of all:

My new dossier on the SIX “Always-Up Stocks” ALSO includes my detailed recommendations for OPTION TRADES on all of six of these stocks…

These are trades that can DOUBLE your money in 30 to 60 days… and sometimes TRIPLE it in less than four months… as with the examples I showed you a moment ago.

For example…

First, right now you can buy a call option for 100 shares of the beauty stock I told you about for just over $18 each.

I believe these could EASILY double your money in the next 90 days.

The last time we made a trade like this we made 54% in just 12 days.

Second, you can purchase just-out-of-the-money calls on the discount retailer, that doubled in value over the past year, for around $6.80 each.

I think these could potentially TRIPLE your money if the stock continues on its current trajectory…

Third, there’s that fitness chain that’s up 74% in the past 52 weeks.

I have an option trade on this stock for calls that currently sell for only $4.00 each. You could control 100 shares for only $400…

The last time I issued an option recommendation for this stock, we made 241.6% profits in just under four months.

And that’s just the beginning.

I have specific option recommendations on ALL SIX of the stocks I recommend in my new special report, Always-Up Stocks: 6 Stocks That Have Gone Up No Matter What.

And I’d be delighted to send you this complete dossier right now…

With ALL of the details on the six “Always-Up Stocks” AND the special call option recommendations that go with them.

All I ask in return is that you agree to test drive my V.I.P. trading service, Bullseye Stock Trader.

What You Get with My Bullseye Stock Trader Service

You can probably tell from the name of the service, but Bullseye Stock Trader gives you the chance to hit the bullseye over and over again on stocks like the six “Always-Up Stocks” I’ve told you about today:

Each month, I send you recommendations for blockbuster stocks… and for precisely targeted option trades on the same.

It’s your chance to grab an extra $10,000… $20,000… even $50,000 per year without putting up a lot of money…

Accept a risk-free test drive today, and you could potentially earn more in the next month than most people do in an entire year of investing.

And that’s no exaggeration.

With your risk-free test drive, you’ll get ALL of the benefits of regular subscribers, including…

- Weekly Hotlines of Bullseye Stock Trader: You’ll receive every copy by email or text, quickly and efficiently.

- Real-Time Buy and Sell Alerts: In this fast-moving, volatile market, I stay in touch. Every now and then I’ll have a trade I recommend you jump on right away, and I make sure you receive these buy and sell alerts the moment they arrive.

- Specific Entry, Exit, and Target Prices: You’ll never have to guess if a stock is a good buy or not. I’ll always give you specific entry points, sell prices, realistic targets, and stop losses for all our recommendations.

- Complete Research for Every Recommendation: You’ll always know exactly why I recommend a stock or option trade. You’ll know what to expect and what to watch for. That way, you can invest and profit with confidence.

- Live Customer Service: If you ever have a question or concern about a recommendation, you can call my Director of Trading Services, Grant Linhares, Monday through Friday between 9:00 a.m. and 5:00 p.m. (EST) and he’ll answer your questions. His number is 844-419-4548.

That’s a pretty full slate of benefits… and it’s still not all.

In addition, you get…

-

The Bullseye Stock Trader Guide to Options Trading: In this bonus special report, I reveal the inside “tricks of the trade” for winning at options. I show you how options work… how we decide if a stock warrants an option trade… the specific techniques we use to maximize profits and minimize losses… and lots more.

- Conference Call Events: These are live conference calls where I give you my latest thoughts about what’s happening in the markets, and insight into some big trading opportunities that are coming up. I also answer questions that you may have about our current recommendations.

- V.I.P. Access to our Private Website: Not only will you find your trade alerts and weekly updates on the site… but you’ll also get our current portfolio, with buy, hold, sell, and stop-loss instructions. You also get members-only access to a comprehensive library of all my current and past research reports. Download any of them, print them out and read them at your convenience.

Of course, I’m sure you’re wondering by now how much it costs to become a member of Bullseye Stock Trader.

After all, I’ve told you about not one but SIX Stocks That Have Gone Up No Matter What... by as much as 34.6% … 42.2% … 47.9% … 74.6% … even 101.6%! in the past year!

What’s more, I’ve shown you examples of option trades like those I’ll give you for each of the six “Always-Up Stocks.”

With these, you can make profits of 50% or more in just a few days… and up to 241% profits in just a couple months.

Plus, you probably know that V.I.P. trading advisories like this can charge up to $5,000 per year.

But you may not know that the regular subscription price for Bullseye Stock Trader is only $1,995 – given the profits I’ve just shown you, that’s an enormous bargain.

Yet you don’t have to pay anything close to even that!

We’re going to give you a $1,000 credit off the regular subscription.

That means, for a limited time, you can receive an entire year of Bullseye Stock Trader for just… $995.

That’s an absolute steal considering that most people make that amount back from just a SINGLE option or stock trade.

And I’d like to make Bullseye Stock Trader even more accessible, so here’s what I’m going to do…

Try Us Out For 30 Days —

With No Hassles… No Pressure!

When you agree to test our Bullseye Stock Trader, you’re covered by my 100% no-risk guarantee.

Take 30 days to decide if Bullseye Stock Trader is right for you.

That’s a full month.

During that time, you receive all the benefits of full membership:

- All the new recommendations…

- All the buy, sell and hold prices…

- All the stop-loss recommendations…

- All the updates and market analysis…

- All the take-profits alerts and…

- Full membership access.

You can log into the private member’s site…

Check out all the special reports…

Read everything you can about the six stocks in my dossier, Always-Up Stocks…

And view every hotline update I’ve posted.

In the unlikely event you find Bullseye Stock Trader isn’t for you, just let me know within 30 days, and I’ll refund every penny you spent on the subscription — no questions asked.

Any information, recommendations, reports, or profits you received courtesy of Bullseye Stock Trader are yours to keep.

You won’t find an opportunity like this very often… and, with the amount of information I’m giving to you FREE of charge, taking a trial run of Bullseye Stock Trader is a no-brainer.

So, if investing in Stocks That Have Gone Up No Matter What is something you’re interested in, I suggest you lock in your spot today.

Simply click the big button below to get started.

But do it now because there’s ONE slight catch…

I Have to Limit This Special Offer to

Only 250 Subscribers!

This part is out of my hands.

You see, my tight-fisted publisher HATES these kinds of super-discounted offers for obvious reasons.

To stay in business, he has to make money… pay for offices, writers, analysts, computers and so on.

And I get that.

Plus, these V.I.P. trading services are very resource-intensive.

They are A LOT of work and cost a lot of money to maintain.

As a result, I have no choice but to limit the number of people who can get the $1,000 discount and join for only $995… to just 250 people.

Once those 250 slots are taken, I’m afraid we’ll have to charge the regular annual price of $1,995.

Yet, for that reason, I’d like to sweeten the deal even MORE:

I kicked and screamed a little bit, and managed to get my readers an even better deal:

If you agree to accept a risk-free trial right now… as in immediately…

You can get the $1,000 discount not just THIS year, but EVERY year…

That means you can LOCK IN the special discounted rate of $995 per year… for as long as you wish to continue!

In other words: this special rate will be guaranteed for you for life…

Let me tell you: this type of offer is NEVER done… at least not that I know of.

So…

Please Do Me a Favor:

Click the Button Below Right Now!

If you delay, you could end up having to pay the regular price of $1,995…

So, I urge you to accept the risk-free TEST DRIVE right now if this is something you’re interested in trying out.

That way, if you decide you like Bullseye Stock Trader, you’ll save $1,000 instantly.

It’s really easy to do. Simply tap the button below right now.

It takes just a moment.

Through the magic of the InterWebs, you’ll be whisked away to a secure, encrypted site where you can fill out the order form.

Once you’ve agreed to test drive Bullseye Stock Trader risk-free for 30 days, you’ll get instant access to our V.I.P. website and ALL of my current recommendations.

What’s more, within minutes you’ll receive your copy of my complete dossier, Always-Up Stocks: 6 Stocks That Have Gone Up No Matter What…

With complete information on all six of the stocks I’ve told you about in this message today:

The beauty company that is up 34.6% in the past year and has averaged a 45.3% annual return for the past 10 years running… that would have turned every $50,000 into $2 million…

The discount retailer that is up 101.6% in the past year…

The fitness chain that is up 74.6% in the past year and has averaged 54.9% a year for the past three years in a row…

The social media stock that has averaged 40% or more for the past 3 years in a row…

And the health care conglomerate with a $250 billion market cap that has averaged 30% a year for a DECADE…

Plus, you’ll also receive special options recommendations on each of these, giving you the opportunity to double or even TRIPLE your money in just weeks…

Like the call option on the beauty stock that made 54% in just 12 days…

Or the option on the fitness chain that made 241.6% in just 113 days…

That’s why I can honestly say that accepting a risk-free trial of Bullseye Stock Trader is the greatest no-brainer offer in the history of no-brainer offers.

So, my advice: Take the plunge.

Check it out.

Click on the button below right now.