For Serious Investors Only:

High Velocity Options

PROOF: You Could TRIPLE the Size of Your

Portfolio in 32 Months

Revolutionary new OPTIONS-ONLY trading system for serious investors

could have turned your $20,000 trading account into $84,117 after just 32 months

Proven track record in 2021 with documented winners like 250% on INMD…

126% on ALGN… 219% on VSTO… 124% on SLTD… and 185% on MELI

Access to an exclusive Charter Member “Getting Started”

webinar, a welcome kit and much MORE!

Dear Fellow Investor,

If you’re a knowledgeable investor who wants to generate extra cash from your investments – without having to put all your life savings at risk in the stock market – then please pay attention.

I’d like to introduce you to a revolutionary new options-trading system that I have developed called High Velocity Options.

A New Way to Make Thousands of Dollars a Month

High Velocity Options are typically a “slightly out of the money” call or put options with an expiration date of 30 to 90 days. They are fast trades that generate double- and triple-digit profits.

When I say fast trades, I’m talking about taking profits in months, even weeks!

Plus, you can get into these trades for as little as $50 per contract… and rarely more than $2,000.

Even better, investing in High Velocity Options is as easy as investing in stocks. It only takes a few minutes per trade. And it’s usually a whole lot cheaper than buying shares of stock outright.

Multiply Your Account by Up to 12 Times!

Yet when done correctly, trading High Velocity Options could grow the size of your trading account by up to 320% in just 32 months.

That’s enough to turn a modest $20,000 trading account into $84,117 in just 32 months

Sound hard to believe?

Well, it’s absolutely 100% real. And I’m going to prove it to you right now.

Let me show you the actual results from one of my other trading services that uses my High Velocity Options system.

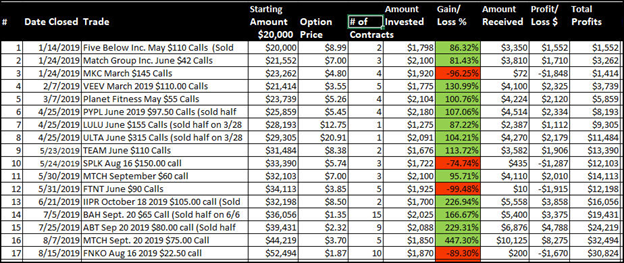

Here Are the Actual Trading Recommendations:

These were REAL trading recommendations. There is nothing hypothetical or back-tested about any of this.

Starting with just $20,000 in 2019 and investing around $2,000 per trade, by the end of the year an account could have potentially made $21,146 in profits and been worth up to $44,146 by the end of the year – that is, more than doubling its value.

Here are the first dozen or so of the actual trades, both winners and losers:

Impressive, right?

In 2020, we did almost as well.

Assuming you made every High Velocity Options trade at the prices recommended, and, with one or two exceptions, limited your investment to around $2,000 per trade…

You could have seen $18,969 in total profits, and your $20,000 initial account would have grown into $38,969.

And through the first three quarters of 2021, an initial $20,000 account would have seen $21,003 in total profits and grown into $41,003 – more than doubling in value in just a little over nine months.

Best of all, most of the time you would have risked no more than 10% of your starting value on any one trade – that is, around $2,000 per trade.

FULL TRANSPARENCY: There were a couple of exceptions. Twice in 2021 I recommended a particularly expensive option that exceeded the normal 10% limit – and both were big winners(185% and 126%).

However, if you wanted to stick to a 10% trading rule, you could have just sat those two trades out.

But what would have happened had you started with $20,000 and just kept going?

In other words, how would you have fared had you kept investing for the full 32 months of this particular service?

Well, we issued 84 specific options-trading recommendations for this one service.

The AVERAGE winner posted a gain of 128.1%. Some were a lot more, but that was the average.

How to Turn $20,000 into $84,117 in Just 32 Months

With winners like that, your $20,000 starting account could have turned into an eye-popping $84,117 in just 32 months… making 84 trades between December 2018 and September 2021.

That works out to an average of $23,315 per year!

Now, it goes without saying that past performance is no guarantee of future results – and you should only trade options with money you can afford to lose.

Yet you’d think EVERYONE would be trading options when you can get started for so little money and potentially, triple your money in under three years.

But you’d be wrong.

The Little-Known Secrets of Successful and Consistent Options Trading

You see, when most people hear “options,” they get nervous…

And for good reason: According to the Chicago Board of Trade, only 10% of options contracts are “exercised.”

Most (50% to 60%) are closed out prior to expiration, with either small profits or small losses. Between 30% to 35% expire absolutely worthless.

However, there are three secrets to trading High Velocity Options that knowledgeable investors understand – and that help them potentially generate profits month after month, year after year.

Allow me to briefly run through them:

Secret #1: When done right, investing in High Velocity Options can hand you at least one TRIPLE-DIGIT winner per month on average:

For example…

In September 2021, I told subscribers to one of my trading services to take profits on InMode (INMD) call options I had recommended for $974 per contract and which were then selling for $3,417 – a profit of $2,443, or 250%!

The month before that, in August, I told the same subscribers to collect their 126% gains on Align Technology (ALGN) call options.

More than doubling their money!

Before that, I also told them to collect 219.6% gains on Vista Outdoor (VSTO) calls… TRIPLING their money…

But that still wasn’t all… Prior to those wins, I led them to…

…101% gains on Wells Fargo (WFC) calls, doubling their money again and 123% gains on Steel Dynamics (STLD) calls.

Before that, it was 130% gains on Etsy (ETSY) options and 185% gains on MercadoLibre (MELI) options.

I’m telling you this not to brag… but simply to show you that experienced option traders see triple-digit gains like these on a REGULAR basis.

In fact, we count on them.

But that’s only part of the story.

And that leads me to the second secret to generating extra cash with options…

Secret #2: These triple-digit winners MORE THAN make up for any losers overall:

The truth is, not all of my recommendations pan out with huge wins. Some have smaller gains of only 20% or 40% — and some even lose money.

But here’s what inexperienced investors don’t realize: If you do it right, the winning option trades MORE THAN make up for the losers, by a huge margin!

After all, the MAXIMUM you can lose on any one options trade is 100%. But sometimes you make 400%, even 900%, on a trade.

For example, here are options gains that I’ve led subscribers to, with the same HVO system:

- 833% on DHI…

- 819% on BNTX…

- 550% on MPW…

- 504% on TSLA…

- 491% on SWBI…

- 427% on MTCH…

- 382% on CAN…

- 329% on AU…

… just to name a few.

Here’s another look at the first dozen trades in 2019 in my stock and options trading service, Bullseye Stock Trader.

As you can see, we had 13 winners and four losers (up to -96%) in the first seven months of 2019.

When trading at only around $2,000 per recommendation, the amounts invested were modest.

And yet the profits really added up: By mid-August, an initial account of $20,000 had grown into $52,494.

That represented a total return of 162.4% in just eight months.

And as I mentioned earlier, the results were just as good in 2020 and 2021.

A starting account of $20,000 in January 2020 could have grown into $38,968 by the end of the year.

And an initial $20,000 account in January 2021 would have grown into $41,003 by Q3 of 2021 – more than doubling the size of your account.

Now, there is ONE LAST secret I’d like to discuss before I tell you a bit more about myself.

Secret #3: Options reduce risk:

The options trades I recommend only cost between $50 and $2,000 per contract, thousands less than owning shares… so trading options puts less money at risk per trade.

The risk in your options trades is strictly defined.

At least the way I trade, you can never lose more than you paid for the option.

And as I said, your potential profits can often be A LOT more than 100% — sometimes 300% or 400% or even 800% or more.

And I have to admit, it’s a lot of fun to make eight times your money on a single trade.

But it’s the consistency that really counts… the ability to have more winners than losers and to make sure that the winners are A LOT BIGGER than the losers.

Now, in just a few minutes, I’m going to walk you through some specific HVO trades step by step… and show you how you, too, can realistically grab triple-digit profits on a monthly basis and sometimes even faster…

Plus, I’m going to share with you the latest batch of potential triple-digit High Velocity Options trades that my unique system has just uncovered.

But before I do that, let me tell you briefly who I am.

From Paratrooper to World-Class Trader

My name is Jim Woods.

People are often surprised when they meet me. I’m not what they’re expecting – a slick Wall Street analyst, dressed in a suit and tie and spouting the same B.S. they hear on CNBC every day.

That’s not me. Instead, I’m a former Army paratrooper who enjoys training horses at my ranch in California, target shooting and going to the beach on the weekends.

Now, you might be wondering how a regular guy like me…

… can outperform most of Wall Street’s best stock pickers and options traders year after year…

After all, I was recently ranked the #1 trader in the world by TipRanks.com out of more than 8,000 competitors – and have consistently ranked in the top five.

Well, I do it (in part) through a unique options-trading system I’ve developed over the past two decades that identifies a triple-digit options opportunity for every single week of the year (on average).

25 Years as an Analyst and Hedge Fund Trader

Plus, truth be told, appearances can be deceiving.

I may look like a cage fighter, but I’ve actually spent 25 years as a stock analyst, hedge fund trader and newsletter advisor.

After the Army and college, my first real job was working for seven years at Investor’s Business Daily in Los Angeles. After that, I was “in the trenches” as a trader at a private hedge fund.

From there, I went on to be a client advisor with Morgan Stanley before finally becoming a full-time market analyst and financial newsletter editor, working first for the Fabian family and then at Eagle Financial Publications.

So, I know what I’m doing.

And after decades of real world trading at hedge funds and as a client advisor, I know what works when it comes to investing in options.

And my readers agree. Here’s what a few of them have written to tell me:

Why Anyone with Commitment Can Become a High Velocity Options Trader

What I really want to emphasize is that ANYONE can do this.

Placing options trades online is as easy as investing in stocks… You just type the right symbol in the right place – and you’re done.

What’s more, you can start small and take baby steps until you gain confidence.

As I said, I issue option recommendations between $50 and $2,000, but you can get into many trades for just a few hundred bucks.

Almost anyone can do that.

Let me give you an example: Jefferies Financial Group Inc. (JEF)

In July 2021, my High Velocity Options system identified this stock as a solid options pick. Plus, it was dirt cheap.

The stock was trading at around $33 a share and you could buy the December 17 $40 call options for just $0.83 – or $83 per contract of 100 shares.

In other words: you could have controlled 1,000 shares (10 contracts) for just $830. A lot of my readers and followers did just that.

Well, the stock just took off and kept climbing throughout the fall.

By October, the stock had hit $40 per share and just kept rising. As a result, the call options soared.

By October 28, when I recommended taking profits, the options were selling for $2.89 each – or $289 per contract.

That was a total profit of 247.5% in 105 days.

Every $830 invested turned into a profit of $2,050.

As I said, almost anyone can trade options. Most can afford $83 to trade one contract.

Here’s another low-cost example:Wells Fargo (WFC).

I recommended Wells Fargo shares back in February 2021 when they were selling for around $36.60 per share.

Everything was lining up nicely: strong relative price, rising earnings, industry leadership, the technical analysis pointed to a strong breakout…

As a result, I recommended that my readers and followers also buy call options on Wells Fargo.

The $40 May calls were pretty cheap: just $1.64.

$164 would control 100 shares – and $1,640 would control 1,000 shares. To own those same 100 shares outright would have cost you $3,660… And to own 1,000 shares? You’d have forked over $36,600.

You tell me, which trade has more at risk?

Well, sure enough: The stock took off and quickly rose to around $46 a share – a nice 25.5% gain in just over two months.

But the call options did FOUR TIMES better!

The call options rose from $1.64 to $3.31 in about the same amount of time – a gain of 101.8% in just 63 days.

If you had bought 10 contracts for $1,640, you would have doubled your money.

Here’s another example: Steel Dynamics Inc (STLD).

In early March 2021, I recommended the stock when the shares were selling at around $43 a share.

I knew that Steel Dynamics was seeing strong relative price performance, with the shares up some 61% over the previous 52 weeks, and its reported earnings per share had surged 56% year over year to 97 cents.

For that reason, in addition to recommending Steel Dynamics shares ($43 at the time), I also recommended that investors consider buying the May $50 calls.

They cost just $1.25 when we recommended them… or $125 for one contract of 100 shares, $1,250 for 1,000 shares, and just $2,500 for 2,000 shares.

That’s the great thing about options: You can often control a lot of shares for very little money.

Had you wanted to buy shares outright, 100 would have cost you $4,300, and a thousand shares would have set you back $43,000.

And just as I thought, in 2021 the old-school sectors were coming back to life and Steel Dynamics surged upward, from $43 per share where we bought it in early March to $55 a share by the end of April.

The “out of the money” calls quickly became “in the money” calls – and rose from $1.25 to $2.79. That was a profit of 123.2% in just 42 days.

Of course, we have more expensive plays as well – and the profits can be just as big, and often bigger.

Back in December 2020, I recommended Etsy (ETSY) calls when they were selling for 15.30.

The shares were selling for $166 each.

It would have cost you $1,530 to control 100 shares of Etsy stock but $16,600 to own the shares outright.

Well, the shares climbed from $166 to $195 by January 2021, a gain of about 17% in 48 days.

But the options more than DOUBLED in value, rising from $15.30 to $35.26 in the same time frame – a gain of 130.4%.

So, for every contract you bought for $1,530, you would have made almost $2,000 in profits.

But you don’t have to buy these more expensive options to get the big percentage gains.

Last September, I recommended call options on Taiwan Semiconductor Manufacturing (TSM) and it was a HUGE win.

I recommended the STOCK when it was selling for $78.81 per share… but I also recommended the November $85 call option when you could pick it up for only $3.30 – or $330 for one contract.

The stock took off like a rocket, gaining 55% by early January 2021.

But the call options went berserk.

The calls soared from $3.30 to $11.35 – for a gain of 243.9%.

So, let’s say you bought five contracts at $330 each. If you bought five contracts, that would have cost you $1,650 up front.

But you would have made $4,025 in profits in just over two months.

That’s why I believe serious investors who want to generate extra cash from their portfolios should seriously consider trading options.

These are trades that often DOUBLE your money in 30 to 60 days… and sometimes more than TRIPLE it in less than three months… as we did with Taiwan Semiconductor Manufacturing.

Introducing My First ALL-OPTIONS Trading Service for Investors Serious About Generating Extra Cash

Now, here’s the purpose of this message:

In the past, you could only access my High Velocity Options trades through one of my other trading services, such as Bullseye Stock Trader.

But over the past year, we’ve heard from an overwhelming number of subscribers and readers that what they REALLY want is simply… MORE OPTIONS TRADES!

As you’ve seen, our HVO-based recommendations regularly post TRIPLE-DIGIT winners… and those winners pile up huge profits over time.

Enough to turn a $20,000 trading account into $84,117 after just 32 months.

So, we decided to give our readers what they were demanding: an OPTIONS-ONLY trading service.

We decided to call the service High Velocity Options… because that is what we provide.

Fast trades and fast gains.

Our aim is to get in fast, risk a modest amount of money (usually just a few hundred dollars) and get out with BIG profits.

And unlike my other trading services, the options recommendations in High Velocity Options will include BOTH calls and puts.

That means you can profit from any market condition, whether stocks are rising or falling.

What You Get When You Accept a Charter Subscription to High Velocity Options

So, here’s what you get when you agree to try out my High Velocity Options trading program for one year…

- First off, as a Charter Member, you’ll get an exclusive “getting started” webinar so you hit the ground running trading options. This is where you’ll be introduced to the strategies and techniques we will use all year long.

- You get A to Z training, in the form of ongoing emails and updates from me, to take you from a beginner to an experienced OPTIONS investor without all the pain of suffering losses through learning by trial and error.

- You get trading alerts on a weekly basis – a priceless value! — sent directly to your inbox and mobile phone with all of the details you need in order to make money trading options. These include recommendations for both puts and calls.

- You get my complete active High Velocity Options portfolio with specific buy and sell instructions.

This is truly a no muss, no fuss system.

My staff and I provide you with everything you need in order to collect fat payouts, including:

- Detailed email instructions

- Weekly updates on current positions

- Hotline investing alerts as needed

- Educational trading videos

- Answers to all of your questions

Plus Access to a Live Human “Coach” When You Need Help!

His name is Grant Linhares, and he’s an experienced options trader with nearly 20 years under his belt helping investors like you.

He’s available from 9am to 5pm (Eastern Time) Monday through Friday. You can call him at 202-677-4492.

In other words: We do everything humanly possible to help you start making serious profits quickly by trading options.

What’s more, I have an HVO price offer you will NOT want to miss:

Get an Instant $1,000 Cash Rebate Save 50% Off the Regular Price

Now, you may be thinking High Velocity Options must cost thousands of dollars.

But that wouldn’t be correct.

The truth is, the regular subscription price for High Velocity Options is only $1,995 – and, given the profits we’ve just talked about, I think that’s an enormous bargain.

But you don’t have to pay anything close to that!

Here at Eagle Financial Publications, we’re offering a $1,000 instant cash rebate on the regular price for new Charter Members, if you act right now.

That means for a limited time you can receive an entire year of High Velocity Options for only $995!

That’s an incredible deal when you consider that some people make that amount with just a SINGLE options trade.

And Now the Bad News: You May Not Qualify!

However, this service is NOT for everyone.

In fact, it’s not for most people, quite honestly.

To really benefit from High Velocity Options, you should have these three qualifications:

- You should be serious about wanting to make money trading options: High Velocity Options is a professional-level service that is designed to achieve big, consistent wins – and lots of them. It’s not for dabblers or occasional traders.

- You should be willing to trade for an entire year: The fact is trading options is NOT day trading. Most option trades are closed out in 30 to 60 days, while bigger profit opportunities may take a little longer.

- You should have at least $20,000 to invest in options: That’s because not all of our trades are winners. Plus, while my trades are usually only a few hundred bucks each, you should have sufficient capital to have multiple trades going at any one time.

Most of all, I only want to accept serious investors – those who understand that trading options takes focus and a commitment to trade regularly over the course of a year.

Limited to Just 100 Traders to Start

For that reason, High Velocity Options is limited to just 100 subscribers to start – and there is NO REFUND.

As I said, this service is solely for serious options traders who are willing to learn how to generate A LOT of extra cash and will stick with it for at least a full year.

However, I will make you a special offer and a promise:

If you don’t make AT LEAST one triple-digit winner per month on average – at least 12 per year – I’ll give you an extra year of High Velocity Options FREE.

That’s a $1,995 value.

The Biggest No-Brainer Offer In the History of Trading!

You get a PROVEN options trading system that could potentially multiply an initial $20,000 investment to $84,117- or 320% of your money.

In just the past few weeks, trading HVOs could have made you:

- $3,800 from one option contract on Generac Holdings Inc. (GNRC) that you could have picked up for only $1,990… handing you a 191% profit on your money in just 65 days…

- $2,435 from just one option contract on InMode Ltd (INMD) that you could have bought for only $947 per contract… giving you a 250.7% return on your money in 95 days…

- $4,447 trading just one options contract on Align Technology (ALGN) that you could have purchased for $3,530… giving you a 126% return on your money in 35 days…

To me, the risk/reward ratio definitely seems worth it.

Especially since I promise you’ll see at least one TRIPLE-DIGIT winner like these per month on average – or you get another year of my options trading service FREE.

Imagine being able to grow your account by 320% over the coming 32 months… starting with a small trading account and while only “working” about 10 minutes a week.

That is what my High Velocity Options can do for you.

So please do me a favor…click on the button below RIGHT NOW!

I urge you to try out a one-year subscription to my High Velocity Options right now. The number of slots is limited to 100, and I expect we will sell out soon.

Through the magic of the Internet, you’ll be whisked away to a secure, encrypted payment site where you will fill out a digital form – and get instant access to FIVE of my very latest options recommendations and my recorded “getting started” webinar for Charter Members…

And, you’ll also get my how-to guidebook for options: “The High Velocity Options Guide to Successful Trading.”

This short options trading manual can take you from novice to serious options trader in less than 15 minutes.

Regularly this report goes for $99, but it’s yours at no charge, just for becoming a Charter Member of my options-only trading service: High Velocity Options.

So, please don’t wait. Click on the button below right now:

To your future prosperity,

Jim Woods

Editor, High Velocity Options

P.S. Remember, I promise you’ll see AT LEAST one triple-digit winner per month on average – enough to potentially turn a $20,000 starting account into as much as $84,117 in just 32 months – or I’ll give you a second year FREE.