What Your Broker Doesn’t Want You to Know:

The One Warning Signal That

Predicts Market Crashes with

100% Accuracy!

Plus: A Proven “Safety Net” Strategy That Can Grow a

Modest Portfolio of $100,000 into $4.2 Million No Matter

What Happens with the Market as a Whole…

What if I told you there is a simple mathematical calculation…

One that a bright 10-year-old student can perform…

That has accurately predicted all NINE U.S. recessions since 1955?

It’s been right. 100% of the time. Without exception.

In fact, it’s been able to do what no economist… no market analyst… no guru… no computer program… has been able to do.

Does it sound far-fetched?

Well, it’s true.

This secret warning signal has predicted EVERY recession and big market crash for the past 60 years.

- It accurately predicted the recession of July 1990 to March 1991, after seven years of a raging bull market…

- It pegged the two back-to-back recessions of the early 1980s…

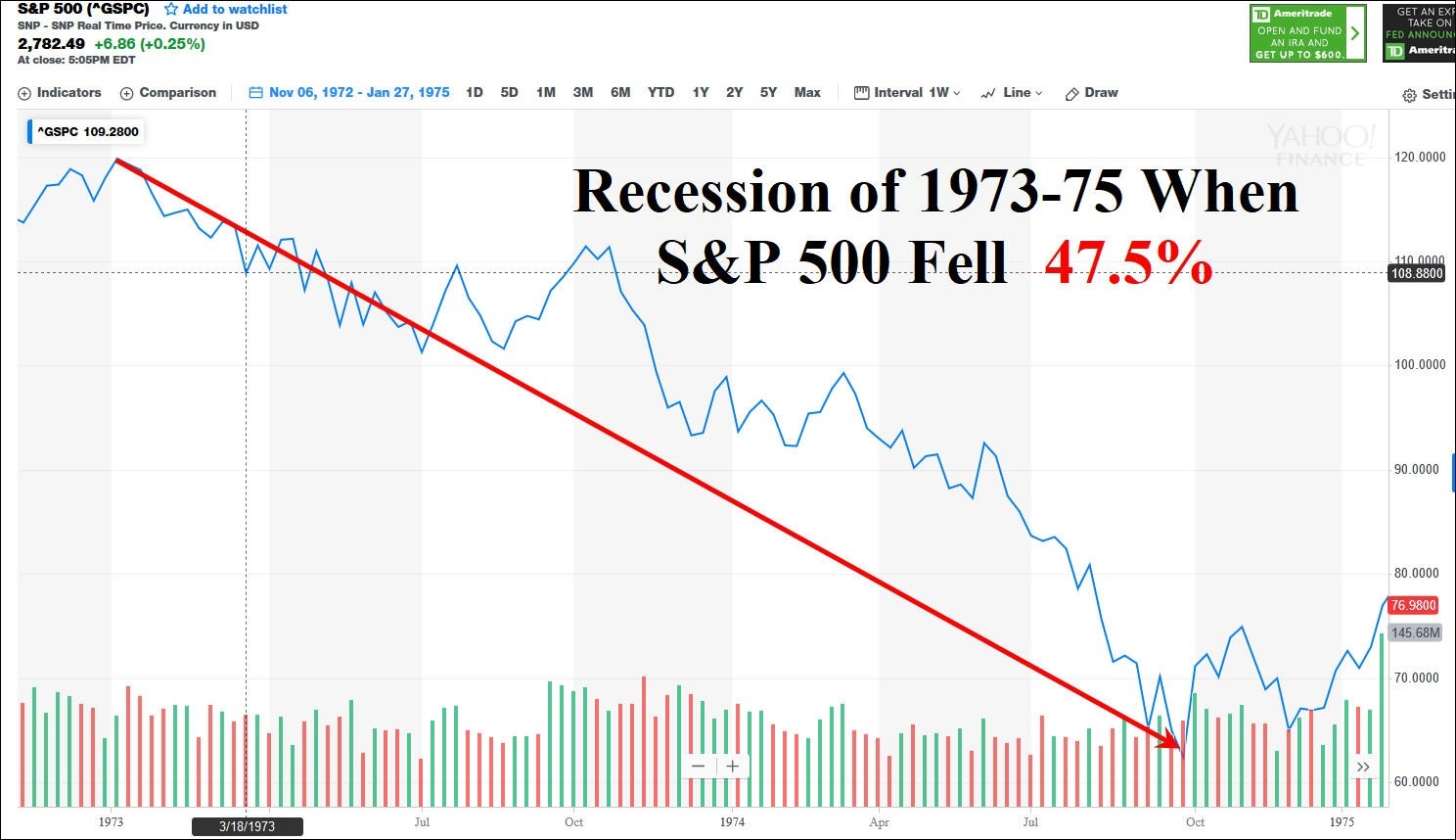

- It spotted the recession that began in November 1973 and lasted until March 1975… when the S&P 500 lost 47.5%.

- It predicted the recession of 1969-1970, when the stock market dropped 25.1% in just five months…

- It was even able to predict the recession that briefly followed Kennedy’s election in 1960, and…

- The little-remembered recession of 1957-1958 when GDP fell a staggering 3.7%…

In each of these cases of economic decline and market turmoil, the secret warning signal flashed red alert…

And warned investors who knew about it to take defensive measures with their portfolios.

Now, professional money managers chart this secret warning signal on a graph for ease of use.

When the line of this graph dips below the warning mark, the secret warning signal switches from green (meaning “all is well”) to red alert (meaning a crash is likely imminent).

Let me show you:

It was the 1990s, the most prosperous period in U.S. history.

For ten long years, the indicator had been green… all was well.

But then, on February 2, 2000, for the first time in a decade, the secret indicator began flashing red alert.

Those in the know quickly took defensive measures.

And what happened next?

You got it: After a decade of prosperity, suddenly the economy began to falter.

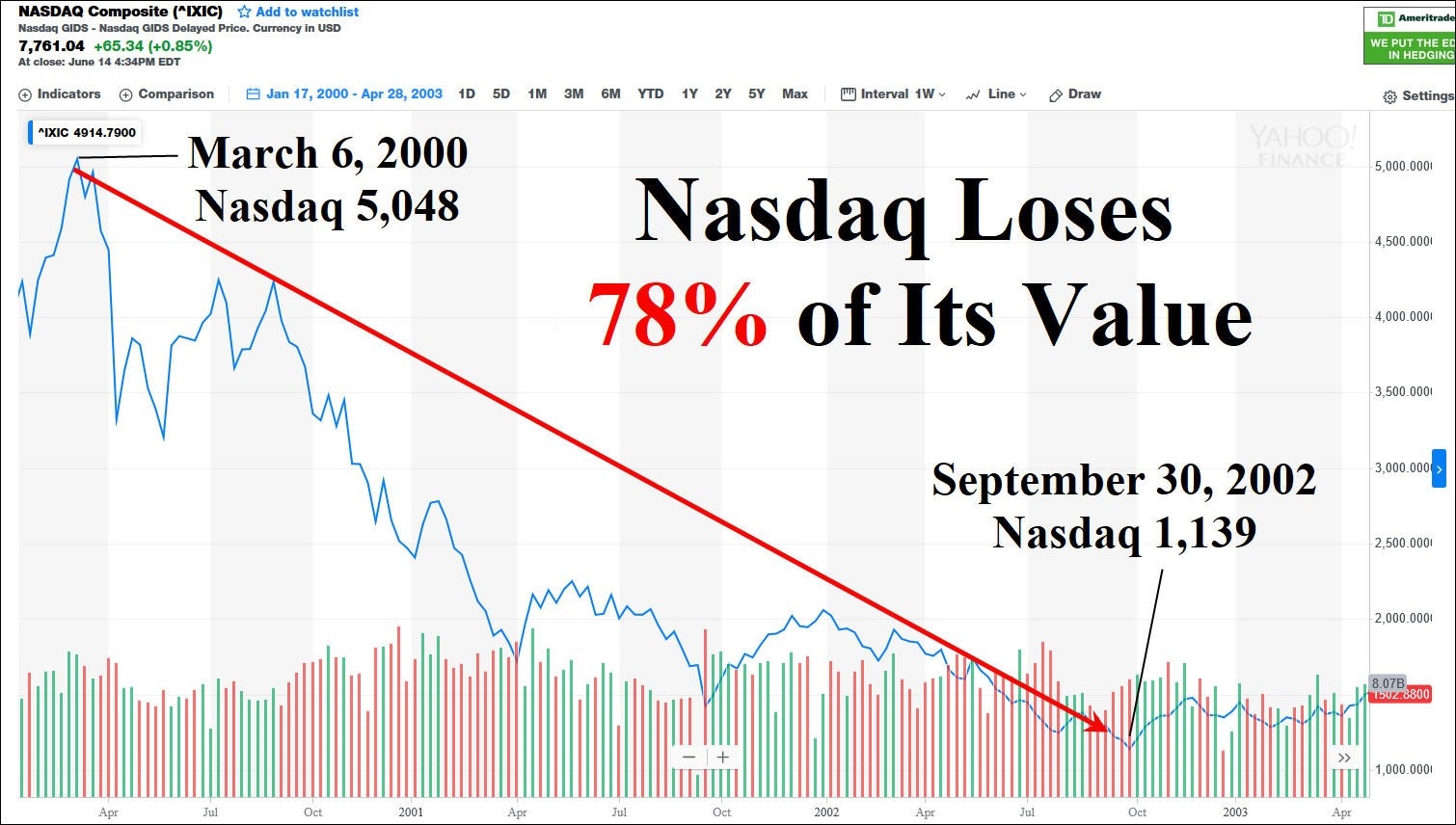

On March 2, just 60 days after the secret warning signal flashed red alert, the Nasdaq went into a nosedive.

It plummeted straight down, first losing 36% of its value in 90 days.

But the bloodletting didn’t stop there.

Day after day, week after week, investors saw their stocks lose more and more of their value. Those who hung on often saw their portfolios decimated.

The Nasdaq finally hit bottom on September 30, 2002.

It had fallen from 5,048 all the way down to just 1,139.

The index lost 78% of its value.

Many individual stocks lost even more, as much as 100% of their value (i.e. they ceased trading altogether).

It’s been the same story for each of the country’s nine recessions since 1955.

And those who knew about this secret indicator in advance had time to protect their portfolios from what they knew was coming…

Here’s another example:

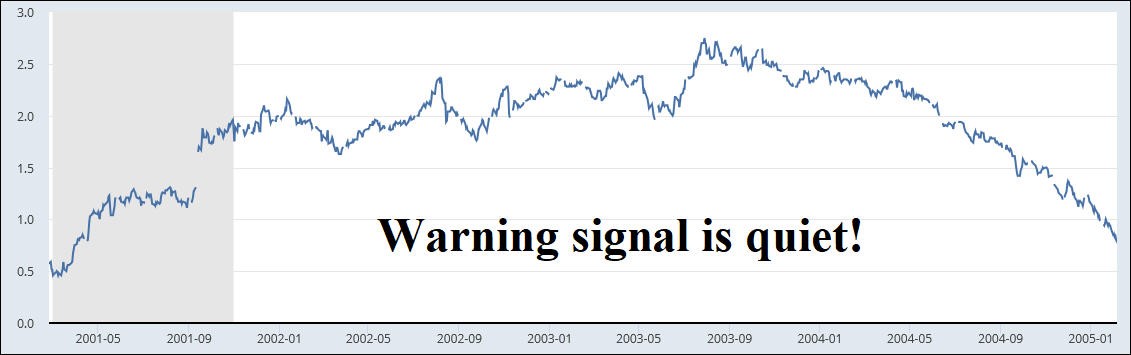

Throughout the 2000s, the secret warning signal was quiet.

Year after year after year, it stayed well above the warning mark.

And you know what comes next.

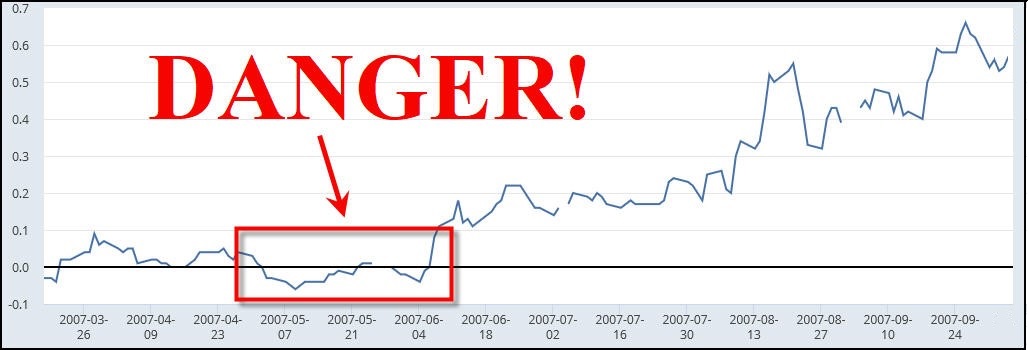

After six years of total silence, and a rising stock market, investors in the know saw something in mid-2007 they had dreaded for years:

The secret warning signal went off twice inside of a month!

The first flashed in May 2007, yet, within 30 days in fact, the stock market started seeing heightened volatility… giving birth to a second crossover indicator flashing sell.

The few people who knew what this meant instantly began taking defensive measures with their portfolios.

By the time October arrived, the market began a long nosedive – slowly at first, but then picking up speed in mid-2008.

The sell-off continued into 2009.

Finally, on March 2, 2009, the S&P 500 hit bottom.

It had fallen from 1,561 in October 2007 to a low of just 683 in March 2009.

That was a loss of 56%.

Many investors sold at the bottom… lost up to half their savings… and were too traumatized to get back into the market when it rallied over the next few years.

Many have yet to recover even now.

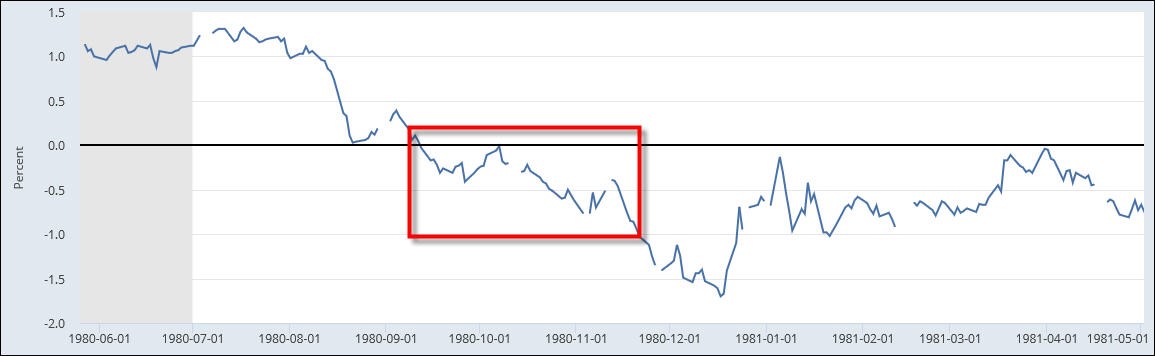

Here’s another example: the smaller sell-offs that hit the markets in the late 1970s and early 1980s. The secret stock market warning signal accurately predicted both of them.

On August 18, 1978, the warning signal went off when the S&P 500 was rising at 104.73.

Just 25 days later on September 12, the market went into a sharp decline. It bottomed out on November 14 with a 13.5% loss.

The same thing happened again just a year later.

On September 12, 1980, the secret warning signal dipped below the warning mark:

That told everyone who knew about the signal that another sell-off was coming. Unlike most investors, those in the know had time to prepare with defensive investments.

Sure enough, on November 12, 1980, just 72 days after the warning signal flashed red alert, the market tanked.

Over the next 19 months, the S&P 500 dropped from its recent high of 140.52 all the way down to 103.85 on August 9, 1982. It was a loss of 26%.

Now, why is this important? And what does it have to do with you today?

Well, let me tell you a little bit about who I am, and I will explain that as I go…

I Have Studied Market Signals for 30 Years…

My name is Jim Woods.

For more than 25 years, I’ve been an obsessive student of market indicators and profit timing systems.

After finishing college, then serving in the U.S. Army as a paratrooper, my first real job was working at Investor’s Business Daily in Los Angeles.

At IBD, I worked closely with founder William J. O’Neil.

In fact, I helped him explain his famous stock-picking system known as CAN-SLIM, and write his training courses on investing based on his book, How to Make Money in Stocks and The Successful Investor.

CAN-SLIM is a hybrid approach that uses both fundamental and technical analysis.

It was so successful that it was named the top-performing investment strategy from 1998-2009 by the American Association of Individual Investors.

AAII tracked more than 50 investing methods over 12 years to see how they would fare.

And CAN-SLIM’s returns over the 12 years showed a total gain of 2,763% — compared to just 14.9% from the S&P 500.

That averages out to about 35.3% a year.

And the CAN-SLIM approach focuses like a laser beam on a series of little-known indicators that many investors ignore.

After working at Investor’s Business Daily for seven years, I was then “in the trenches” as a trader at a private hedge fund.

From there, I went on to be a client advisor with Morgan Stanley before finally becoming a full-time market analyst and financial newsletter editor, working for the Fabian family.

My time at both IBD and Fabian taught me a very important lesson… and it may surprise you:

Being Too Cautious Can Hurt Your

Financial Future MORE Than a Market Crash!

You see, I quickly learned what many people know but don’t follow in practice: being too cautious hurts your financial future even more than a crash.

For example, right now, everyone is worried about another big sell-off in the markets.

And not without good reason.

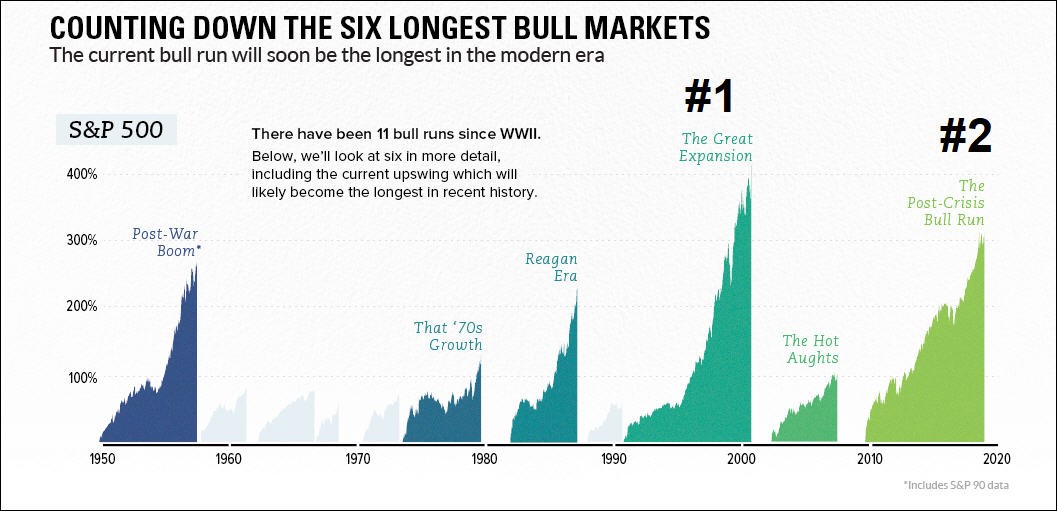

Depending upon your definitions, and whether you count closing or intraday prices, we’re currently experiencing the second longest bull market in history.

The stock market has risen for 109 consecutive months… or nine long years.

That alone makes many investors nervous. And it’s not merely the duration of the current bull market that worries investors.

It’s also the memory of what happened during the last crash.

In 2008-2009, the market lost more than half of its value.

It vaporized $10 trillion of investors’ portfolios in just seven months – a catastrophe from which many investors have still not recovered.

Yet, at the same time, too much caution can also have devastating consequences for long-term prosperity.

For example, so-called experts were telling everyone to get out of stocks way back in 2014. In January of that year, two announced on CNBC that the market would likely tank 60% or more.

“A jolt to international confidence in central banks will lead to a 30 to 60 percent market decline,” one analyst told the network.

“Unfortunately, I think it could come on a crash similar to what happened in 2007,” said another analyst.

And what actually happened? The opposite of what the experts said!

Instead of tanking, the stock market actually skyrocketed. It went up and up and up, year after year, for the next four years.

The Dow rose from 16,469 at the start of 2014 to around 24,753 today, a gain of 50.3% overall and equal to about 10.72% per year.

The Nasdaq did even better.

It shot up from 4,131 to 7,433, a gain of 79.9%.

If you had listened to those so-called “experts” and sat on the sidelines, you would have missed out and your portfolio would have suffered.

You see, economists have long proven that being out of a rising market usually hurts your long-term finances far more than riding out a down market.

And the reason is simple:

Just a Few Days Account for

95% of Stock Market Gains!

In one study of 15 separate markets, missing just their best-performing 10 days resulted in portfolios 50.8% less valuable than portfolios that caught them.

An earlier study was even more dramatic: For the 31-year period from 1963 to 1993, just 90 trading days – 90 out of 7,812 total days or 1.1% – accounted for 95% of all market gains.

Think of that: just 1.1% of trading days account for 95% of market gains.

In dollars and sense, missing these best trading days means literally millions in lost profits for your future.

For example, an investor who starts with a modest $100,000 portfolio…

Who was invested in the S&P 500 during the 25 best trading days…

Ends up with an extra $3.1 million more over time compared to someone who missed the best performing days in the market.

And that extra $3.1 million can make a huge difference during your retirement:

Over 25 years of retirement, you could withdraw an extra $10,000 per month from that additional $3.1 million – and still not run out of cash!

Fortune Favors the Bold: The Secret to

Market-Beating Returns in Uncertain Times

That’s why it’s essential that you not panic and get out of a bull market too early.

And that’s why the secret market signal I just told you about is so valuable:

It gives you the confidence to stay invested for those big up days… while also letting you know when it’s time to take more defensive measures.

Now, one important note: I’m not talking about market timing here.

Market timing is when you move in and out of the market.

I don’t advocate that. At all.

Instead, what I’m talking about is profit timing.

By that I mean we stay fully invested to squeeze every last drop of profit from a rising bull market…

But, once the secret warning signal, and others like it, indicate that a plunge is coming, we hedge our investments with a series of defensive plays that soar during market downturns.

This is what professional money managers do. And that’s what I do.

I’m happy to say it works better than you can imagine. That’s not just me bragging…

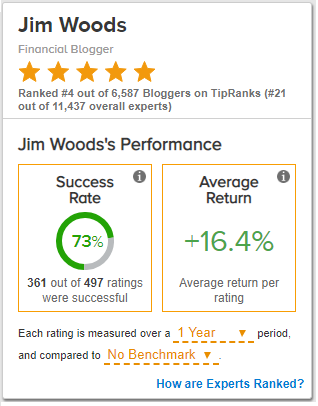

The independent firm TipRanks currently ranks me the No. 4 financial blogger in the world out of more than 6,000 reviewed.

Since 2010, TipRanks calculated I made 361 successful recommendations out of 497 total, earning a success rate of 73% and a +16.4% average return per recommendation.

Using “insurance policy” plays like these when the market corrects is a huge part of my continued money-making success.

For example, during early 2018 when the stock market jumped up and down like a roller coaster, my crash-protection investments did very well indeed:

- Market Vectors Brazil Small-Cap ETF skyrocketed 34% from $32 to $95 a share.

- Another investment I recommended was up 20%.

- And a third soared 30%!

These are just a few examples!

- One short-term investment grade bond fund I recommend is up 25% for the year…

- My favorite play on the skyrocketing real estate market has already jumped 30% since January.

- And a stock I currently recommend for good times and bad is already up 43.7% for the year – and has posted 20.2% a year for the past 15 years!

Listen: That’s enough to turn every $5,000 investment into $12,441 in just 60 months.

At that rate…

Even a Modest $300,000 Portfolio Could

Potentially DOUBLE to As Much As $746,496!

And when a real market crash occurs, these crash protection investments take off like a rocket.

For example, one of the crash protection investments I recently recommended skyrocketed 61.2% following the stock market crash of 2008…

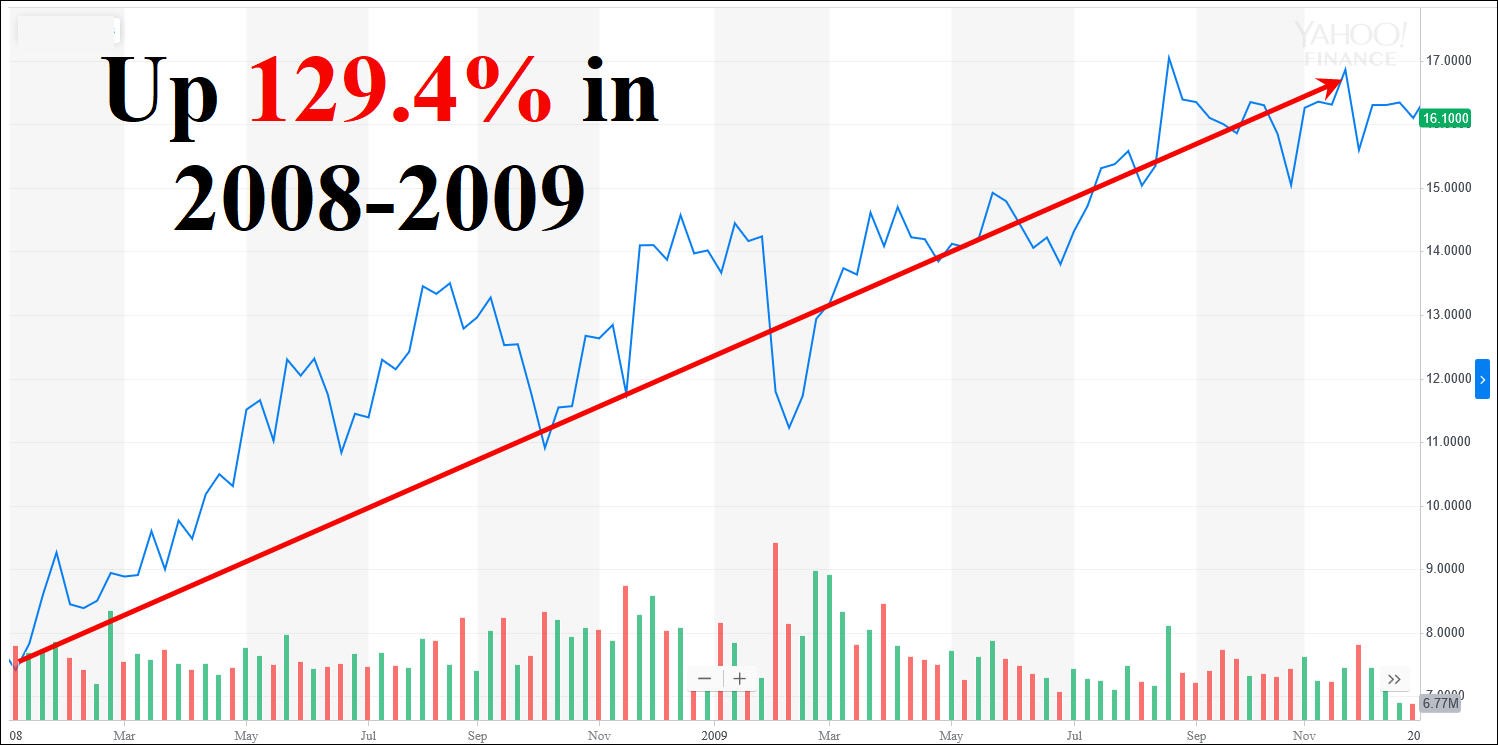

Another investment in this period rose a staggering 129.4% during the worst market crash since the Great Depression.

A third was up 97.7%.

These Are the Types of “Insurance Policy”

Investments You Can Find in My Advisory:

Intelligence Report

Now let me tell you the purpose of this message:

The crash warning signal I’ve just told you about is only one out of 10 that I track religiously.

As I mentioned earlier, I am an obsessive student of market signals.

While many analysts are content to say that a crash is coming “someday,” or “soon,” I want you to know that such imprecise predictions often cause more harm than they prevent.

They keep investors from profiting in some of the greatest wealth-building opportunities to come along in years… and the continuing bull market in stocks.

That’s why I’ve created a special package of precision tools and resources all geared towards helping you — not merely survive this era of uncertainty — but actually grow far wealthier than anyone could ever expect.

I call this investing resource the Intelligence Report.

It’s a comprehensive advisory service designed for the serious investor.

When the indicators I monitor are still green, we follow a strategy proven to produce the very best returns in good times and bad: investing in quality blue chip stocks and ETFs with, in most cases, decades-long track records of increasing their annual dividend.

I have my own proprietary stock-picking system, developed over two decades of hands-on experience at IBD and as an investment advisor, for identifying these market-beating investments.

When the indicators go red, telling me the market’s going to drop, I recommend a series of precisely targeted defensive measures that many investors know very little about.

These are crash-protection investments that soar when the market as a whole retreats.

Unlike bonds, which have underperformed in recent years, these tactical defense measures can often double your money in a matter of months.

Now, the moment you agree to try out my advisory service, Intelligence Report, the first thing you’ll get is a dossier containing ALL 10 of my preferred crash indicators and the investments we recommend when these signals flash red alert.

The title of this investing guide is, Always Right Crash Signals: Predict Market Downturns with 100% Accuracy.

This no-nonsense dossier reveals, in detail, the specific investments, strategies and techniques you need to protect your savings, while also growing wealthier, not poorer, during these uncertain times.

It includes detailed information on all 10 of the very best warning signals I use to spot danger in the markets.

Plus, this report also provides you with an overview of the wealth-building, wealth-protecting investments you can use to safely grow your portfolio.

Here are a few of the investments it covers in detail:

- A specialized precious metals investment that will provide you with iron-clad protection when global trade conflicts accelerate the return of high inflation and rising interest rates…

- An easy-to-make foreign currency play that lets you diversify your wealth outside the U.S. dollar, without having to trade foreign currencies, travel overseas or even hold paper currencies…

- A fantastic investment that will let you earn eye-popping profits with emerging markets overseas…

- An income investment that lets you grab huge dividends, potentially handing you double-digit, even triple-digit, profits over the coming months and years…

- And more.

Now, I could easily get $79 or more for this report if I sold it to the public.

But I want to give it to you – and anyone else who gives my Intelligence Report a look – free of charge.

And that’s just the beginning. As an Intelligence Report member, you’ll also get ALL the resources you need to put my proven investing program into action:

- Economic Analysis: As you saw in this message, part of my job is to help you understand what’s going on in the market. I regularly review and explain the little-understood market indicators that let you know if a major market event, such as a crash, is likely possible. I go into some detail about why you should pay attention to these proven signals – and neither be complacent (danger always lurks) nor panic unnecessarily.

- What’s Up & What’s Down: This is my detailed, up-to-the-minute summary analysis of the key trends in the market and overall economy. With just a glance, you can see instantly how the market indices are faring… which sectors are over- and under-performing… the best performing mutual funds and ETFs… and lots more.

- Top 10 Common Stocks to Own Now: I keep things simple. With Intelligence Report, I tell you about the top 10 stocks I believe every investor should own. These are my best recommendations for what you should invest in right now.

- Tactical Trends Portfolio: In addition to my Top 10 Common Stocks, I also recommend five investments, with slightly more risk, that I believe will outperform in the medium term — over the coming two to six months. These are the “best of breed” stocks and sectors moving the market right now. They’re outpacing their peers in terms of share-price performance and fundamental metrics (earnings growth and revenue growth).

- Income Multipliers: This is my comprehensive list of recommended income investments divided by market sector – such as Energy, Financial, Healthcare and so on. These are not fly-by-night “high yield” investments but, just what the name says, income multipliers. They are solid, blue chip companies, MLPs and REITs that pay out dividends with solid yields as high as 7-8%.

- Portfolio Protection Recommendations: In every issue, I give you my specific recommendations for portfolio protection investments. These are the investments I believe will skyrocket in the event of another major market crash, ones that you should add to your portfolio as the secret warning signals I described in this message begin sounding.

- Weekly Updates: Every week, I will send you an email “hotline” alert updating you on the most important developments in the markets along with any changes to my Intelligence Report

- Comprehensive Monthly Newsletters: In addition to weekly updates, I also provide you with a detailed monthly Intelligence Report This is my comprehensive analysis of the current recommended portfolio… my research on new opportunities… my breakdown of market, economic and geo-political trends.

- 24/7 Website Archive: Intelligence Report is available online, 24 hours a day, seven days a week, through my subscriber-only website. Here, you can access a full archive of my weekly updates and monthly issues as well as special reports, investing resources and complete recommendations.

Special One-Time Offer:

Test Drive Intelligence Report Risk-Free

Now, I talked my tight-fisted publisher into lowering the fee for Intelligence Report to only $249… but you won’t have to pay anything close to that!

As we were preparing this special message, we decided that even that low price didn’t fit the current situation.

Many investors are nervously watching the markets, fearful of a crash, with no idea what to look for…

As a result, I’ve arranged for a special, limited-time price for anyone willing to become a member today after reading this message.

When you agree to a risk-free trial of Intelligence Report, you’ll get the best possible deal… ever.

So, instead of paying $249 for a full year’s worth of Intelligence Report delivered to your e-mail box monthly…

And $79 for my special report of Always Right Crash Signals and its protection-themed investments…

If you join me right now, you’ll receive 12 issues of Intelligence Report, plus a copy of my Always Right Crash Signals special report. That’s $328 in total value, but you’ll pay just $99.95.

That’s right: Just $99.95!

You’ll get more than 60% off of the $249 price — just pay $99.95 for a full year of my ongoing investment guidance during this time of both real danger and real opportunity.

That’s an unprecedented value.

You could easily recoup 10 times the cost within weeks of signing up.

If You Try Us for 2 Years, You’ll Get

Bonus Gifts & Savings Worth $704!

For an even better deal, consider a two-year membership for a mere $189. That’s a savings of $309 from the normal two-year rate of $498.

Plus, if you act today, I’ll send you FOUR additional bonus reports for FREE!

BONUS GIFT #1: The Top 12 Stocks to Buy Now — $79 Value, Yours FREE!

Back in October 2017, the World Bank predicted that commodities would experience growth almost across the board in the new year.

So far, those predictions have been proven correct.

We’re currently seeing some of the highest manufacturing activity since the global financial crisis, and this has set commodity prices soaring.

In this remarkable report, you’ll discover the stocks that are most likely to multiply your money in the years ahead.

And you probably won’t have to wait long to begin seeing them!

Thanks to massive demand, commodities-based stocks are already exploding higher… and they’re just getting started! This report tells you all about…

- An ETF that tracks an index of 14 commodities (including things such as metals, grains, oil, soybeans and sugar) that is widely followed as a benchmark index of the commodities space….

- An easy way to invest in 100 of the largest non-financial stocks listed on the Nasdaq that soared 32.6% in 2017…

- The best way to play the surging financial sector after the Trump tax cuts…

- And much MORE!

BONUS GIFT #2: Top 8 Investments for Safe Profits — $79 Value, Yours FREE!

Together, the stocks in this special bonus dossier form an all-weather portfolio that will let you take advantage of the market’s bullish trends…

While also offering protection when an inevitable correction comes – and come it will.

You’ll discover some of my favorite plays for income in a low-rate environment, stocks positioned to profit for the long-term (no matter where the overall market goes), and precious metals (the ultimate defense against a market meltdown). You’ll learn about…

- One of my favorite “all weather” stocks that has posted an average of 7% a year for the past decade, while also paying a respectable current dividend of 4.3%…

- The best “consumer staples” play for uncertain times, a $200 billion behemoth that has been in business for 140 years and pays a 3.35% dividend…

- My favorite way to play the recent spike in oil prices, an MLP that has posted a 9% gain per year for the past decade.

- And lots MORE.

BONUS GIFT #3: Cannabis Cash: 3 Canadian Pot Stocks You Must Have NOW — $79 Value, Yours FREE!

This valuable bonus report contains information on the three Canadian cannabis plays that I’ve identified as your best shot for runaway gains in the marijuana sector.

As Canadian companies, it doesn’t matter at all which side in the U.S. Civil War on weed comes out on top. They’re already locked into a market that’s exploding as recreational marijuana becomes legal in Canada.

This is happening as we speak now. All bets are off for just how high these companies’ shares can go. I suggest you get into them now, so you get all the upside of what’s sure to be a monumental marijuana bump.

Of course, you can buy all three of my recommended Canadian cannabis plays on U.S. exchanges. In this report, you’ll discover…

- Why the right pot stocks can protect your core wealth …

- The medical marijuana stock that has averaged 219.6% for each of the past three years …

- A new cannabis stock on U.S. exchanges that posted a one-year gain of 427.4%…

- The company that is bringing medical marijuana to pharmacies across Canada, which has seen its shares double investors’ money in just a year.

- And much, MUCH more.

BONUS GIFT #4: How to Own Gold & Silver — $79 Value, Yours FREE!

Don’t buy a penny’s worth of gold until you read this report.

I’m not recommending these plays for their potential profits. Rather, I recommend using precious metals for protection… against a volatile market, against a plunge in the dollar, against geo-political issues that could spin out of control, against uncertainty.

I believe you should always have a portion of your portfolio reserved for precious metals – especially silver and gold – in order to protect your wealth.

In this exclusive guide, I will show you precisely how I think you should own gold and silver today. You’ll discover…

- Why I believe the demand for silver is only going to increase in the coming months and years…

- Why central bankers and government bureaucrats HATE gold, and why you should own some…

- A simple and easy way to add gold and silver to your portfolio…

- And MORE.

Now, normally each one of these four bonus reports would be valued at $79… for a total value of $316.

But you’ll get all four at no cost whatsoever, along with the other benefits of a two-year membership to Intelligence Report.

That’s a total of $814 in value, for just $189.

If that’s still not enough to get you to check out my advisory service, then this should be…

My No B.S. Iron-Clad Guarantee:

You Must Love Intelligence Report…

Or You Pay NOTHING!

If you’re not astonished at the profits you see piling up…

Like the 427% profits you could have made last year on one of the Canadian cannabis stocks I recommended…

Then simply call our customer service number within 30 days.

We’ll cheerfully refund every penny you paid for your subscription. You’ll get to keep all of the special reports and other resources as our gift to you.

One final comment:

I’ve become well known for accurately warning major turns in the markets well in advance.

Through my work on Wall Street and Investor’s Business Daily, I’ve been able to accurately predict many of the biggest shifts in the market, including…

- The Great Recession of 2008/09 (and the recovery that followed)…

- The Municipal Bond Default Crisis of 2011/12, and…

- The Tech Bubble and Crash of 2001/02.

Without bragging, I can honestly say I’ve been right more often than I’ve been wrong.

The reason for this is that I don’t panic prematurely. I attribute this to my military training.

Too many investors overreact. They sell when they should be buying more… and buy when they should be cautious.

Premature panic can be devastating for your portfolio… and to your long-term prosperity.

This Offer May Not Last Long –

And Our Recommendations Are Taking Off!

I urge you to take advantage of our zero-risk, 30-day test-drive offer at a special low subscription price of just $99.95 for the first year.

Based on my recent success rate, the gains you could make will likely be substantial, and could be made quickly.

In fact, some of the investment opportunities I’ve recommended recently to subscribers of Intelligence Report are already surging fast.

- One is already up 23.2% for the year.

- Another is up 45.1% so far this year.

- And yet another, one of my favorite oil stocks, is up 32.3% since March of this year.

So, take advantage of our special low-cost offer and zero-risk guarantee.

Click on the button below, or call us toll-free at 1-800-211-4766 right now.

Don’t let fear or lack of information rob you of your future prosperity.

Best wishes,

Jim Woods

Editor, Intelligence Report

P.S. Remember, this is truly a zero-risk offer. You can try out Intelligence Report risk-free for 30 days… get copies of all the valuable reports mentioned in this special message… cancel on the very last day if you’re not satisfied… and get all of your money back.