Top 20 Economist Dr. Mark Skousen issues his most terrifying warning since 2008…

Is the Fed About to

Slaughter Another Bull Market?

The last time this happened, the Federal Reserve made a crucial mistake,

and triggered the worst market crash since the Great Depression,

wiping out an estimated $10.2 trillion in wealth.

Now the Fed’s poised to do it all over again in 2018.

If you want to protect yourself and your portfolio,

you must take these 3 crucial steps before June 13, 2018.

It’s déjà vu all over again at the Federal Reserve.

No matter what your broker may tell you… no matter what the Wall Street Journal may claim… no matter what the talking heads on CNBC may say… market volatility of 2018 is FAR from over!

In fact, the stomach-churning sell-offs we’ve seen over the past several months could be little more than dress rehearsals for the main event:

A Fed-triggered panic that could very well drive the Dow back below the 16,000 level.

How can I make such a dire claim?

Because we’ve been down this path before with the Fed.

And both times we’ve been down it, investors have gotten crushed.

It’s the same path the Fed took before the March 2000 crash that saw the NASDAQ swoon by 78% from peak – and end up losing $1 trillion in value in just 30 days.

And the same path that ended with the 2008 crash, resulting in the market losing $10.2 Trillion, with some investors seeing up to 50% of their portfolio go up in smoke.

Only this time, with the market so much higher, and so overvalued, it could even be worse.

If you’re at all scared that the Fed’s actions will have the same effect they’ve had twice before…

Killing the Bull Market

Then you need to take immediate steps to protect your life savings from a possible market meltdown.

Hello. My name is Roger Michalski.

I’ve been the Publisher of Eagle Financial Publications for 15 years now.

I work closely with some of the most brilliant economists and market analysts in the world.

In the next few minutes, I’ll going to share with you:

Why the U.S. stock market could be in for even rockier times ahead, and…

Why some of your favorite stocks, mutual funds and ETFs could potentially lose up to HALF their value in a matter of a few months.

However, that doesn’t mean you should sell everything you own and head for the hills.

Quite the opposite.

In fact, I believe you should be fully invested.

But in a series of conservative investments that go UP, rather than down, when the Fed screws up again and travels down this wrong path for the third time in 20 years.

What kind of investments do I mean?

- One is a “Fed-proof” investment pool that has posted an average annual return of 15.61% for the last 15 years running…

- Another is a little-known investment that has earned 34% a year for the past 15 years.

- And another is up 44.19% in the past year, even as volatility rises.

I’ll tell you more about these “Fed Goof-Proof” investments – plus many more – in a moment.

But first, let me explain how the Fed has been responsible for killing the last two bull markets…

Why today’s market is on the chopping block… and why you need to begin protecting yourself today.

How the Fed Blows

Faltering Bull Markets to Smithereens!

It’s happened twice before in less than 20 years… the Fed stopping a charging bull market dead in its tracks.

And it all stems from the Federal Reserve’s fetish for manipulating interest rates.

For example, look at the end of the 90s, when we were at the top of the dot.com run up…

The Fed – wanting to tamp down an overheated market and keep inflation under check – started monkeying with interest rates. …

It raised rates THREE times… from 4.75% at the end of 1998 to 5.0%… then, in 1999, to 5.25%… then 5.5%.

It did the same thing the next year, in 2000: Raised rates to 5.75%… then 6.0… then 6.5%.

SIX rapid increases in the Fed Fund Rate were followed, almost like clockwork, by a market wipeout. As you can see on the chart below:

After that, the market plummeted in March 2001, ending a bull market that had lasted for 12 years and had created more wealth than at any period in history.

Unfortunately, the Fed never learns from its mistakes, simply repeating them over and over again. So, when it did the same thing just a couple years later…

Nobody was surprised we ended up with the same results.

After the dot.com bust, the Federal Reserve kept interest rates artificially low, all the way down to 1.25%.

At the same time, the government was doing everything it could to gin up a new housing boom. And it worked! Government bureaucrats pressured mortgage lenders to loosen loan regulations so anyone with a pulse could buy a home.

With rates so low, banks began offering “interest only” loans for only 5%, or even no money down.

Buyers could move into mansions that were 2, 3, even 5 times more than they could really afford.

And then, to top it off, greedy Wall Street bankers bundled all these instant mortgages together and resold them as “investments” to retirement funds and ordinary investors.

According to the Bank of International Settlements, these “house of cards” investments amounted to as much as $11 trillion.

And it really was a house of cards.

Everything was fine so long as interest rates stayed low – and double-income couples kept making their payments.

But beginning in 2004, the Fed started raising rates again.

In fact, it raised interest rates nine times in the next three years: from 1.25% all the way up to 5.25% by 2007.

It did this even though GDP was growing at a respectable 3.8% annually and inflation was holding steady at around 3.3% a year.

The skyrocketing interest rates meant homeowners could no longer afford to make their mortgage payments – or buy new homes.

This triggered a tidal wave of loan foreclosures – which led, in turn, to a global banking crisis that nearly destroyed the entire economy.

This culminated in March 2008, when the market began to tank.

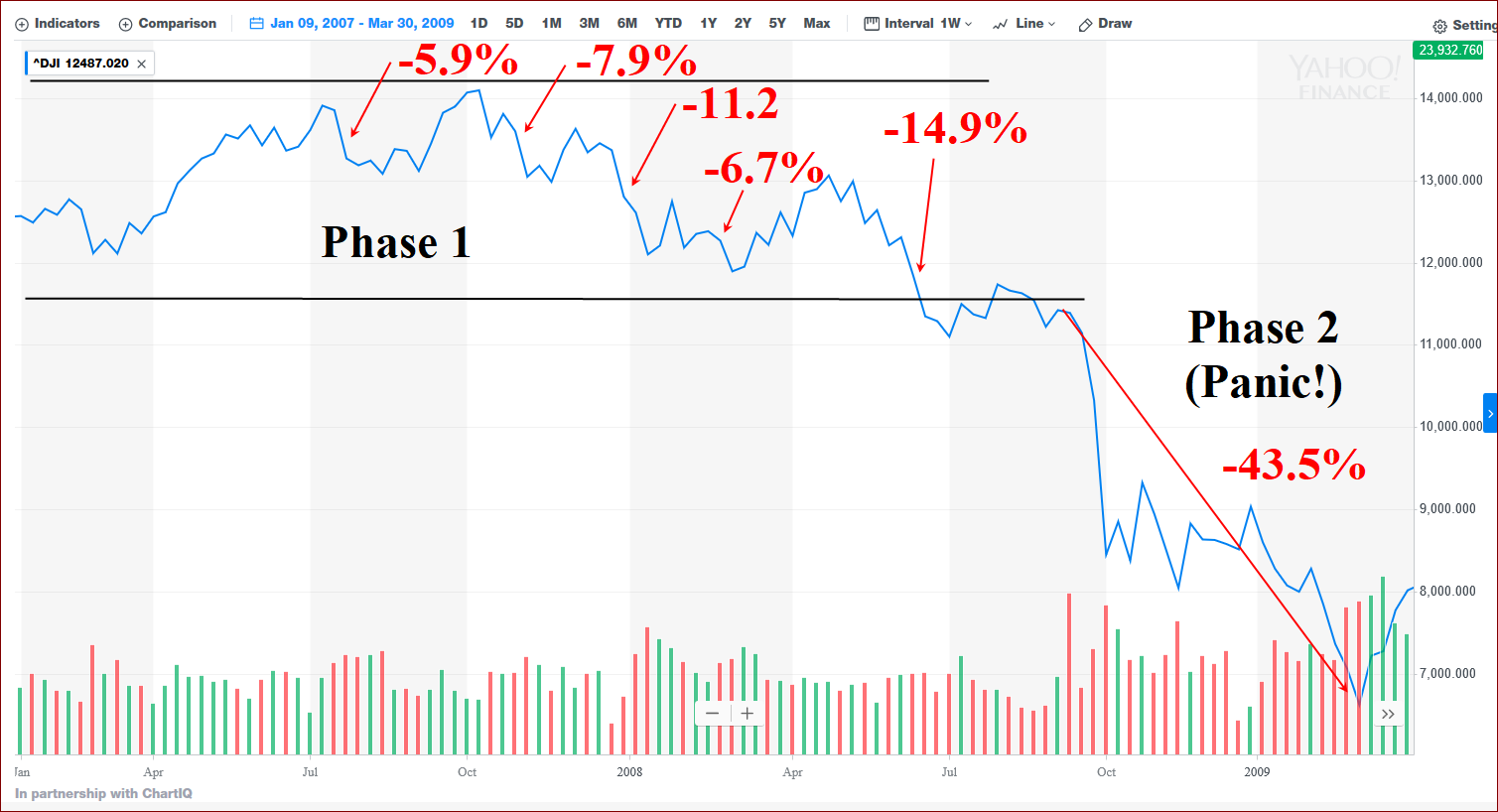

Leading up to that meltdown, Fed rate bumps were often accompanied by smaller sell offs (just like the ones we’re seeing today). This is “Phase I” in the chart below:

But then all hell broke loose!

The market panicked and we saw a huge sell-off.

Between September 19 and October 10 2008, the Dow lost 3,600 points – a drop of -31.2% in just three weeks. (Phase II in the chart above.)

But it didn’t stop there. No, the stock market kept falling… lower… and lower… and then lower still…

When it was all over, the Dow had plummeted from a high of 14,164.43… all the way down to 6,594.44 on March 5, 2009.

The market had lost HALF its value.

An estimated $10.2 trillion in American wealth was vaporized in a matter of months.

And virtually overnight, the entire global economy came to a crashing halt.

Banks worldwide began closing their doors. Millions lost their jobs. Businesses shut down everywhere.

Why share this?

Because, even though we may not be staring down the barrel of a housing market collapse like we were in 2008…

Many of the same conditions that existed in 2008 have reappeared today.

And true to form, the Fed’s going down the same wrong-headed path it’s followed twice before to control the economy with, predictably, the same results.

Following recent rate increases, there have been a series of market plunges… just as there were a decade ago in 2008.

If this is truly another “Phase I,” then America could very well be headed for another Phase II crash.

This time, it could mean a WORSE economic disaster.

That’s why I turned to the one man I could trust to make sense of all this… to confirm for me if we’re really heading down the road to another dying bull.

He’s the same economist who warned the world about the Federal Reserve way back in October 2007:

“I urge you to hedge your investments by diversifying abroad in growing, foreign markets and by maintaining a position in precious metals and natural resource stocks as a hedge against inflation and uncertainty,” he wrote.

Just months later, in January 2008, he warned readers again about a sell-off in the markets:

“We beat the market again in 2007, but the outlook for 2008 is not so clear. A storm still is haunting the global financial markets, which were fueled in part by artificial easy money policies that created a boom-bust real estate cycle, and now we are paying the price of too much credit….

“Four factors at work mentioned in recent issues are still depressing stocks: (1) the continued fallout from the weak credit/real estate markets and the falling dollar; (2) a slowdown in corporate profits; (3) talk of tax increases by the Democrats; and (4) the Fed’s recent squeezing of the money supply. M2 now is growing at only 2-3% compared to 8-9% a few months ago. That should be bullish for the dollar but bearish for stocks and gold…”

The man I’m talking about is Dr. Mark Skousen.

Dr. Skousen is a former analyst for the CIA, who has spent the last 38 years working as a professional economist, investing expert and university professor.

He is the author of more than 25 books, including such bestsellers and textbooks as The Making of Modern Economics, The Big Three in Economics, and Investing in One Lesson.

His analysis also appears regularly in such publications as the Wall Street Journal, Forbes, and the Christian Science Monitor, and he is a regular commentator on CNBC Kudlow & Co.

Of course, since 1980, Dr. Skousen has been Editor-in-Chief of Forecasts & Strategies, published here at Eagle.

Now, in recent weeks Dr. Skousen has been warning all of us here at Eagle about some NEW dangerous developments occurring at the Federal Reserve.

He points to recent research by David Ranson, chief economist at HCWE, Inc., based in Portland, Oregon.

Ranson has reviewed the past 14 bull markets since 1925, and noted that there have been THREE extremely long-lasting bull markets:

- Super Bull Market #1: November 1946-November 1957, a full 11 years or 132 months: Total return, 427%.

- Super Bull Market #2: August 1988-January 2001, over 12 years, or 149 months: Total return, 610%. (The 1990s was the mother of all bull market decades.)

- Super Bull Market #3: The current bull market started at the end of February 2009 and has lasted nine years, or 108 months, with a total return of 334%.

So, what put an end to these bulls? According to Dr. Skousen, they don’t die of old age. Instead, they’re murdered in cold blood by harmful public policies.

And not just any public policies.

Surprisingly, higher taxes and more regulation are NOT what cause the markets to crash. Both Presidents Clinton and Obama raised taxes and increased regulations, yet stocks roared ahead anyway.

On the other hand, George W. Bush cut taxes, but we still suffered from a financial crisis in 2008 and one of the worst market declines since the Great Depression.

So, if tax policies or regulations don’t doom bull markets, what does?

Dr. Skousen’s answer: The Fed.

The Federal Reserve’s policies appear to be the key factor in the death of any long-term bull market.

If the Fed imposes a tight monetary policy and raises rates too quickly, it can kill off a faltering bull market faster than you can say, “Black Monday.”

That’s what happened in both 2000 and 2008.

Now the Fed is Aggressively Raising Rates

Again in 2018!

The Fed already raised rates THREE times in 2017, from 0.75% to 1.5% — even though unemployment had hit historic lows of only 4.1% and inflation was just 2.1%.

Yet the Fed has promised that it’s not finished with increases.

Under its new chairman, Jerome Powell, the Fed said it expects to increase more in 2018, and then 2019.

Even though the Fed’s continued rate manipulation offends Dr. Skousen’s Austrian economic values down to the core…

It doesn’t automatically create a market downturn. But it does bring Dr. Skousen’s ‘biggest worry” for the economy that much to reality.

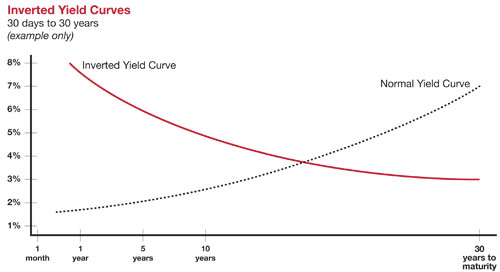

An inverted yield curve.

An inverted yield curve occurs when the yields for short-term bonds are larger than the yields on long-term bonds. Rates flipped like this in 2008, just before the market fell off the cliff.

When you combine an inverted yield curve, the Fed’s insistence on controlling interest rates, and a series of market slides…

With Donald Trump’s determination to wage a trade war with the rest of the world…

With the EU’s plans to rein in tech companies like Facebook and Google…

The potential for a large market sell off – just like in 2000 and 2008 – just keeps growing.

Dr. Skousen is NOT the only expert warning investors that the Fed could trigger a new global financial apocalypse.

Just the opposite:

Scott Minerd, global chief investment officer at Guggenheim Partners, recently stated:

“Eventually the Fed will acknowledge that three rate hikes will not be enough, but it is going to raise rates four times in 2018, and market speculation will increase that there may be a need for five or six rate hikes. That will be the straw that breaks the camel’s back.”

And Dr. Nouriel Roubini, another economist credited with predicting the 2008 financial crisis, recently declared that…

“Investors have reason to be concerned,” adding that “market illiquidity will eventually trigger a bust and collapse.”

And legendary investor Jim Rogers, co-founder of the Quantum Fund, predicts that the coming Fed-triggered bear market…

“…will be the worst in our lifetime.”

This is why Dr. Mark Skousen urges all investors who care about preserving and growing their wealth to take three important steps right away…

Before the Fed sends the market spiraling down…

Step 1: Fed-Proof Your Fortune

Make Investments that Grow as Rates Rise

You see, according to Dr. Skousen, the Federal Reserve is a lot like the Biblical parable of the wheat and the weeds (tares) – a story about how a field was planted with a mixture of both good seeds and weeds.

Both the wheat and the weeds thrive until the weeds eventually crowd out the wheat.

“The private sector creates genuine prosperity through hard work, thrift, productivity and technological advance. Who is the enemy who plants the weeds?

You got it: the Federal Reserve!

The Fed creates artificial stimulus through easy money. The easy money at first creates the illusion of prosperity.

But it turns out to be artificial and cannot last. When the harvest comes, the excesses of the economy prove to be unsustainable and must collapse into recession (the burning).”

Now, a lot of people will ignore this warning.

They think their investments are completely safe, not realizing how much they’re exposed to interest rate increases through mutual funds, ETFs, pensions, annuity, or whole life policies.

The horrible truth is that you can’t trust the Federal Reserve policymakers with your money.

It repeatedly misses key shifts in the economy.

It often slashes rates when they should be left alone, and raise rates when nothing is wrong.

Investors have suffered from this over and over again.

Now, Dr. Skousen is sounding another warning.

The Fed is poised to skyrocket interest rates yet again, and millions could lose another huge chunk of their portfolios as a result.

As MarketWatch’s Brent Arrends pointed out two years ago, with interest rates so low, bonds will provide little or no protection during a big crash.

“If stocks have a terrible year and Treasury bonds don’t step up, an investor with a balanced portfolio may end up losing even more money than in 2008,” he said.

Investors will likely endure painful losses in any interest-rate-sensitive asset they have — from bonds to mutual funds and stocks in 401k or other retirement accounts.

In other words: The Fed is setting you up again.

Any investment you have that is tied to interest rates could drop like a lead balloon.

But you still have time to protect your life savings while also creating new wealth in a rising interest rate economy.

Dr. Skousen has just finished a special dossier that reveals precisely the types of specialized investments he recommends for an era of rising interest rates.

The dossier is called, Fed-Proof Your Fortune: Protect and Grow Your Wealth in Uncertain Times.

It describes in detail how you can safeguard your portfolio quickly and easily, so you can be ready if and when another Fed-triggered financial crisis arrives.

In this valuable report, Dr. Skousen reveals investments that are resistant to increases in interest rates – and which he believes will continue making money over the coming months and years.

The proof is in the pudding.

Despite the massive sell-offs in the market in February, March and April, Dr. Skousen’s Fed-resistant recommendations held up very well.

- One of Dr. Skousen’s current recommendations was up 25% in 2018 – despite the recent sell-off – and up a whopping 124.3% in the past 12 months!

- Another “Fed-resistant” play was up 13.2% in the first months of 2018 and up 29.7% over the past 12 months…

- A third current recommendation was up 10.7% at the time, and up 46.8% over the past 12 months…

My point is simple: By getting into investments like these today, you protect against rising rates, and the death of the bull market.

But that’s not all. You’ll make money too.

You see, according to Dr. Skousen, the secret to consistently building wealth is to invest when everyone else is selling… so long as you invest in the right opportunities.

And that’s what this new special report, Fed-Proof Your Fortune, is all about…

It reveals everything you need to protect your core wealth from the potential bull market-stopping actions of the Fed.

This valuable investing resource is quite simply a MUST-HAVE. And Dr. Skousen wants to send it to you today for FREE…

I’ll tell you how to get your copy in a moment.

But first, here’s the second step Dr. Skousen believes is essential for protecting your fortune from a Fed-triggered disaster….

Step 2: Fed-Proof Your Income!

Only Play the Best Income Investments

After nearly a decade with no interest rate hikes, the Federal Reserve decided to remove the stops and allow interest rates to rise.

The 10-year Treasury rate is rapidly approaching 3% and the 30-year Treasury rate is already at 3.22%.

Plus, under the new Chairman Jerome Powell, the Fed has approved the central bank plans to confirm the bond market’s lead and raise the Fed funds rate again this year.

Clearly, this is not a trend that will be going away in the immediate future.

So how do you, as an investor, survive and prosper from this?

Well, it turns out that there is a silver lining to the current turmoil in the markets – and to rising interest rates.

If you play your cards right, you can end up with significantly more income, not less.

Here’s why.

According to Dr. Skousen, the secret lies in making sure your income investments are not tied to lower interest rate bonds and bond funds.

Instead, he believes you should take advantage of rising dividend yields now found in a number of “crash-resistant” companies and mutual funds.

Not only do these “Fed-proof” plays hand out handsome cash payments, but all five of these specialized investments are profitable.

And now Dr. Skousen reveals his complete income investing strategy, sharing the names of all five recommended plays in this second, MUST-HAVE dossier for uncertain times.

It’s called, Fed-Proof Your Income: The Best Income Investments for Rising Rates.

In this vitally important dossier, Dr. Skousen shows you his winning strategy for creating MORE income, not less, when markets tumble, including his three favorite plays today:

Best Income Play #1: This $5.9 billion healthcare empire spans 35 states and is still growing. Because of its ties to the booming healthcare sector, this company offers protection against a crash, as well as a low-risk way to profit from rising rates. Add share appreciation to this stock’s healthy 9.2% yield, and you’ve got a strong defense against whatever the Fed may pull.

Best Income Play #2: This financial company has been called the “best dividend stock in America” by the Wall Street Journal. It makes loans to small or medium sized businesses to help them grow. As interest rates rise, and the U.S. economy continues to grow, this company’s profits will soar. All the while, you’ll be collecting a fat, consistent 7.2% yield, paid out monthly. This company’s rising dividend policy ensures it’ll continue to pay off, no matter what the market does.

Best Income Play #3: This $60 billion behemoth is one of the safest, most consistent, dividend-paying investments you’ll ever find. In fact, it’s raised dividends for 46 straight quarters despite the fact it exists in the highly volatile energy sector. However, this company’s business model builds in profits regardless of the price of oil. It’s worked for 15 years through all market conditions… and looks poised to go on doing so for another 15.

As with the first dossier, Fed-Proof Your Income is not available in any store, Amazon, or as an ebook anywhere else.

It’s was created solely by Dr. Skousen for his loyal readers and followers.

But there is a way you can get BOTH dossiers for free…

- A copy of Fed-Proof Your Fortune delivered instantly to your inbox…

- And a copy of Dr. Skousen’s special research dossier, Fed-Proof Your Income.

I’ll explain how in just one more minute.

Before I do that, however, Dr. Skousen outlined one more step to take today to protect yourself…

Step 3: Fed-Proof Your Tax Savings

Little-Known Loopholes and Investments

Protecting your fortune and your income from a Fed-triggered downturn are essential steps.

But there is one more step you simply MUST take as well.

You have to worry about protecting your fortune and income from the IRS.

Despite the recent tax cuts passed by Donald Trump and the Republican leadership, keeping more of your money in legal ways is just as important as ever.

Fed-triggered panics often force investors to sell off assets prematurely, resulting in potentially MASSIVE and unnecessary tax bills.

Fortunately, investors today face a more tax-friendly environment than they have in years – thanks to the recent appointment of Dr. Mark Skousen’s friend, the economist Larry Kudlow, as the Trump Administration’s economics czar.

Kudlow is a hard-nosed advocate for supply-side economics, and a former advisor to President Ronald Reagan in the 1980s. He’s been a strong advocate for tax cuts for individuals, businesses and investors.

In fact, Kudlow and his two supply-side friends – Steve Moore and Art Laffer, who head up the Committee to Unleash Prosperity – actually helped design the Tax Cuts and Jobs Act of 2017.

Dr. Skousen believes investors should take FULL advantage of these new laws, strategies and tax-advantaged investments so they can keep more of their gains… and make sure they don’t suffer from unnecessary tax penalties.

To help you do that, Dr. Skousen has created a third valuable dossier that you’ll get absolutely free of charge.

It’s called, Fed-Proof Your Tax Savings: Loophole Investments the IRS Keeps Secret.

In this report, you’ll find valuable resources to further protect your wealth.

Of course, everything in this dossier is 100% legal, including powerful tactics such as…

- 3 special types of annuities that lock in guaranteed returns along with protection from the IRS…

- An IRS loophole that lets you legally “hide” up to $500,000 from the government…

- A way you can potentially DOUBLE your income from one tax advantaged investment, simply with a note from your doctor…

- The best way to increase your income WITHOUT increasing your taxes…

- Why shopping around for tax-advantaged investments can help you collect 50% more income…

- A way to invest in real estate that has special tax advantages…

- A special type of tax shelter that can pay income tax-free.

- And lots MORE

Dr. Skousen doesn’t want you to hand over a single penny from your portfolio to the IRS unless you have to. And he shares the strategies for accomplishing that in this third dossier.

Now, normally, each of the three special reports I’ve told you about…

Fed-Proof Your Wealth

Fed-Proof Your Income

Fed-Proof Your Tax Savings

Is valued at $179. That’s a total value of $537 for all three.

Yet as I mentioned, you don’t have to pay a single penny for all three of them.

We here at Eagle Financial Publications want you to have them all for free, just for accepting a risk-free trial subscription to Mark’s Forecasts & Strategies service.

You can download your copies of all three instantly with your Forecasts & Strategies trial subscription.

In these scary times, Forecasts & Strategies is the best way I know to stay ahead of what the Fed, the President, and the world is doing – when it comes to your money.

A full year of Forecasts & Strategies is normally $249. However, with this special offer, you won’t have to pay anything close to that…

If you join Dr. Skousen today, and find out how you can protect and grow your fortune during times of market turmoil and rising interest rates.

Not only will you get all three of the special dossiers I just told you about – a $537 value…

You’ll ALSO save a whopping 80% off the regular subscription rate of $249 and get 12 months of Forecasts & Strategies for just $49.95.

You save $200 instantly and get a full year of issues and updates for just 14 cents per day.

So, please click the button below now. You’ll be taken to a secure order form.

After you click the button, you’ll receive instant access, so you can download all the dossiers – with all the specifics and stock symbols – free at no charge.

Plus, you’ll also get a free subscription to Mark’s weekly electronic newsletter, Investor CAFÉ.

With Investor CAFÉ, each week you’ll get Mark’s no-holds-barred commentary on the markets, the economy, politics and other topics of interest, as well as updates on his investment recommendations.

In addition, you’ll receive V.I.P. introductions to Mark’s live briefings at the MoneyShow and special conference calls.

Once every few months, or when events dictate, Dr. Skousen meets Forecasts & Strategies members through a phone conference to share his detailed thoughts about what’s going on with the economy, the markets and the world at large.

During these calls, Dr. Skousen reviews the various sectors of the market and gives you his thoughts on the investments he’s currently recommending.

And he often take questions LIVE from Forecasts & Strategies members.

On top of all this, you get a brand-new issue of Forecasts & Strategiesevery month to make sure you stay on top of new strategies for protecting and growing your wealth.

Over the years, Forecasts & Strategies has made a huge difference for thousands of readers.

Steven H. of Utah says…

“I have subscribed to [Mark’s] newsletter for many years, and generally found that I make a much better return following [his] suggestions than those of the professional money managers and big company financial advisers that I’ve had money with over the years.”

Steven L. of Springboro, Ohio, says Dr. Skousen has earned his trust:

“Of the newsletters I get, I like Mark’s the best. I’ve dropped most others.”

And Dr. Lee H. of Cleveland, Ohio, counts on Dr. Skousen to keep his wealth secure:

“I think anyone who invests should invest with Dr. Skousen. I’ve been studying the investment industry for over 60 years, and Mark Skousen is the # 1 man I trust with my investments. Just about all of his [Forecasts & Strategies] stocks have done well. Many years ago when I was too busy with my career, I hired a firm to manage my money. I lost 81% of my portfolio, so I signed up with Dr. Skousen and I recouped a large part of it. I like that he’s conservative and very knowledgeable and he gives me very sensible recommendations.”

Nevertheless, as I said earlier, this is a “no-risk” trial subscription.

You must be delighted by the practical, wealth-growing advice you discover in Forecasts & Strategies, and with the results Dr. Skousen helps you achieve, or you may cancel any time in the first 30 days of your subscription to get a full refund.

If you do cancel – even on the last day of your trial subscription – your three free dossiers and everything else you get in the meantime will be yours to keep with Mark’s thanks, just for giving Forecasts & Strategies a fair try.

Once you’ve experienced Forecasts & Strategies for yourself, I sincerely doubt you’ll ever want to invest without it.

After all, Laine J. of Lubbock, Texas, says …

“I have been a subscriber for a long time and I have been extremely pleased with the advice from this newsletter. I still read Forecasts & Strategies from cover to cover with every issue.”

And James R. is thrilled with the profits he’s earning thanks to Forecasts & Strategies:

“I have been a subscriber to Forecasts & Strategies for the past several years. In February 2011, Mr. Skousen recommended purchase of Cubist Pharmaceutical (CBST). I purchased 1000 shares of the stock for $22.22 [each]. I held the stock until January 2015 at which time the company was bought out and I received $102.00 per share. Needless to say I am very pleased with a capital gain of $79,771.08.”

And Chip P. says Dr. Skousen has impressed him for decades:

“I started with Dr. Skousen in 1993, and let me say that I regret the stocks he’s picked that I DIDN’T buy. It seems as soon as he picks a stock, it tends to go up. He picks mostly winners, and the winners offset the losers by far.”

To me, when you see what happy subscribers say, this is a no-brainer decision to check out Forecasts & Strategies.

However, if you’d like an ever BETTER value, then I invite you to accept a risk-free trial of Forecasts & Strategies for TWO years and get two more bonus gifts:

Bonus Dossier #1: Forecasts & Strategies Quick Start Guide – a $79 Value, Yours FREE: This is the easy-to-follow guide Dr. Skousen recommends for every new investor. In this report, you’ll find a list of the six first steps you should take to get the most out of your new subscription. In the 10 minutes it’ll take you to go through this user’s guide, you’ll find everything you need to hit the ground running as a new Skousen reader.

Bonus Dossier #2: The Big Biotech Bounce of 2018 – a $79 Value, Yours FREE: In this extra bonus portfolio, Dr. Skousen reveals not one but THREE biotech stocks to play in the coming months ahead.

His rigorous system identifies investments with the highest probability of profiting in the coming year. Each must also meet his 5 Biotech Criteria to be considered for investment. Today, Dr. Skousen’s analysis has identified three biotech investments – above all others – that offer huge potential profits.

- A successful pharma company developing innovative therapies for neurodegenerative disorders like Alzheimer’s and Parkinson’s, which has seen its stock soar 77.8% in the past 12 months…

- A biotech company with new technology that could completely change the battle against the #1 most deadly disease in America: heart disease.

- The Big Pharma conglomerate that has free cash flow of $15 billion and literally dozens of new drugs in its pipeline.

Bonus Dossier #3: The SWAN Strategy: A Year’s Worth of Profits in 5 Minutes – a $79 Value, Yours FREE: The SWAN, investment strategy focuses on a handful of bargain large-cap stocks among the ranks of the Dow Jones index. Since 2000, returns from this simple technique have, on average, outperformed the Dow and the S&P 500, with an average annual return of 10.1%, compared to 6.7% and 6.1%, respectively.

In this special report, Dr. Skousen explains exactly how the SWAN Strategy works, and how you can begin using it today with very little money.

Remember, you’ll get all three of these reports – Quick Start Guide, Big Biotech Bounce and the SWAN Strategy – absolutely free of charge when you accept a two-year subscription of Forecasts & Strategies.

Each of these three special reports could go for $79 apiece – that’s $147 of additional value you’ll get absolutely free.

So, Let’s Add Up All These Bonuses,

Discounts and Free Gifts!

Sold individually, all of these wealth-protecting and wealth-building resources I’ve shared with you would be worth $695!

Now, add in a two-year subscription to Forecasts & Strategies, which normally costs $498, and you have a total value of $1,193.

But if you act right now, you can get all of this for the low price of just $89 – an 82% discount off the regular subscription price.

That’s a total savings of $1,104!

You won’t want to miss out on the time-tested advice that Dr. Skousen gives his readers during trying times like the past few months.

So, please don’t delay.

This offer will not be available for long.

Click the button below to get up to $1,104 worth of free reports and savings – and instant access to your “Fed-Proof” resources.

Dr. Skousen and I look forward to welcoming you aboard, and helping you protect and grow your wealth in these uncertain yet exciting times.

Best wishes,

Roger Michalski

Publisher, Forecasts & Strategies