Renowned investing expert Bryan Perry reveals…

Forbidden Microcap Opportunities

Wall Street Doesn’t Tell You About!

Bryan Perry reveals the “golden needle” companies he’s found in the haystack of microcap stocks. Each has the potential to make you richer than Midas.

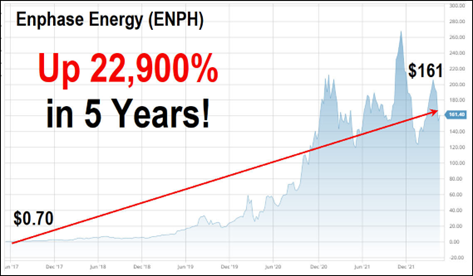

*Like Enphase’s jump from 70 cents per share to $161 per share – or 229 times your money

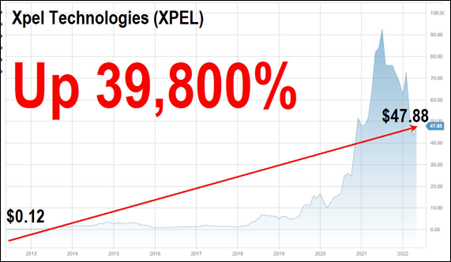

*Or Xpel Technologies’ leap from 12 cents to $47.88 per share – 398 times your money

*Or Align Technology’s jump from $1.30 to $729 per share – 559 times your money

He’s sharing the top-secret details on ALL-NEW microcap stocks he’s convinced will become tomorrow’s blockbusters – and perhaps change your life overnight.

Hello. This is Bryan Perry.

It’s a sweltering Saturday afternoon, and I’m standing out on a barge in the Louisiana bayou with my good friend Roger Michalski, publisher of Eagle Financial Publications.

We’re on a research mission investigating a new startup company, a crypto mining facility on an island out here in St. Charles Parish.

After having gumbo with the locals, we’re going to meet with the company’s CEO to go over the business plan line by line.

According to the CEO, the company’s unique approach to crypto mining – what they call the “Blockchain on the Bayou” – makes it a possible 10-bagger investment.

As usual, Roger and I are polite… but skeptical.

We’ve heard similar stories from CEOs across the country when we’ve visited their startup operations in person, often in hard hats.

Over the course of a given year, I review HUNDREDS of companies, visit many in person, and recommend only one or two stocks each week.

Before coming to Louisiana, I spent three days at the Miami Boat Show, where I risked life and limb as I flew across Biscayne Bay in one of the world’s fastest all-electric boats.

I do all this for a reason.

The only way to know if an unknown company has the potential to become a blockbuster stock is to meet the leaders in person and see their products firsthand.

But here’s the thing: When you do find that golden needle in the haystack – a microcap stock with a unique position in the market that’s selling for just a buck a share – it can quite literally set you up for life.

Take Enphase Energy, Inc. (ENPH).

Just a few years ago, this California tech company was a penny stock: You could buy all the shares you wanted for between 70 cents and 80 cents per share.

Yet anyone who visited its headquarters in the East Bay area knew this was a company with a future.

In essence, Enphase produces the electronics that make solar power work. Its microinverter and other components allow solar panels to interface efficiently with power grids and local battery banks.

Over the past few years, Enphase has installed more than 45 million microinverter systems on over 2 million homes in over 135 countries.

And its stock has done a moon shot: Enphase shares shot up from just 70 cents in 2017 to $161 in May 2022 – a gain of 22,900% in five years.

Every $5,000 investment made in 2017 would be worth $1.1 million today.

Here’s another example: Xpel Technologies (XPEL).

This has to be one of the most boring industries you can imagine. Founded in 1997 in San Antonio, Texas, the company manufactures protective films and coatings for cars, including the UV coatings on windows.

Fifteen years after it launched, XPEL was still a penny stock.

You could buy all the shares you wanted in 2012 for just 12 cents each. At some points, you could even buy a share for just a nickel.

But anyone who visited Xpel’s factory could see that it was a solid operation that was making money.

Plus, manufacturers loved the company’s products.

“Not only are car enthusiast end-users moving to Xpel,” wrote one auto writer in 2012, “but so is the new car business.”

It was the kind of microcap stock that a certain type of investor takes a chance on – investing maybe $500 at 12 cents a share (for a total of 4,166 shares).

Fast-forward to today.

What would have happened to that $500 flyer had you invested in Xpel?

Well, at this writing, Xpel sells for $47.88 a share, a gain of 39,800%.

Every $500 invested in Xpel 10 years ago would be worth $200,000 today.

If you went crazy back then and invested $1,000, you’d be sitting on over $400,000.

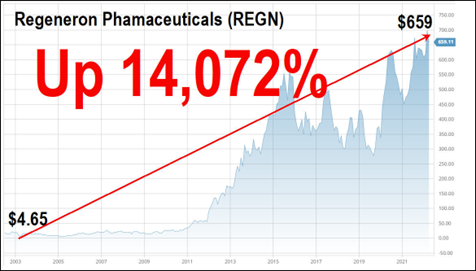

Here’s another example: Regeneron Pharmaceuticals, Inc. (REGN).

Back at the turn of the millennium, Regeneron was a small startup formed by two physicians, Leonard Schleifer and George Yancopoulos, that raised $91 million from an IPO at $22 per share.

But after the initial excitement of the IPO, the price gradually sank back down to earth, and by 2005 you could pick up shares for just $4.65 apiece.

However, early investors who met the founders knew something the public didn’t: Regeneron was sitting on a potential gold mine.

The company had developed a special process for creating “optimized” human antibodies for specific diseases – including, eventually, catastrophic diseases such as Ebola and COVID-19.

It took a while, but gradually the potential of this new technology was revealed – and Regeneron shares skyrocketed in value.

Today, Regeneron stock sells for a staggering $659 per share.

From its price in mid-2005, that’s a profit of 14,072%. Every $5,000 invested back then would be worth $700,000 today.

The secret to these early investors’ success lay in knowing details about Regeneron’s business that they didn’t read in The Wall Street Journal…

Details you can only know by talking to the founders in person and checking out the operations on-site.

I remember another microcap stock in the early 2000s that a lot of people didn’t think would do anything. That was when I first got seriously interested in microcaps as an investing strategy.

The company was a small Boston-based startup called Abiomed that made medical devices to help people suffering from heart failure, a very common ailment among an aging population. The company had a special technology that allowed it to “assist” failing hearts.

Back in 2003, the stock sold for just over $3 a share – not a penny stock but a “microcap” nonetheless. It was a classic biotech play. Today, Abiomed sells for $286 a share.

That’s a profit of “only” 9,433% – or 94 times your money.

Yet if you had invested $5,000 in Abiomed back when it was a struggling startup, you could potentially have an extra $470,000 in your account today.

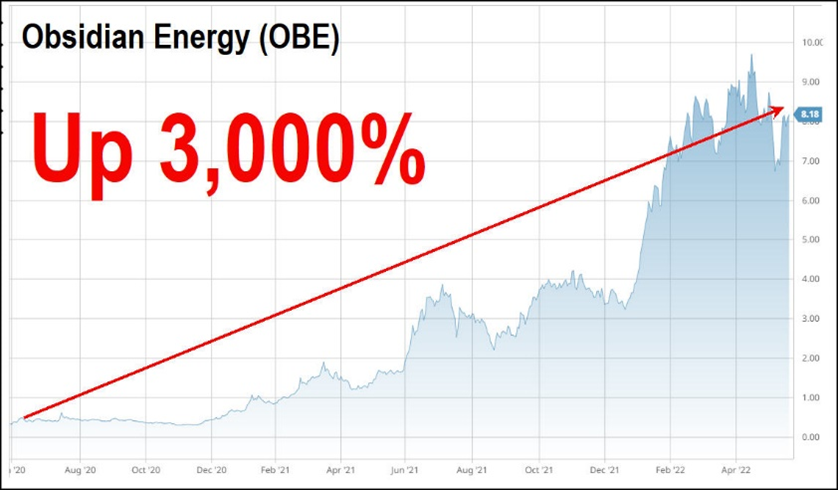

And plays like these are not just things of the past. Even over the past two years, as COVID-19 changed the world, you could have marched right along, not missing a beat, with gains like:

13 times your money on Titan International (TWI)

15 times your money on Renren, Inc. (RENN)

17 times your money on Bluelinx Holdings Inc. (BXC)

22 times your money on WaveDancer, Inc. (WAVD)

27 times your money on Charge Enterprises, Inc. (CRGE)

30 times your money on Obsidian Energy (OBE)

even 51 times your money on Alpha Metallurgical Resources (AMR)

…to name just a few.

And the big question is: Why haven’t you heard about these plays?

The Forbidden Stock Plays Wall Street

Doesn’t Want You to Know About

These are publicly traded companies with market caps of between $50 million and $300 million, generally trading for around $1 to $5 per share.

Trades in this “underground” market happen every day, but you rarely read about them in The Wall Street Journal or Barron’s.

That’s by design. Wall Street doesn’t want you to know anything about these small companies…

For one thing, they’re risky.

Also, some brokers want to keep the best of these mega-opportunities for themselves – and for their ultra-rich clients. And the investment banking divisions of big brokerage houses don’t have a stake in them, so they’re not on the “approved buy list” that brokers get from their corporate headquarters.

Make Up To $200,000 With a Modest $1,000 Investment

The truth is, a lot of regular investors have made very handsome gains with these long-shot plays… just by putting $1,000 or $2,000 into one or two of these microcap stocks.

That’s often all it takes.

For example, the graphic chip manufacturer Nvidia (NVDA), one of my favorite stocks, was a penny stock back when it started out.

It sold for just 92 cents a share back in 2003, when I first started following it.

Today, those same shares go for $185 – which is a potential profit of 20,000%.

So, if you had taken a flyer on Nvidia back when I first started following it and had invested, say, $1,000 in the company, today you’d have an extra $200,000 in your account.

Here’s my point: Even if you strike out with nine out of 10 of these opportunities, you still could end up with a sizable pile of cash…

Like with Align Technology (ALGN), which sells orthodontic products and sold for only $1.30 a share when it was starting out.

Last year, the shares topped out at $729 per share – a gain of 55,957%.

Just imagine…

Someone told you about Align Technology and you decided to plop down just $500 on shares – and then forgot all about it.

You could have woken up 13 years later with an extra $279,000.

If you had invested $2,000, you’d be looking at an extra $1.1 million.

There are very few opportunities – anywhere – that hand you even the possibility of seeing gains like these.

Yet every year, microcap opportunities appear that have the potential to make you hundreds of times your initial investment.

And the best part is, you DON’T have to risk a lot to make a lot…

It’s stocks like these that can set you up for life – you, and your children, and even your grandchildren.

Identifying Microcap Blockbusters Is Far More Difficult Than Picking Blue-Chip Stocks

Now, what I didn’t tell you when I mentioned these companies is that… I hear about investments like these all the time.

I usually don’t tell my subscribers about them. And there is a good reason for that.

For one thing, these stocks are highly speculative, highly risky investments. They go up and down like a rollercoaster. Plus, identifying these opportunities isn’t easy.

You must know things large-cap analysts don’t fully understand or have the time to dig into.

The difference between success and failure for microcap companies is often just a single deal, a single agreement, or a single technological breakthrough.

And in almost every case, their ability to get that one deal done – or that one contract signed – is impacted by much more than simply supply and demand.

You must know:

- The history behind these companies and the history of the executives who formed them.

- Where the company stands in terms of its life cycle.

- The politics of the states in which each company operates.

- The creative financing that small companies use to keep the doors open (founders and CEOs have options you rarely hear much about: secondary offerings, warrants, preferred shares, interest-bearing paper, a new line of credit, a blend of two or more of these methods).

Plus, when it comes to companies introducing new technologies, you must know whether a big blue-chip behemoth – like an Apple or an Amazon – might be standing in their way.

The Secret to Finding Golden Needles in Haystacks

In other words: Some of these plays are ultra-risky penny stocks. Others are tech startups. Still others are pre-IPO or private placement deals.

Quite a few don’t go anywhere.

But there is a way to vastly improve your odds of finding the real microcap moneymakers when investing in companies like these – what I like to call top-down fundamental research.

First, you want to look in the right sectors.

I concentrate on those sectors that are off the charts in terms of revenue growth.

Sometimes one of those sectors is tech, or cannabis, or EV batteries.

You definitely want to look in the top-performing sectors to start off with.

Second, once you know what you want to concentrate on, you use a bottom-up approach.

This is when I look at all the microcap stocks in a red-hot sector and try to determine which ones have the best fundamental outlook – the fastest revenue growth and, if possible, the least debt.

You might only have 10 or 20 microcap candidates in a given sector. So you whittle it down to the best two or three.

The third thing you do is personally visit the company’s headquarters, talk to its chief officers, and tour its facilities.

That’s why I’m talking to you today from the bayou – to check out, firsthand, some unusual opportunities you won’t read about in Barron’s.

If you visit a company in person and look through the haystack one piece of straw at a time, you can sometimes find that golden needle.

The thing is, when you’re investing in, say, Pfizer, you don’t have to interview the CEO to find out what the company is doing.

Wall Street has 27 analysts working full time covering this company. There are endless government filings, quarterly reports, earnings briefings, and so on.

But when you invest in microcap stocks, there is none of that.

When I interview the CEO of a startup or small company, sometimes I’m the only analyst to do so.

This gives me and my readers a huge advantage.

We can spot the unique combination of a breakthrough technology and a market need that produces a runaway bestselling company.

A Unique Opportunity to Profit from

Microcap and Pre-IPO Stocks

Over the past few years, I’ve crisscrossed the country to conduct research, find profitable opportunities, and, most importantly, glean lucrative details from as many top-tier experts as I can.

I’ve been to New Orleans twice, Miami twice, New York, San Francisco, Texas, Vancouver, Puerto Rico, Toronto, Los Angeles, Orlando… the list goes on and on…

I’ve made contacts all over the world.

It’s because of the extra effort I put in that I’ve gained a reputation for delivering profits time and time again for subscribers to my services. For example, over the past two years, my subscribers have made…

- 123% on Marvel Tech Group

- 152% on Qualcomm

- 123% on Activision Blizzard

- 216% on Autodesk

- 359% on Echo Global Logistics

- 128% on Cisco Systems

- 130% on Cadence Design Systems

- 136% on Digital Turbine

- 105% on Snap, Inc.

… to name just a few.

Profits like these helped change people’s lives. I know this because my subscribers have told me so.

One guy by the name of Gregory D. wrote to me about one of my recent recommendations…

Michael P. of Alhambra, California, shared his story, too:

And Erika S. of Prescott, Arizona, wrote me to say:

But my favorite is from Grant R. of Overland Park, Kansas:

And that brings me to the purpose of this special message:

A New Opportunity That Is Light-Years Beyond What I Have Been Able to Offer Before!

At least two or three times a week I get a call from a CEO or a big-fish investor telling me about a new company I should know about.

These calls are often about a new startup with a cutting-edge technology that is poised to dominate an entire industry – or, more typically, could be the target of a takeover bid by a much bigger company.

Or I hear about a special pre-IPO or private placement offering being made only to accredited investors.

Or I hear about a company that may be doing something especially unusual, such as mining for Bitcoin in the Louisiana bayou.

And each time, I think to myself:

“Which opportunities should I share with my readers… which are the ones they could potentially make millions of dollars out of?”

But the thing is, these companies are tiny, often trading at less than a buck a share.

That means they’re simply too risky for my regular readers. Penny stocks are often penny stocks for a reason.

Investors could easily lose money on these highly speculative plays. It would be the height of irresponsibility to recommend any of them to my regular subscribers.

Yet the Potential Profits of These Microcap Shares Are Also Phenomenal

As I mentioned, over time they often shoot up 20,000%… or 30,000%… or sometimes even 50,000% or more!

And it simply drives me crazy to let these opportunities for huge profits go to waste, to not do SOMETHING with them.

As a result, a few months ago I began talking to Roger and the team at Eagle Financial Publications about whether we could create a small VIP investment group dedicated to microcap investing.

This small “private” group would focus exclusively on these long-shot microcap stocks and other “forbidden” deals usually meant only for the ultra-wealthy.

It would be an elite group made up only of well-heeled subscribers who had some risk capital to put to use – not rich people, necessarily, but people with some extra cash to invest.

And it would NOT be open to the general public.

I would send this tiny group of elite investors details on publicly traded – or ABOUT to be publicly traded – microcap stocks… that they could often buy for pennies or a few dollars a share.

They would all be long-shot plays, usually based on new technologies or acquisitions that the public doesn’t see coming yet.

Normally, you would have to be an accredited investor with a net worth of at least $1 million or an income of at least $200,000 a year even to hear about these deals.

(And the truth is, you probably wouldn’t hear about them even then.)

But because most are publicly traded stocks, no one can stop you from buying them!

If the stock goes from $1.30 a share to $729 a share, as happened with Align Technology, you’ll still make a fortune whether you’re an accredited investor or not.

Every $1,000 invested here turned into $559,000.

Here’s an example of what I’m talking about: a relatively small startup that has developed the world’s most powerful electric outboard motor and a whole line of electric boats…

Microcap Million-Dollar Opportunity #1:

Never Work Again Once You Invest in the Tesla of the Water…

If you fish or spend any time out on the water, you may, like me, have experience with small electric motors: tiny outboard engines for trolling at slow speeds.

If you want to get anywhere fast, forget about it.

So I was totally unprepared for what I experienced at the Miami Boat Show this year when I took one small company’s electric boat out for a spin.

Its top-of-the-line all-electric engine is a 180-horsepower outboard motor that sent the boat I was driving careening across the glassy water of Miami’s inland waterways like a cruise missile.

I could feel my eyeballs being squeezed flat like a flounder’s as the warm sea wind pressed against my face.

Plus, this company sets records in more ways than one.

One of its all-electric boats, which looks and feels like a classic Chris-Craft from the 1940s, is the world’s fastest production electric boat with a miles-per-hour speed record.

In addition, this microcap company is breaking into an industry at the best possible time imaginable.

With gasoline prices hitting record highs, everyone interested in boats is wondering if there is an alternative to the gas-guzzling outboard motors that have dominated the industry for more than a century.

Estimates vary, but some analysts are projecting the global electric outboard engine market to triple from $4.5 billion in annual revenues today to $12.3 billion by 2027.

Those are conservative numbers. Other analysts insist we could see $17 billion in sales by 2025.

Like a “Tesla of the water,” the boat I drove accelerated effortlessly and seemed to plane almost immediately, with little of the vibration you normally experience with gas motors.

Plus, the company has a valuable first-mover advantage: It’s already listed on the Nasdaq.

That’s why I believe this could be a potential microcap blockbuster.

With a market cap of only $31.5 million, sales are up 54.1% year over year ending in August 2021.

And while the company is not yet profitable, its cash in the bank is up 825% in the same period, signifying revenue growth that is off the charts.

The company’s sales took a bit of a hit during the COVID-19 pandemic, but now they’re roaring back – with sales nearly quadrupling (up 297%) year over year at the end of February 2022.

In other words: The sky’s the limit for this ambitious startup…

And here’s the great part of this: There is a way for regular investors in our private VIP group to buy these shares right now.

At the current price of $3.70 per share, you could buy 1,000 shares for only $3,700.

I believe this stock could easily top $10.00 a share within a year… and could potentially reach as high as $50 a share.

In other words: This is a chance to make up to 12 times your money (1,251%)!

There’s just one catch: You have to take a chance on this stock before the general public hears about it… when it’s still just selling for a couple of bucks a share.

That’s why I’ve prepared a brand-new, “top secret” report about this unique all-electric boat company.

This private dossier is called Microcap Millionaire, and it contains my write-ups on what I believe are potential microcap blockbusters.

I’ll tell you how to get a copy of this report, and my Tesla of the Water recommendation, in a moment.

But first, let me give you another example of the types of opportunities that exist in the “forbidden” underground market of microcap stocks…

Microcap Million-Dollar Opportunity #2:

Buy the Next PayPal for Pennies a Share Before It Skyrockets Above $100!

In case you’re not aware of it, the hottest play in the financial world right now is not cryptocurrencies – which bounce up and down like a yo-yo – but something known as decentralized finance, or DeFi.

Decentralized finance (DeFi) is a financial technology based on the same encrypted digital ledger system, known as the blockchain, used by cryptocurrencies.

As Investopedia puts it, the advantage of DeFi and the reason for its burgeoning popularity is that it “removes the control banks and institutions have on money, financial products, and financial services.”

Yeah, it’s pretty darn abstract – but here’s why you might want to learn a bit about it…

Despite its legendary volatility, the entire DeFi market is estimated to be worth nearly $1 trillion ($976 billion) today.

The industry is red-hot right now, and for obvious reasons.

The entire world watched as Canada turned off political protesters’ access to financial institutions with a flip of a switch.

Whether you agree with the aims of those protesters or not, it was instantly apparent to everyone paying attention that governments now have the ability, and usually the desire, to seize financial assets in seconds – and without court orders or even much discussion.

That’s where the second company I want to tell you about comes in: It’s developing a technology platform to make DeFi and cryptocurrencies accessible and easy to use for ordinary people.

The company’s main product is a mobile app that lets you trade digital currencies and NFTs (non-fungible tokens) on your mobile phone as easily as you now use Venmo or Acorn.

It gives you unprecedented levels of financial privacy and control over your assets.

You can also use the app to earn interest on your crypto and DeFi assets, invest in the DeFi market by holding ETF-like indexes that track the price of multiple DeFi and crypto sectors, and even track your portfolio growth with the app’s unique dashboard.

The potential of this company – which is backed by a celebrity billionaire – is simply huge.

It’s a tiny company that has a lock on a very sophisticated technology and, at the same time, owns the largest crypto marketplace in Canada.

Unlike most small startups, it has raised a decent amount of cash – at least $72 million in various private placement offerings since inception. It has $34 million in cash on its balance sheet.

And here’s the amazing part: Even though this startup company is poised to utterly dominate the DeFi industry… almost no one knows about it yet.

It is flying totally under Wall Street’s radar.

Best of all, you can pick up shares of this breakthrough DeFi microcap for less than $1 each. It’s been as low as 35 cents per share during market selloffs.

Yet despite its absurdly low share price, this company is growing like crazy.

Through a series of strategic mergers – most notably, its acquisition of Canada’s cryptocurrency marketplace – this tiny, virtually unknown company with just 130 employees has acquired more than 600,000 users in 174 countries.

And as a result, it now has its fingers in…

- the $200 billion crypto exchange universe

- the $100 billion DeFi smart contract world

- the $180 billion GameFi (play to earn) gaming world

- the $22 billion NFT market

Now do you see why I like these microcaps?

That is the type of play I’m talking about.

If you can put up, say, $2,000 in this company, and it gets bought out by some financial giant like Robinhood or Stripe… you could walk away with a sizable profit.

Bottom line: No guarantees, but this DeFi app company has the potential to be one of those stocks that sets us all up for life – especially if you can buy up shares for under $1 per share.

And I’ll give you all the details, as well as my recommended buy prices, in your copy of Microcap Millionaire.

Now, before you send for your copy, let me tell you about just ONE more microcap opportunity that I’m very excited about – one that almost literally makes money out of thin air.

Microcap Million-Dollar Opportunity #3:

Retire Rich from the One Commodity the Entire EV Industry Can’t Do Without!

The move to electric vehicles is an unstoppable trend, driven by both new government mandates and the skyrocketing cost of gasoline.

The State of California, which has the highest gasoline taxes in America, has decreed that all new cars and passenger trucks sold in the state must be zero-emission vehicles by 2035.

As a result, car companies worldwide are switching to EV technologies.

A new report by Bloomberg New Energy Finance shows that by 2040, fully 58% of all passenger vehicle sales worldwide will be for electric vehicles.

And as Forbes magazine reports, “Porsche aims at making 50% of its cars electric by 2023… General Motors, Toyota and Volvo have all declared a target of $1 million in EV sales by 2025.

By 2030, Aston Martin expects that EVs will account for 25% of its sales, with the rest of its lineup comprising hybrids.

While those are truly awesome goals, there’s a big problem: The EV industry can’t get enough copper.

Copper is essential for many components in EV vehicles, yet copper prices today are the highest they’ve been in decades. One reason is that electric vehicles use up to four times more copper than internal combustion engines.

That’s why my next potential microcap blockbuster is a little-known Canadian company that operates a copper mine in Chile.

More precisely, the company reprocesses environmental waste known as tailings and turns it into pure copper.

It reminds me of the fairy tale about Rumpelstiltskin in which his female captive spins straw into gold. In goes environmental waste left over from mining operations, and out comes… money.

Revenues for this company have risen steadily, from $136 million in 2018 to $199 million last year.

Yet net income has nearly quadrupled in the same period, from just $10.5 million to $39.8 million.

Plus, this company’s stock price has done a moon shot despite the recent volatility in the stock market.

Its shares have skyrocketed from just 15 cents in mid-2020 to $1.57 today – a gain of 713% in just two years.

Every $5,000 invested in this company in 2020 would be worth $40,650 today.

And here’s the best part of the story: I believe this company is just getting started.

According to Goldman Sachs, the 2020s will see the strongest growth in global copper demand in history.

“The demand for copper… will increase by almost 600% to 5.4 million tons in our base case and 900% to 8.7 million in the case of hyper-adoption of green technologies,” the company reported.

That’s because, according to the Copper Development Association, a conventional car uses around 18 to 49 pounds of copper while electric cars use up to 183 pounds. And EV buses can use as much as 814 pounds each.

But while demand is skyrocketing, the number of copper-producing mines is actually quite small.

Global supplies have shrunk to such a degree that the world is looking at a supply deficit in 2022 of 100,000 tons.

That’s why I believe this Canadian copper play could be another microcap blockbuster.

Right now, you can still buy shares for only $1.22 each. But not for long.

Once word gets out about the global copper shortage, I expect this company’s shares could easily triple… and then triple again – just as they did in the previous two years.

I give you all the details in Microcap Millionaire.

How You Can Get In on Opportunities Like These

Now, as I mentioned earlier, these microcap investments are not for everyone.

I can’t in good conscience recommend these investments to my regular subscribers.

These are long-shot plays that have the potential to make you 50, 100, or even 200 times your initial investment… but also, they could lose money.

As a result, they are not for 99.9% of regular investors.

But there is a group of investors out there, aggressive investors with some extra capital, who want in on some of these plays – put $500 or $1,000 into a few of these microcap blockbuster opportunities.

And until now, I couldn’t think of a way to help this small group get into these trades.

But after months of work and research, my team and I have put together the private VIP investing group I mentioned earlier – but we’re only going to offer it to a VERY small number of our subscribers and only to those investors who can afford it.

Introducing My First Micro-Cap Stock Trading Service for Investors Serious About Mega-Profits

We’re calling this new VIP investing service the Micro-Cap Stock Trader.

If you agree to one condition – and, yes, there is one condition – let me tell you what you get when you become a member:

A VIP launch Webinar: on investing in Pre-IPO and Micro-Cap Stocks.

To kick off our NEW Micro-Cap Stock Trader service, I am hosting a LIVE video training – a VIP webinar about investing in microcap stocks – that will reveal the truth about this hugely profitable but also challenging market.

It will begin at 1:00 ET on June 23:

During this VIP introductory webinar, I’ll reveal:

- Why investing in microcap opportunities is a proven path to multigenerational wealth.

- The difference between penny and microcap stocks – and what you must know before investing in either of them.

- How to identify the hottest sectors for microcaps.

- How to avoid falling for penny stock scams and frauds.

- The best money management principles to follow when investing in microcaps.

…and lots MORE.

This VIP webinar could cost you a small fortune if you attended in person.

I’ve seen weekend boot camps on microcap investing that cost hundreds, even thousands, of dollars to attend.

But you won’t be paying anything close to that. In fact, this VIP webinar (Microcap Trading Masterclass) is included FREE as part of a special offer I’ll tell you about in a moment.

In addition to the introductory VIP webinar, you get…

FREE ACCESS: to my latest report on trading the microcap market, Microcap Millionaire.

This no-nonsense, plain-English guide reveals why these three small microcap companies offer realistic opportunities to multiply your wealth many times over.

It gives you SPECIFIC trading recommendations for profiting from these little-known investments that only the ultra-wealthy normally hear about.

It tells you what to do and when to do it.

In addition, Microcap Millionaire gives you a solid introduction to the private placement and pre-IPO universe.

You also get an overview of trading strategies to maximize your profits.

You’ll learn the best way to get into and out of these investments.

Also, you’ll discover how you can make even bigger potential profits by waiting for the right moment to buy into these stocks.

I’ve seen big-fish investors make 100 times more money by waiting for exactly the right moment before pulling the trigger. I’ll tell you all about that.

Then the BIG moneymaking benefits really begin:

NEW MICROCAP TRADES: You get SPECIFIC microcap investment recommendations almost every week – sent directly to your inbox and mobile phone with all of the details you need.

In addition to the current portfolio, you get ongoing new trading recommendations for microcap trades throughout the remainder of 2022 and into 2023.

I typically offer 20 to 30 recommendations a year.

These recommendations include startups in a number of explosive stock sectors, wherever there’s a fortune to be made.

I make sure all of my recommendations are easy to understand and simple to take action on.

For each and every investment, I tell you exactly what to buy, what prices I recommend, and what the relative risks and potential rewards of the investment are.

Now, I can’t tell you in advance when an opportunity will come up.

These are highly speculative, often “early stage” special situations.

Sometimes we just sit tight, waiting for the right moment to get into a stock at just the right price.

Other times, we have a number of investments in quick succession.

The instructions I give in every investment recommendation are clear and precise.

They are described in great detail in our hotline emails: The specifics of each and every investment recommendation are written in plain English.

Plus, you also get…

FOLLOW-UP ON ALL TRADES: You also get my crucial follow-up instructions on all of these companies and investments, as many as are necessary, with SPECIFIC instructions on precisely when to get in, when to get out, and when to take profits.

If you’ve ever gotten recommendations from someone and haven’t known exactly what to do, I promise you: That will NOT be the case with me.

Unlike many advisory services, I will tell you precisely when to take profits in all of my recommendations.

And when I exit a profitable trade, I’ll normally close out the trade in stages.

For example, if we have had microcap stock that has soared over the past few months, I’ll recommend you sell a portion of your position one week to lock in profits (and if it’s over 100%, we’re playing on house money with the rest)…

Then, when the stock moves even higher, sell again and lock in more gains.

As you can see, this kind of information really isn’t for the average investor.

ANSWERS WHEN YOU NEED THEM: Get your most important questions answered when you need them.

Last but most important, I answer typical member questions.

For legal reasons, I cannot address your specific situation.

That would make me a broker/adviser, and I am not that.

Still, I can answer questions about our recommendations and how you should go about making these investments – and I will do so.

An Instant 50% Off Charter Member Price

A one-year subscription to all this – including my current recommendations for microcap stocks with the potential to skyrocket from mere pennies a share to $30, $50, or $100 a share – was going to be $2,995 with no discounts.

However, for readers of Eagle Financial Publications only, I am offering a limited-time 50% discount off the regular price:

That means for just $1,495, you can get a full year of my very best microcap, private placement, and pre-IPO investments with the potential to make you a fortune.

Of course, there are no sure things in investing.

Past performance is no guarantee of future results, and, for this service especially, you should only invest with money you can afford to lose.

But with that said, I expect at least one of the first batch of recommendations you receive from me could easily cover the cost of the service, and more.

That’s an absolute steal considering that you could potentially make that amount back from just a SINGLE microcap stock trade.

And I’d like to make Micro-Cap Stock Trader even more accessible, so here’s what I’m going to do…

Try Us Out for 30 Days With

No Hassle… and No Pressure

When you agree to test-drive my new Micro-Cap Stock Trader service, you’re covered by an unconditional 30-day refund policy.

Take 30 days to decide if Micro-Cap Stock Trader is right for you.

During that time, you’ll receive all the benefits of full membership:

- all the new recommendations…

- all the current buy, sell, and hold prices…

- all the stop-loss recommendations…

- all the updates and market analysis…

- all the take-profits alerts…

- and full membership access

You can log in to the private members’ site to check out all of the current microcap recommendations… read everything you can about the stocks in my new dossier Microcap Millionaire and view every hotline update I post.

In the unlikely event you find Micro-Cap Stock Trader isn’t for you, just let us know within 30 days, and we’ll refund every penny you spent on the subscription – no questions asked.

Of course, any information, reports, or profits you received courtesy of Micro-Cap Stock Trader are yours to keep as a free gift for giving us a fair try.

So if making modest investments in microcap stocks with big potential is something you’re interested in, I suggest you lock in your spot today.

Simply click the big button below to get started.

But do it now because… there’s ONE slight catch…

Strictly Limited to 97 Qualified Investors

Helping people discover investments like these is my life’s work.

As a result, this is not a mass-market trading service. Not even close.

We don’t need thousands of people copying my current and upcoming trades. Not on these microcap plays.

Volume like that could prematurely move the market… and make it difficult for members to scoop tens of thousands of shares at rock-bottom prices.

That’s why we have to limit membership of Micro-Cap Stock Trader to only 97 members.

I’m only offering this service to the most aggressive traders out there, not people looking to build up retirement savings…

… those who understand that you may have to rip through nine bad trades before you get that one life-changing microcap blockbuster…

That’s also why I only want traders who have the extra capital to invest on higher-risk plays like these.

Remember, in just the past 24 months you could have potentially made up to…

- 13 times your money on Titan International (TWI)

- 15 times your money on Renren, Inc. (RENN)

- 17 times your money on Bluelinx Holdings Inc. (BXC)

- 23 times your money on WaveDancer, Inc. (WAVD)

- 27 times your money on Charge Enterprises, Inc. (CRGE)

- 32 times your money on Obsidian Energy (OBE)

- 55 times your money on Alpha Metallurgical Resources (AMR)

So, if you want to take a shot at potentially life-changing investments, act right now, while there are still openings.

Click on the button below… fill in the form provided… promise that you will not share these trades with another living soul… and let’s get started.

But you must act fast.

There are only 97 spots available – and when they’re gone, they’re GONE. You won’t be able to get in for love or money.

If you want to be a part of something potentially big, then join us right now by clicking on the button below.

Best wishes,

Bryan Perry

Editor, Micro-Cap Stock Trader

P.S. Remember, as a Charter Member and Eagle Financial Publications member, you can join with a full 50% off the regular price of $2,995 a year (you pay only $1,495). But once all 97 openings are taken, that’s it: You’ll have to wait until an opening is available and then likely have to pay the regular price of $2,995. – B.P.